Welcome to Monday and another week on the charts. With all the buzz around central banks last week something which slipped under the radar was a downbeat report from FedEx (FDX), states Ian Murphy of MurphyTrading.com.

The global carrier reported lower-than-expected profits and anticipates a slowdown in the year ahead. Transport firms have always offered early warning signs of declining economic activity.

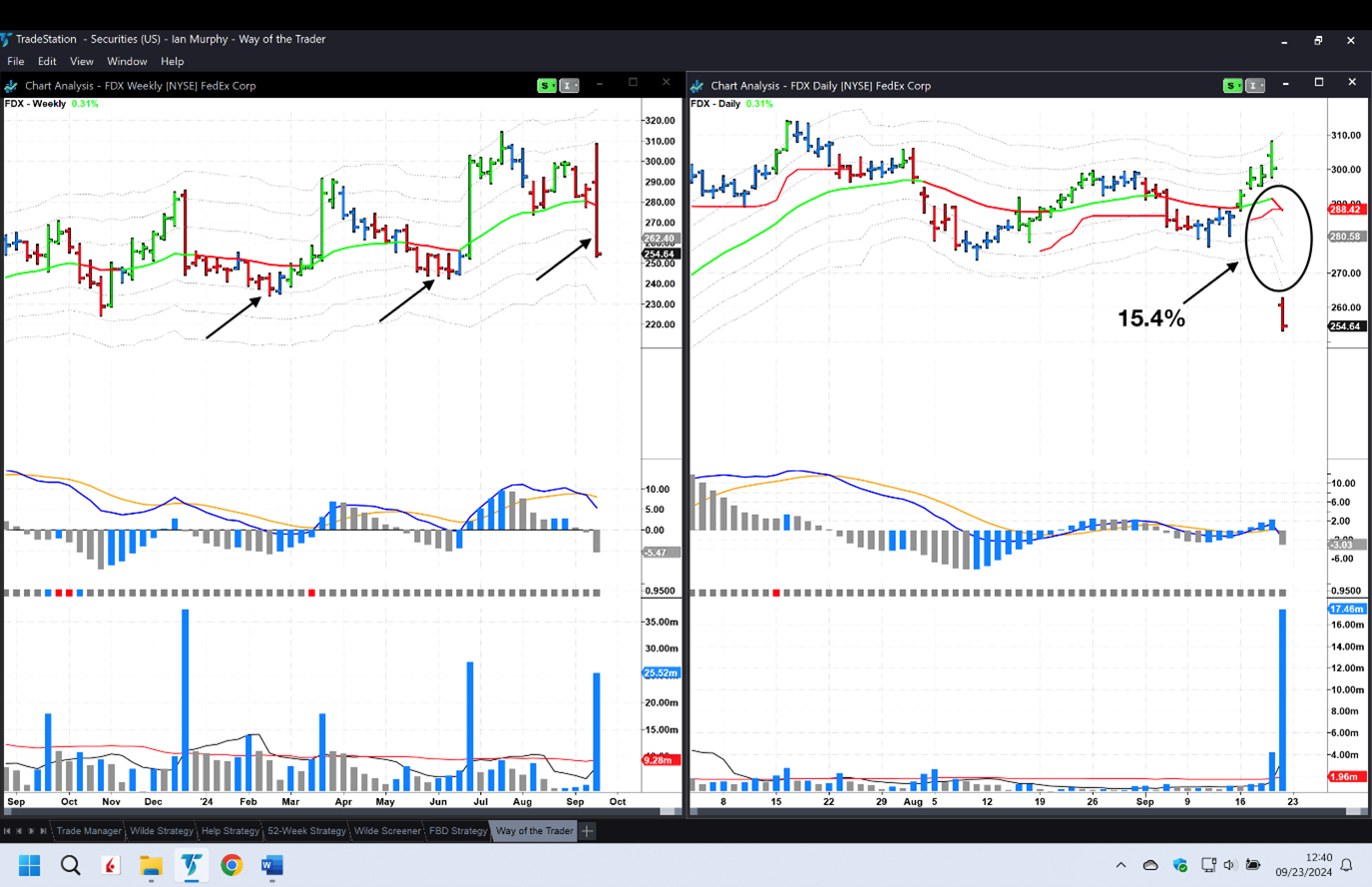

On Friday, the share price gapped down at the open on a daily chart and closed 15.4% lower than the previous session on a huge spike in volume (right above). On a weekly chart, (left) it also closed below the all-important -1ATR line which is a departure from what happened on the two previous pullbacks on earnings (arrows).

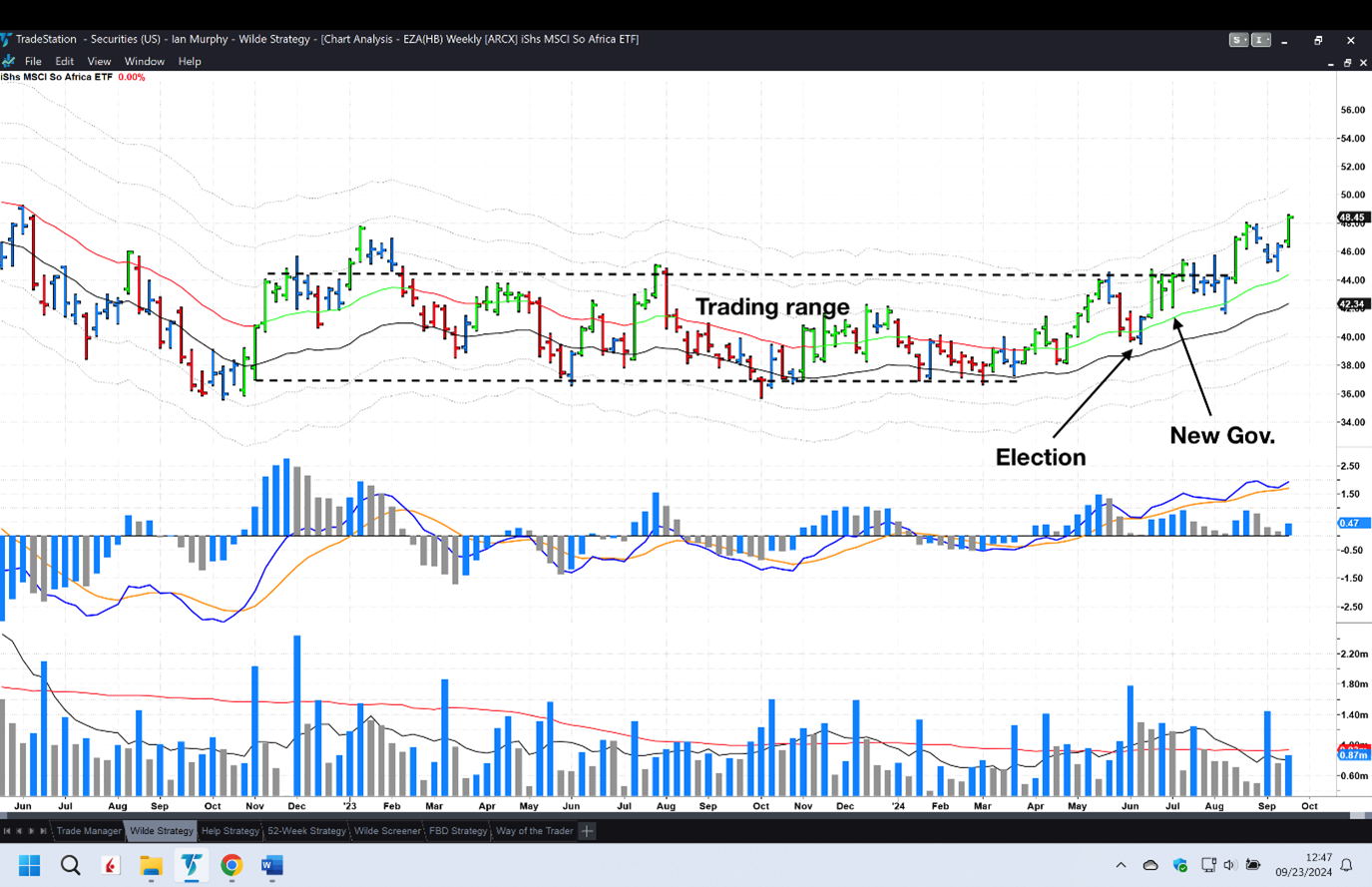

In other news, Sammy R. has asked about gaining exposure to South Africa as that country’s new coalition government is proving to be more business-friendly than expected. The iShares MSCI South Africa ETF (EZA) tracks the country’s stock market and has been climbing steadily since the government was formed in the summer having broken out of a trading range.

The price is already bullish and closed above the 2ATR on Friday. There is currently a $6.11 risk per share, which would mean a small position if you entered now, so maybe a pullback to the EMA might offer a better entry.

Learn more about Ian Murphy at MurphyTrading.com.