Long Straddles are most effective when there is high volatility in the underlying stock, or when you predict big movement in the future in the underlying stock, writes Aravind Siva, certified options trader.

For example, let’s take a look at INVESCO QQQ Trust (QQQ) in the six-month chart. QQQ has displayed tremendous upward volatility in the past months, so buying a straddle on QQQ would be beneficial to take advantage of this volatility.

However, this high volatility will not always be present, as some stocks sometimes display very little or no movement. For example, a stock might be consolidating after a huge directional move either to the upside or the downside. This is when long straddles lose the most money, due to the combination of neither of the legs being ITM and the theta decay that long options are subject to.

When the underlying stock has no movement, an effective strategy would be to short the same straddle at a closer expiration date. For example, if you purchase a $100 strike price long straddle that expires in one month for stock X, and stock X is not moving at all from $100, then the strategy would entail shorting the same straddle, but in an expiration cycle one week from now. If you buy 20 of the longer-out straddles, you can short 10 of the closer expiration date straddles, as the daily decay (theta) on the longer-out straddles would be covered by the huge theta gain on the closer-out straddles.

Why does this strategy work? Well, long straddles profit when the underlying stock goes above the upside breakeven point (UBEP) or below the downside breakeven point (DBEP), and that is when the investor will exercise the options. However, when shorting a straddle, you want it to expire worthless. A straddle expires worthless when the underlying stock stays right at the strike price. So, if the stock is displaying little to no volatility, shorting the straddle will be effective as the straddle will expire worthless.

Let’s look at the Greeks of this strategy, more specifically, the theta. Theta is your enemy when long a straddle, but when shorting the straddle, theta becomes your friend. Theta is at its highest during two scenarios: when the options are ATM and near the expiration date. Additionally, theta increases exponentially as you get closer to expiration. So, by shorting a straddle with little volatility in the stock and a closer expiration date, theta works in your favor at an increasing rate.

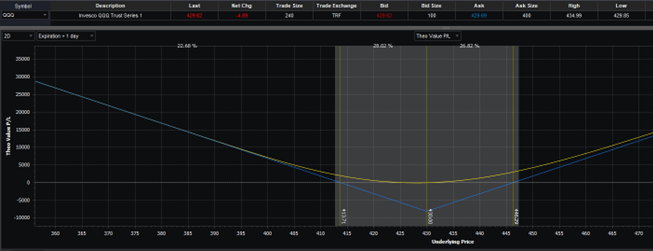

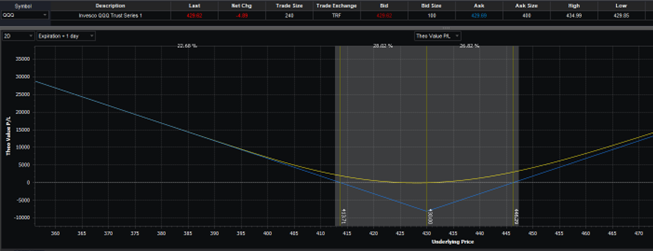

Let’s look at a real example, with the March 15 QQQ at the money (ATM) straddle. QQQ is currently at $429.62, so an ATM straddle would be at a strike price of $430. The straddle costs $16.29, so the UBEP would be $446.29 and the DBEP would be $413.71. Since this is a long position, the $16.29 premium is your maximum loss.

In this case, if QQQ displays low volatility and just bounces around the $430 mark, the strategy would entail shorting the same $430 straddle, but at a closer expiration cycle, for example, the Feb 29 expiration cycle. By February 29, if QQQ stays near 430, the long straddle will just incur theta decay, but the short straddle will expire worthless, giving you a hefty profit with theta having worked in your favor.

The expiration cycle you short the straddle is based on the judgment of the stock. For example, if after analysis you think QQQ will only stay near $430 for the next two weeks, you should short the straddle in an expiration cycle two weeks from now or even before that. Once the short straddle expires with little movement in QQQ, depending on the volatility of QQQ, you could repeat the same process of shorting the straddle, or you could wait for a big move in QQQ for the long straddle to profit.

Long straddles thrive on high volatility, but stocks do not always display huge directional moves. In these scenarios, shorting a closer-out straddle helps cover the daily theta on the long straddle, and this gives you time to wait for a big directional move on the underlying stock. As with any strategy, this strategy requires some judgment on how far out you want to short the straddle, but with proper usage, this strategy can help investors manage long straddles even in times of unfavorable market conditions.