The recent rotation into small and mid-cap (SMID) stocks still has plenty of room to run. Battered SMID stocks have lagged the mega-caps for years. But the times, they are a-changing, states Alec Young of MAPSignals.

Here are five big reasons the rotation into small- & mid-caps is just getting started. Today, we will dive into the macro-outlook, supporting the catch-up trade. It’s time to win big by getting smaller!

Five Big Reasons the Rotation into Small & Mid-Caps is Just Getting Started

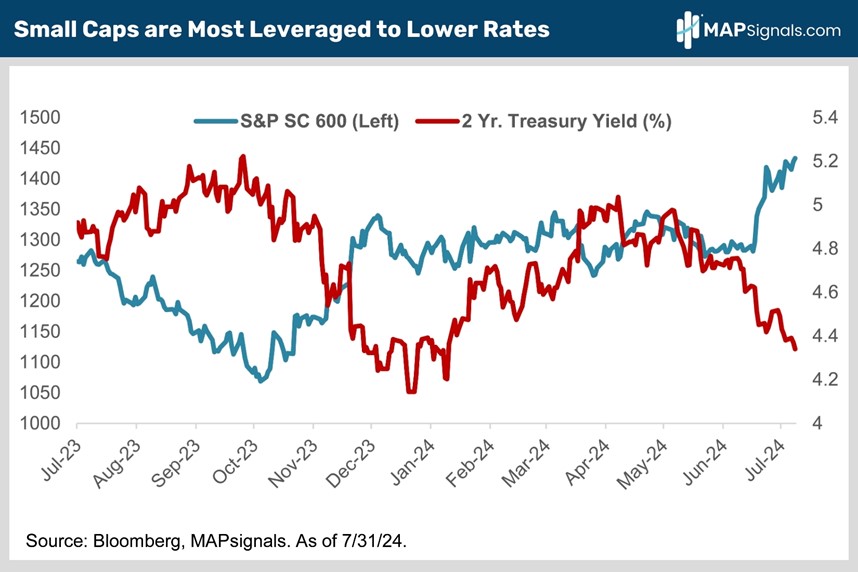

To kick things off, let’s rewind the tape to March. Back then we told you Federal Reserve rate cuts might be delayed but they wouldn’t be denied in 7 Charts Signal More Pain for the Bears. Sure enough, goldilocks growth and falling inflation have the Fed Funds Futures market betting the Fed will begin easing in September. Treasury yields keep pulling back from last Fall’s 5% peak. Lower rates are great for SMID stocks because they stimulate economic growth. Smaller companies are more leveraged to the health of the economy than larger firms. Small- and mid-cap companies also carry more debt than blue chips and pay higher interest rates on those loans. Small- and mid-cap earnings only cover 1.9X and 3.9X, their annual interest expenses, respectively, vs. a much larger 7.8X interest coverage ratio for the S&P 500 (chart).

However, the lower earnings base for less capitalized firms means that EPS can explode when interest rates collapse. Betting on SMID makes a lot of sense against this fundamental backdrop. Add it all up and the number one reason to buy small- and mid-cap stocks is their greater leverage to falling interest rates. Check this out. There’s a clear negative correlation between the two-year Treasury yield (the proxy for the Fed Funds rate) and small-cap stock performance. When one zig, the other zags. Falling rates mean the budding rally in SMID stocks has a lot more room to run as the Fed shifts to an easing stance. Notice how when the red line (two-year yield) drops, the S&P Small Cap 600 (blue line) pops:

Let’s keep this bullish thesis going and talk about earnings. Mega cap earnings growth has been much more robust than the rest of the market over the last couple of years. That’s one of the main reasons they’ve outperformed by so much. But that dynamic is changing fast. Tougher year-over-year comparisons are making it harder for the Magnificent Seven to continue posting massive profit growth. While big tech’s results remain solid, small- and mid-cap earnings growth is poised to take the lead (chart). The second reason to buy small- and mid-cap stocks is a better earnings growth outlook. Below reveals that small-caps are estimated to grow EPS by 24.3% and mid-caps by 18.7%. Those easily eclipse the S&P 500 large-cap’s growth forecast of 14.7%:

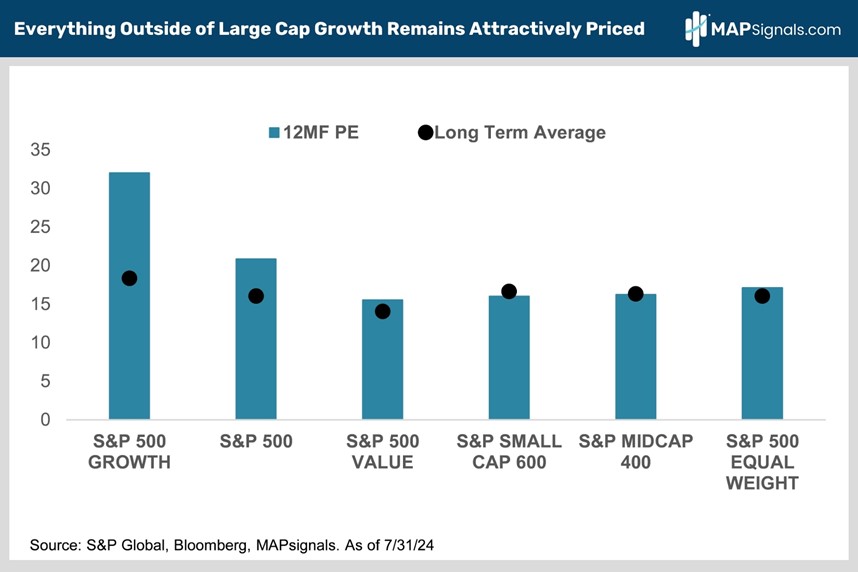

Let’s shift gears and review valuations. Small-cap stocks have rarely been cheaper relative to the S&P 500. Since 1995, they’ve averaged a 3% valuation premium because they’ve delivered slightly higher long-term returns. Right now, at 16.1x 12-month forward earnings per share, small-cap stocks are trading at a 23% discount to the S&P 500’s forward price-earnings ratio of 21x. If we zoom out and look at broad stock market valuations across the entire equity universe, large-cap growth stocks are the only ones trading at rich valuations. Everything from large-cap value and the equally weighted S&P 500 to mid and small-caps remain attractively priced relative to history (chart). Desirable relative and absolute valuations in an accelerating EPS growth environment are the third reason to own more mid and small-cap equities:

What This Means for Your Portfolio

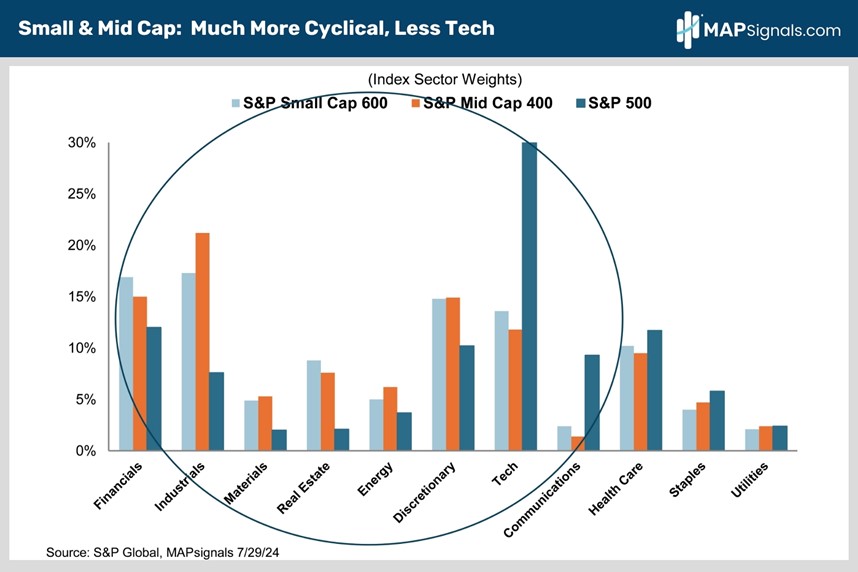

The biggest tactical takeaway is that the market rotation from large-cap growth into SMID equities is grounded in the tectonic shift in macro forces. Cyclical and rate-sensitive sectors like financials, industrials, real estate, and utilities have led in July as interest rates continue to collapse. Meanwhile, technology has seen overdue and healthy profit-taking. Rate-sensitive, cyclical sectors are seeing institutional Big Money buying and leading our sector rankings while tech’s ranking has dropped from #1 to #5.

This is a good thing, folks!

Here’s the best part for all you index fans. Small-cap and mid-cap indices like the Russell 2000, the S&P Small Cap 600, and the S&P Mid Cap 400 are loaded with cyclical stocks. The fourth reason to like SMID equities is their much heavier weight in newly outperforming, cyclical, interest-rate sensitive areas. Financials, industrials, real estate, and utilities combined comprise nearly 50% of the S&P Midcap 400 and S&P Small Cap 600 indexes compared to only 25% of the S&P 500. Now you know why the rebirth has been so powerful:

With the economy slowing yet healthy, inflation falling, and Fthe ed easing around the corner, greater cyclical exposure means the small- and mid-cap rally is for real. The number five reason to buy smaller stocks is superior money flows since May. A staggering 84% of our 4,473 discrete equity inflows have been in companies with market caps below $50 billion:

Add it all up and the macro plus money flow backdrop favors newly ascendant mid and small-caps. That’s a powerful 1-2 punch! Let’s wrap up.

Here’s the Bottom Line: Goldilocks growth and falling inflation mean the Fed will begin easing in September. Treasury yields keep pulling back after a big run-up. Falling rates mean it’s finally time to bet big on SMID stocks. Attractive relative and absolute valuations in an accelerating EPS growth environment are two more solid reasons to buy mid and small-cap equities. Remember, small- and mid-cap earnings growth is poised to be faster than the S&P 500’s in 2025 and we know markets always look ahead. Throw in Big Money buying and a near 50% allocation to the newly outperforming financials, industrials, real estate, and materials sectors, and you’ve got a recipe for success.

To learn more about Alec Young, visit Mapsignals.com.