Proprietary trading firms have gained significant popularity lately due to their unique offering of large funded accounts and risk-free trading opportunities for traders. However, this trend experienced a substantial blow from USA regulators, making everybody question whether these firms can keep up with traditional trading for the next decade, states Konstantin Rabin of LearnFX.

Proprietary Trading: Promising New Sector in Financial Trading

Proprietary trading firms, or prop firms, offer traders the opportunity to access the firm’s capital and trade on financial markets. Traders have to pass an evaluation phase with certain rules to get a real funded account. This way, traders can access the firm’s capital and trade almost risk-free. Prop traders are not liable for losses on funded accounts and have high profit-sharing, keeping a significant portion of profits when trading with the firm’s capital.

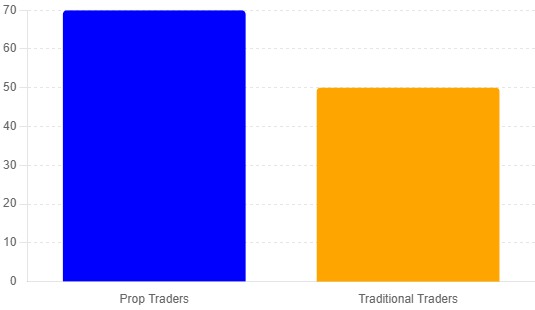

Failure Rates of Prop Traders Versus Traditional Traders Blowing Up Their Accounts

The failure rate of prop traders is higher than that of traditional traders. Over 70% of prop traders fail to pass the evaluation challenge and access funded accounts, while only half of traditional traders blow up their trading accounts. So, prop firms offer trading capital to traders, but very few make it to the end to acquire those funded accounts.

If this trend of low pass rates continues, there is a very low chance that prop trading can even match traditional trading in volume. To be more exact, the daily turnover of Forex was $7.5 trillion in 2022 dwarfing every other financial market. The contribution of prop firms in this staggering turnover is currently insignificant. Robinhood reported growth in funded accounts, increasing from 12.5 million in 2020 to 22.7 million by 2021. This is a tiny amount of capital when compared to Robinhood’s 89 billion in assets in 2022. Binance also had an estimated 31 million funded accounts as of October 2022. The peak 24-hour trading volume on Binance was 94 billion USD, which is significantly more than 31 million USD. The numbers show that despite low volumes when compared to traditional trading, prop trading is gaining momentum. However, there are many scams and frauds in the industry as it is still in its infancy. Therefore, traders should only opt for prop firms launched by industry veterans to sign up with only the industry’s best.

What Future Holds for Prop Trading

Developments in Artificial Intelligence and machine learning will play an important role in the future of prop trading. With many prop firms allowing Expert Advisors (EAs) or automated trading algorithms, traders will use this opportunity to automate their strategies. With access to prop firms’ capital, they are going to maximize their profits. Since automated trading allows traders to remove emotions and human error from their trading, prop trading is going to provide a perfect answer with access to large trading accounts, perfect for automated trading. AI-based robots are becoming more refined and with technological developments, it becomes even cheaper to develop or purchase more accurate systems. The only thing remaining for traders is to gain access to substantial trading capital and launch their algos live. As you read this, AI is gaining momentum, becoming faster, more accurate, and cheaper. The prop trading industry is also in its infancy, and we can only speculate what happens when these two fields collide.

Growth Potential and Market Trends

While still in its beginnings, prop trading has a massive growth potential, with more and more firms launched almost daily basis. Empowered by rapid technological advancements and increasingly sophisticated trading platforms specifically developed for prop firms, the future might be bright for this type of trading. The sector is also attractive for traders despite low pass rates. It offers access to massive trading accounts and greatly amplifies profit potential. The reason the pass rates are low is that prop firms have risk limit rules and most traders are bad risk managers. As traders adapt to prop trading specifics, the popularity of the sector will increase significantly. Because of its fast-growing nature, prop trading will become a staple point for showing one’s trading skills in the future, making it a popular way of financial trading for both beginners and industry veterans. Prop trading is going to be a sweet spot where traders can test their skills while accessing the trading capital needed to generate profits for daily expenses.

Bottom Line

While the prop trading industry continues to grow in both popularity and trading volumes, traditional trading is on the same path. With lower rates of blown-up accounts when compared to failure rates of prop accounts, traditional trading will continue to dwarf prop trading in the foreseeable future. However, prop trading offers risk-free access to funded accounts, which can not be underestimated. AI and machine learning will provide traders with even more incentives to start prop trading for enhanced profits.

By Konstantin Rabin, a FundedBull Marketing Consultant