Today kicks off the last full trading week in June and the final weekly price bar for Q2-2024, states Ian Murphy of MurphyTrading.com.

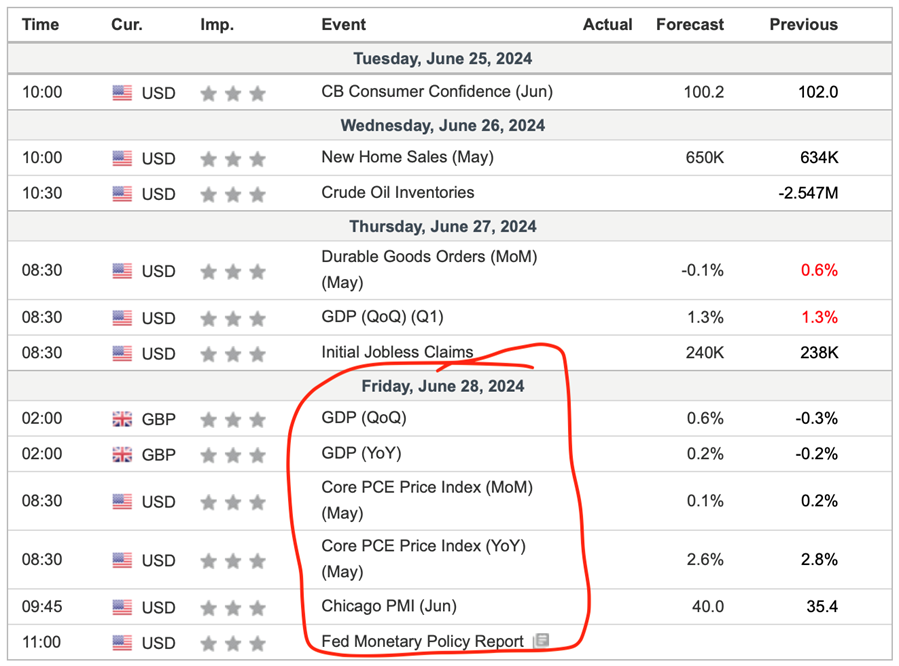

The economic calendar is light in the UK, EU, and US until Friday when US inflation data (Core CPI) is out.

Source: investing.com

Considering that it will be the final day of the month and quarter, there may be fireworks if the numbers surprise the market.

Friday’s trade idea was triggered when the price bar on Micro E-mini futures closed negative and below Thursday’s close. So far, the position has survived overnight trading. The initial stop and targets on Micro E-minis are shown above (left) for convenience.

Remember we are swimming against the prevailing market tide here, so be prepared to get out fast if this reverses by pulling down the stop to break even as soon as reasonably possible.

Donal B. has asked, “How can we be long the S&P 500 on the 52-Week Strategy and the Help Strategy (right above), but also be short the S&P 500 on this ‘reverse Help Strategy’?”

Short answer: Because waves go in and out while the tide is still coming in. Have a look at the videos on market cycles and market trends for more info.

Learn more about Ian Murphy at MurphyTrading.com.