As The Elliott Wave Financial Forecast (EWFF) explained in November 2023, recent market action is “simply what happens at the biggest tops. Technology breaks through in some fundamental way, only to yield to a future that is the opposite of the boom that participants cannot stop anticipating.” The state of the electric car industry is a cautionary tale that Artificial Intelligence (AI) backers might want to heed, writes Steven Hochberg, chief market analyst at Elliott Wave Trader.

Readers will recall the intense mania for Electric Vehicle stocks in the first quarter of 2021. In March 2021, EWFF noted that droves of money-losing EV and battery companies had come public through various means.

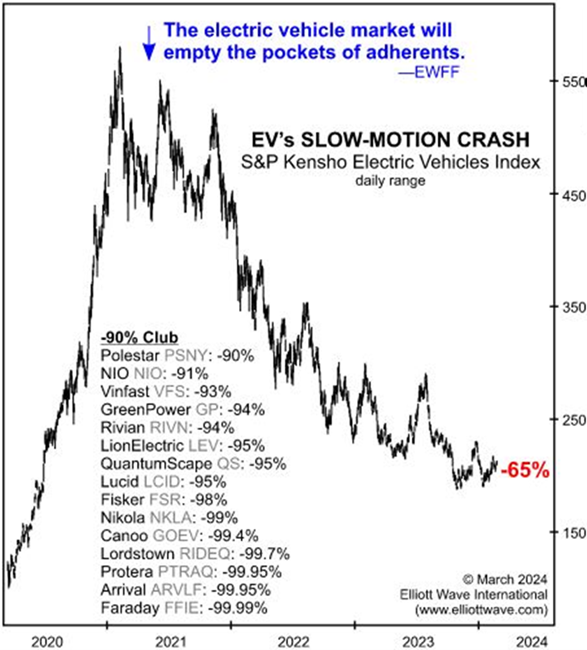

We asserted that it was only a matter of time before “the brutal competition of the auto industry” catches up to the upstart electric car makers. “The electric vehicle market will ultimately empty the pockets of adherents.”

This chart shows that the stocks of these companies are doing just that. A broad EV index is currently down 65% from a peak on Feb. 9, 2021, while the blue-chip EV company, Tesla (TSLA), is down 52% from a top on Nov. 4, 2021. The inset on the chart shows there are 15 companies whose share prices are down 90% to 99.9% from their respective peaks.

Recently, Apple (AAPL) put an exclamation point on the carnage by ending its effort to build an autonomous EV after investing more than 10 years and millions of research and development dollars in the project. The “brutal competition” that investors utterly failed to recognize in 2021 is now firmly entrenched, not to mention drivers’ continued preference for the good old-fashioned internal combustion engine.

As for competition, the capacity of Chinese electric car makers is so overwhelming that US car companies are falling behind. “China’s Electric Vehicles Are Going to Hit Detroit Like a Wrecking Ball,” reported The New York Times recently.

“It happened very quickly. Over the past three months, America’s Big Three automakers landed in big trouble. A new crop of Chinese automakers” is bringing “a deluge of electric vehicles” that sell for as little as $11,000. The threat is so pronounced, the Times says, “The federal government is going to have to help the Big Three—and the rest of the US car market—again very soon.”

Artificial intelligence backers argue that AI is “real.” Well, so are EVs. History demonstrates that the reality of a product will not stop the destruction of financial prices.

The latest issue of The Elliott Wave Theorist debunked the idea that a repeat of the Roaring Twenties was only beginning. But spurred by the limitless possibilities of the dream of AI, Bloomberg expressed a hundred years’ worth of optimism on Feb. 19: “Stock Markets Are Driving a New American Century.”

One cited reason is “the rise of tech as an economic force. AI innovations may cause US tech companies to rise all the more.” Another key reason is that China is “crashing.”

Notice that this is happening even as China is reputedly ready to conquer the global car market. As I recently pointed out in our Economy & Deflation section, China is, in fact, the future. But it is leading the way into a long-term downtrend that will startle and confuse the unprepared.

Subscribe to Elliott Wave International’s Financial Forecast Service here…