It’s not easy losing money in the stock market, and it’s even harder to get used to accepting losing trades. But if you want to successfully trade over the long-term, you have no choice, states Bob Lang of ExplosiveOptions.net.

As a trader, you will have losing trades. It’s just a fact. And the more you trade, the higher the probability of losses. This doesn’t have to end your career as a trader! Just understand that it is part of the game.

Roger Federer, arguably the greatest tennis player of our generation, won just more than half of the points he played. Think about that for a moment. A man who won 20 grand slam tournaments was just slightly better than his opponents over a 20-year career. He was willing to accept that he would lose points. He just needed to be a bit better than his challengers and stay focused on winning the last point of the game.

This is the same in trading.

Though it’s nice to think that you will do nothing but sell at the right time and cash in on winning trades, trading isn’t a game of perfect.

How I Got Used to Accepting Losing Trades

I am constantly looking for opportunities to trade, mostly options where timing is critical. A misstep here or there and the consequences could be devastating. I know I need to pay attention to the markets and follow my risk management principles. And I do.

But even the best-laid plans don’t work out. I recently booked a few losses that were not my fault, but they stung anyway. So here’s what I did:

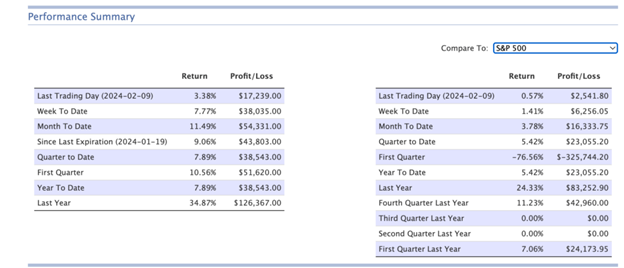

I looked at all the winning trades I had recently made. And then I looked at my portfolio, which showed I was up–way up!

Like Roger Federer, I had losses. But they weren’t fatal. I shook them off and put together some winning trades that more than made up for the loss. This is not easy to do when a loss is staring you in the face, but you’ll find your results dramatically turn in your favor when you start accepting losing trades.

Just remember: you only need to post a few more wins than losses.

Learn more about Bob Lang at ExplosiveOptions.net.