No changes are expected when the Fed shares their latest thinking on interest rates at 2:00 PM ET today, while market types will be eagerly listening for clues on the path to easing in the follow-up press conference, states Ian Murphy of MurphyTrading.com.

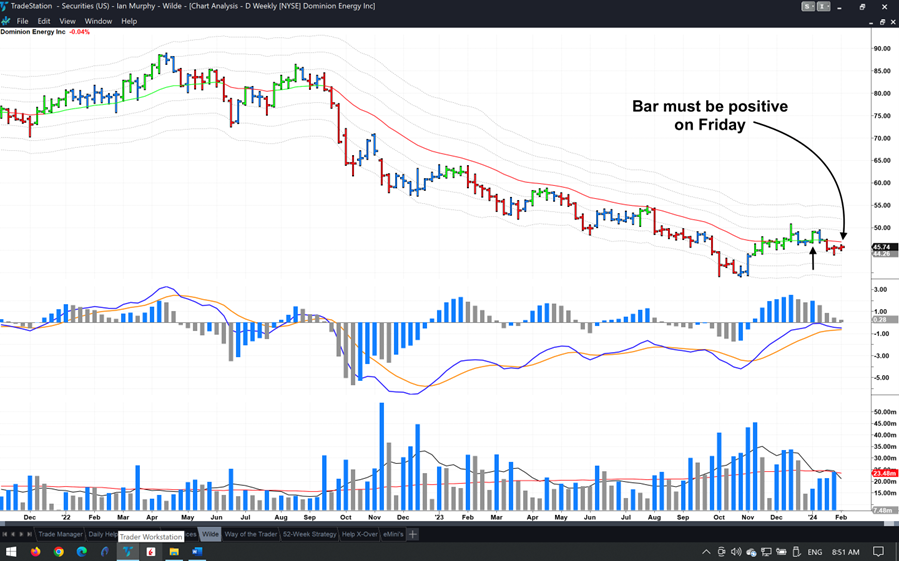

Meanwhile, inflation in Germany, Europe’s largest economy, slowed more than expected this morning indicating the ECB may also be approaching rate-cutting territory. This week’s trade idea is an opportunity to enter the Dominion Energy (D) trade from January fifth (arrow) if you missed the chance. The stock has pulled back and appears to have found support after washing out the -1ATR line (hence a soft stop, on a weekly closing basis).

If this week’s bar is also positive, it will be another entry signal at a better price, with a tighter stop (and resulting larger position) than the first entry on January fifth. This also means traders who took the first trade can increase their position now if their risk limits allow. Earnings are expected on Feb 22, so there will be three more complete weekly price bars by then.

Learn more about Ian Murphy at MurphyTrading.com.