The S&P 500 (SPX), Dow Jones Industrial Average, and Nasdaq100 all went out last week at new all-time highs. Again, states JC Parets of AllStarCharts.com.

We're now officially in Month #20 of this bull market that began in June of 2022. We've seen some corrections along the way, and I bet that we see more of them this year. One could argue that stocks have already been corrected over the past six weeks. The new highs lists all peaked in mid-December. And since then, it's been at least a stealth correction underneath the surface. At worst, the beginning of something larger that could last into Q2:

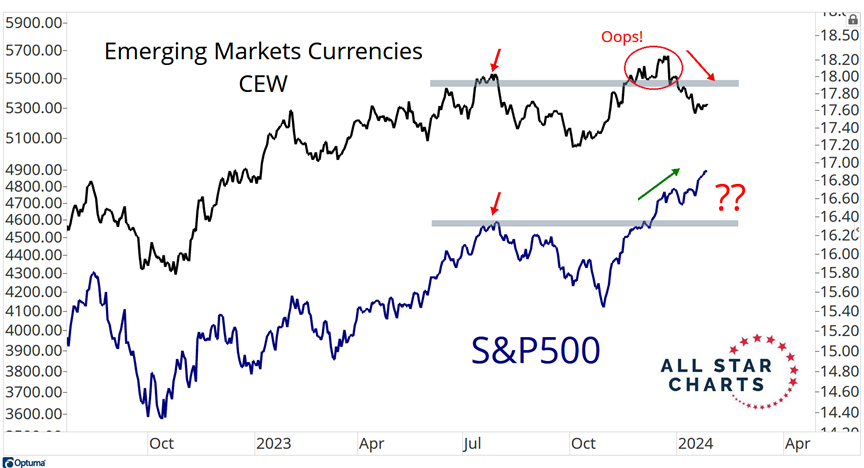

There are divergences out there for sure, and they're starting to add up. We came into the year pointing to what it would take for us to start to get a lot more bearish toward equities. And we've already checked the box on some of them, including strength in the US Dollar, which we've seen all year. Emerging Markets currencies have been a tremendous leading indicator for us, as you guys are well aware. It's been very helpful in convincing us to be buying stocks so aggressively last year. But now this:

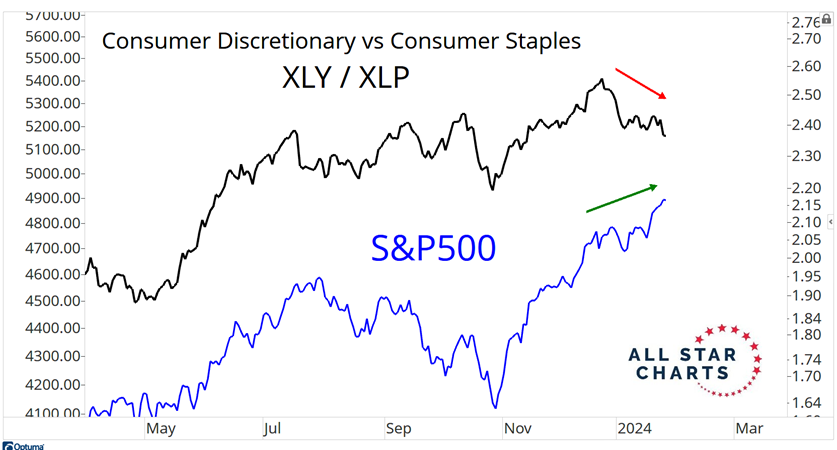

If EM Currencies are below their July highs (when stocks peaked), then the biggest risk for stocks is lower or sideways, not higher. Meanwhile, here's another big divergence. We haven't seen Consumer Discretionary rollover vs Consumer Staples like this since the end of 2021.

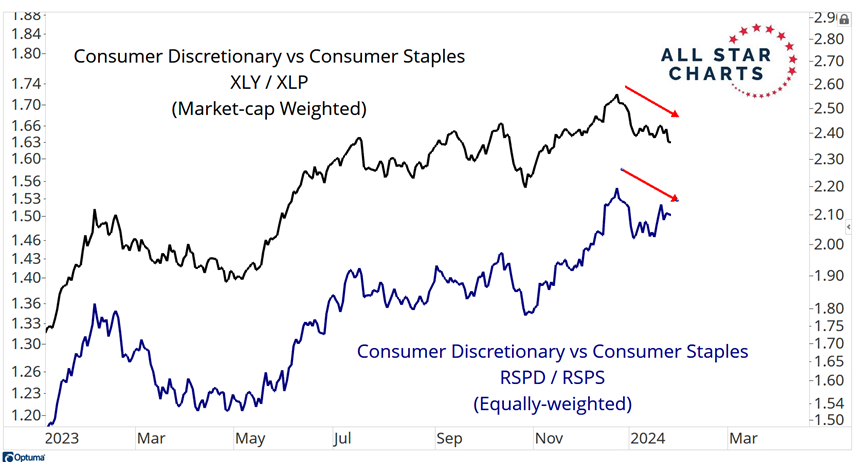

Some people like to point out how top-heavy these market-cap-weighted indexes are, with Amazon and Tesla dominating the Consumer Discretionary Select Sector SPDR (XLY) index, for example. But when you look at the equally weighted ratios, you're going to see the same divergences. So it's not an "Amazon and Tesla" thing. It's a Consumer Discretionary rolling over relative to Staples thing.

Remember, every big market correction first starts as a small one. But not every small correction turns into a big one. So what would it take for this six-week stealth correction to turn into something more powerful? I still think it's these. We're looking at some of the most important groups of stocks in the market. Maybe even THE most important groups. Notice how each of them: Broker-Dealers, Industrials, Semiconductors, and Homebuilders are all still holding above those former highs:

If this is more than just a "stealth" correction, that has mostly gone unnoticed, you're going to start losing these leaders one by one. You haven't yet. But the stage is set. One thing I will say is that the way we've approached the market has already been different for most of this month, compared to how we were approaching things in November, for example. During that face ripper of a rally late last year, volatility was super low. So we were just long stocks. Easy. Simple.

But this month, with volatility higher, things are not that simple. Even with the Cboe SPX Volatility Index (VIX) still down near lows, you've certainly seen a pickup in implied volatility at the individual stock level. So we've taken advantage of that by selling premiums to collect income. We couldn't do that before.

The question now becomes whether we keep selling some premium while volatility is elevated, before reverting to last year's strategy of just getting long. OR, do things get progressively worse, volatility spikes, and our strategies turn much more bearish? That's what we're asking ourselves heading into February, which is historically one of the worst months of the year for stocks.

Our new trade ideas and adjustments to prior trades will be dependent on the factors above. Rug pulls don't happen overnight. They first need to be set up. I've seen it happen a million times. And that's helped me be more prepared.

To learn more about JC Parets, please visit AllStarCharts.com.