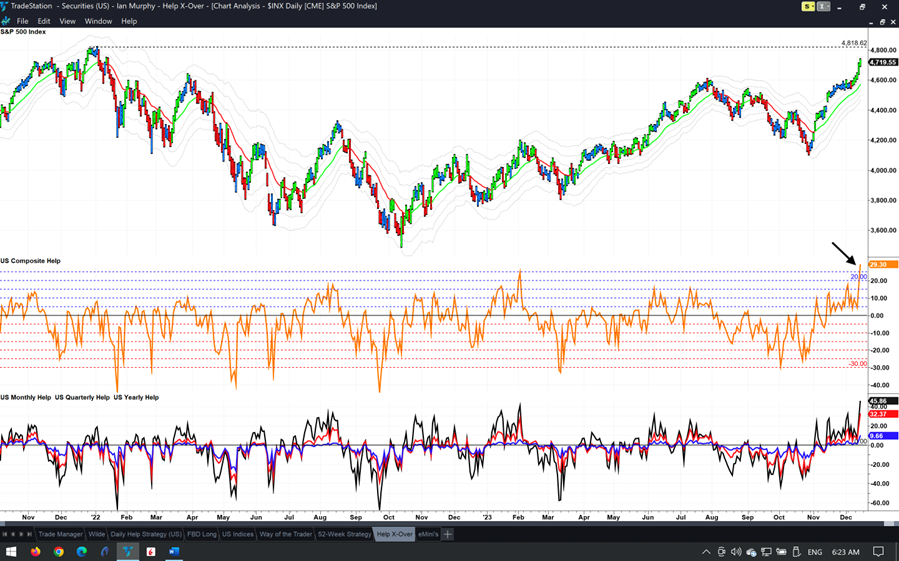

Just under half of all US-listed stocks made a new 20-day high, states Ian Murphy of MurphyTrading.com.

This was helped along during yesterday’s session as Powell’s speech turbocharged the Santa Rally.

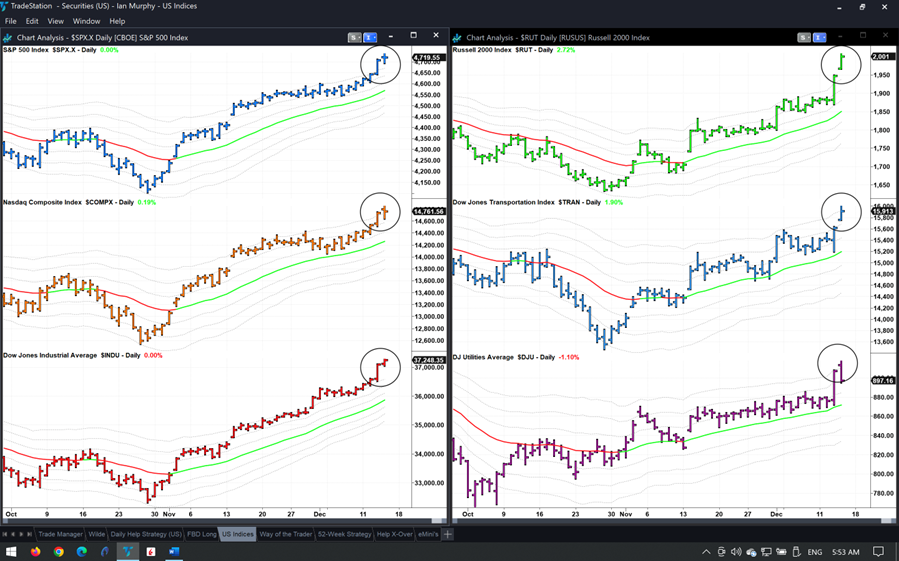

According to Bloomberg, all the indices we track traded above their 3ATR channels on a daily chart (circles) and the market had its best reaction to a Fed announcement in 15 years.

Slowly but surely the S&P 500 is closing in on the previous all-time high of 4818.62 from January 2022, and it’s beginning to look like that level will be taken out on or before January 2024. Look at the Composite indicator (arrow), all three NHNL time frames are strongly positive.

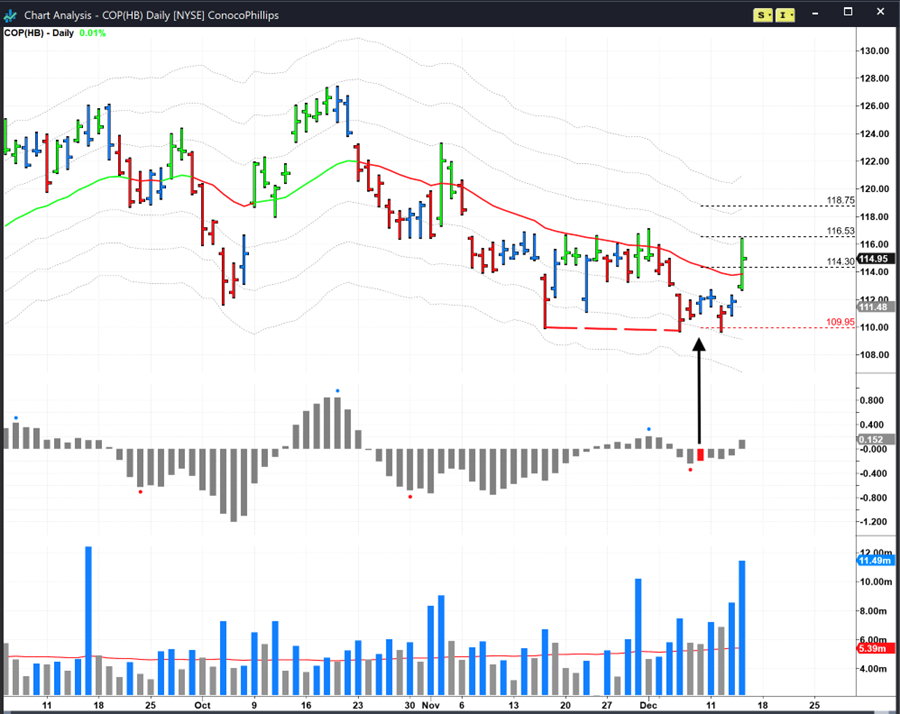

As for active trades, the 52-Week and Help triggers are progressing positively, but the trade idea for ConocoPhillips (COP) mentioned in the mid-month review on December 11 has been frustratingly stopped out before reversing and rallying to the first target. The stock made a new low by a mere 4c two days after the trigger, taking out the protective stop by 25c. The oil major then did an about-face and rallied 6% to hit the first target and come within touching distance of the second.

When this happens, there is always a temptation to adjust the settings on protective stops – should we set it at 0.6ATR or 0.75ATR below the low? In my experience (and based on comprehensive back testing) a whipsaw at 0.5ATR rarely happens. The stock either takes off skywards, or tanks quickly, and any reasonably placed stop would be hit anyway, so 0.5ATR gives enough room for a shallow pullback while keeping the risk-to-reward ratio sensible.

Learn more about Ian Murphy at MurphyTrading.com.