Fed chair Powell's primary intention and challenge is to sound positively hawkish, states Ashraf Laidi of AshrafLaidi.com.

Meaning to maintain the soft landing narrative, while pushing back against market (fed funds futures) pricing of 4-5 rate cuts in 2024. Powell's ability to convince markets will primarily depend on the interplay between the DotPlot (Fed members' forecasts for FedFunds rate) and the Summary of Economic Projections (SEPs)—the average forecasts for growth, inflation, and unemployment.

New vs September DotPlot for 2024

The current median of Fed members' FedFunds expectations issued in September stands at 5.1%, meaning policymakers were pricing about one rate cut for 2024. Today's meeting is expected by economists and strategists, not the “market” to see the median dot plot dropping to 4.9%, meaning two rate cuts of 25 bps by the end of 2024. Again, the market (fed funds futures) is currently pricing between four and five rate cuts by the end of 2024.

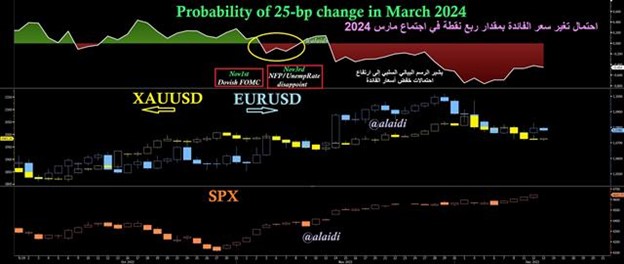

About the Above Chart

The chart above shows the non-surprising relationship between the probability of a 25-bp FedFunds rate change at the March 2024 meeting. The current -0.45%—indicating a 45% chance of a 25-bp cut—is much less than the 75% probability of a similar rate cut seen last week, when gold and EURUSD were both higher. Watching the real-time development of this probability pricing will be crucial in gauging the evolving market reaction, and that's exactly why I'll be updating our WhatsApp Bdcst Group members before and after the decision.

Another thing (not on the chart) is that Bitcoin also peaked at the bottom of these FedFunds expectations for March 2024, whereas SPX and Nasdaq100 tend to show more resilience.

Good luck to everyone, and don't forget Thursday's BoE decision, especially after today's dismal GDP and industrial production figures. Once that's done, we move to the unimportant ECB decision before next week's crucial BoJ policy decision.

Learn more about Ashraf Laidi at AshrafLaidi.com