The S&P 500 (SPX) just went out at a new 52-week high, asks JC Parets of AllStarCharts.com.

If you go back and look, you'll find that in bear markets you don't see a lot of new 52-week highs. As it turns out, you'll regularly see 52-week highs during bull markets.

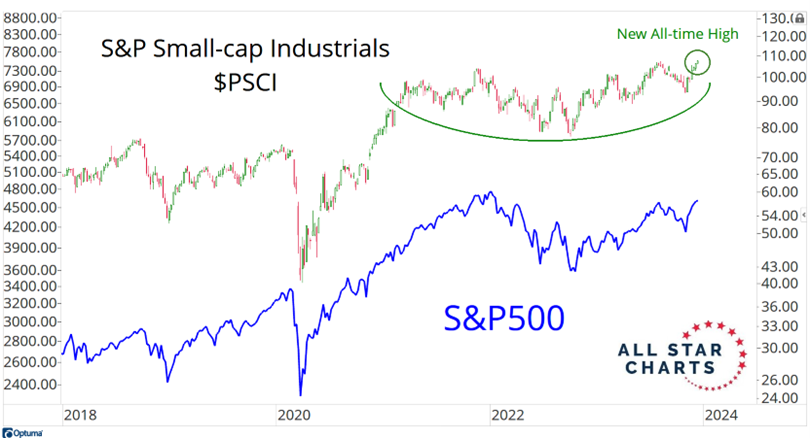

Remember when they told you that small caps were going to drag the rest of the market lower? But that's just not how markets work. Here are small-cap Industrials going out at new all-time highs:

Some people claim to not care whether we're in a bull market or a bear market. They say that it doesn't matter, just trade what's in front of you. But you see when it comes to time allocation, this is an important distinction. We want to ask ourselves whether we should be spending more time looking for stocks to buy, or should we spend more time looking for stocks to sell.

It's been a bull market for 18 months now. Spending more time looking for stocks to buy has paid us very well. The question is what we're doing about it moving forward. What is Q1 of 2024 going to look like?

To learn more about JC Parets, please visit AllStarCharts.com.