The logic is simple: first, as the US dollar appreciates, the cost of oil in local currencies increases, and second, higher prices reduce demand and, ultimately, prices, states Brett Friedman, Winhall Risk Analytics/OptionMetrics Contributor.

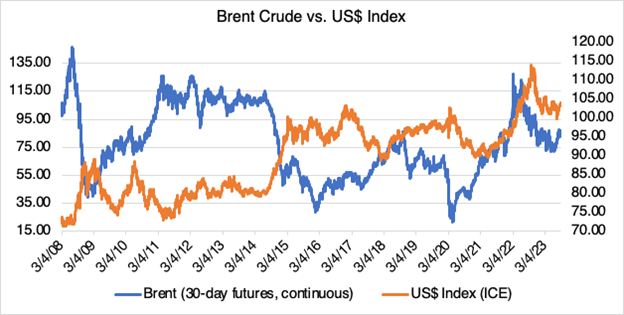

This relationship seems to be generally accepted and is frequently mentioned in articles and discussions regarding oil prices. Despite its ubiquity, is it still true? Let's begin by reviewing the historical relationship between the USD (ICE US Dollar Index) and crude oil (Brent, 30-day continuous contract) since March 2008:

Source: OptionMetrics; ICE

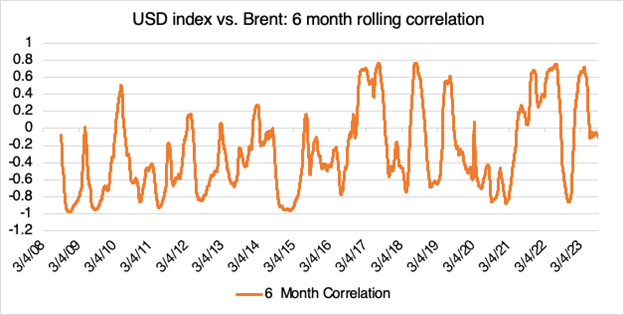

Source: OptionMetrics; ICE

Using daily data from OptionMetrics, the six-month correlation during the period was highly unstable and varied between -0.98 to 0.77 with an average of -0.27. Using a 12-month correlation yields similar results, the range shifting slightly to -0.97 and 0.87. Although rolling correlation may not be the most appropriate statistical technique to determine the relationship, the conclusions using more elegant techniques are similar and extreme enough to merit attention. Tellingly, the most variation occurred during periods when the dollar or crude was moving extremely due to external events. For example, during the 2008 financial crisis (defined roughly as 08/2008 - 12/2009), sharply lower growth expectations led to sharply lower crude oil prices and a flight to safety to the US dollar, eventually leading to a (0.98) correlation. Similarly, the plunge in oil prices in 2014 and the concurrent sharp rise in the dollar (albeit with a several-month lag) resulted in the correlation moving to less than (0.95).

The tendency of the correlation between the dollar and crude oil to react most sharply during certain periods suggests that the correlation is only noteworthy when macro events common to both have caused a major increase in either crude or the US dollar. The factors that might lead to a direct linkage between the dollar and crude oil are difficult to discern, inconsistent, or sometimes simply ignored by the market. Common factors that affect the dollar and crude oil but may not necessarily lead to a direct causal relationship between the two (such as relative growth rates or geopolitical risk) may be the primary drivers behind significant moves in correlation. For example, changes in the world's propensity to hold dollars as a result of geopolitical events will have a direct effect on the dollar but may or may not have a direct causal relationship to crude oil. The familiar warning that correlation does not equal causation applies.

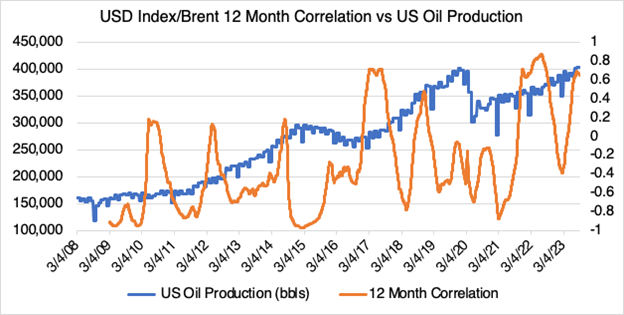

Although the dollar-to-crude oil correlation is clearly unstable and sometimes hard to justify, it has been slowly trending to a more positive correlation since about 2015. What is behind this? Mostly, technological advancements in US crude oil production have changed the relationship between crude oil, the US trade deficit, and the dollar. Domestic oil production has been increasing since 2011, spurred on by the "shale revolution," or the combination of hydraulic fracturing ("fracking") and horizontal drilling. Consequently, crude imports declined, and by 2019 the US became a net oil exporter (as well as the world's largest producer starting in 2015). All this helps to reduce the US trade deficit, and along with other factors, helps to support the dollar. This is in contrast to when the country was a net importer of oil, which widened the trade deficit and contributed to a lower dollar. However, in both cases, US crude oil production, not necessarily its price, led the dollar, not the other way around.

Source: OptionMetrics; ICE; Federal Reserve Economic Data (FRED)

Given the relatively low correlation, as well as its instability, it seems that the crude oil to US dollar relationship is inconsistent, unreliable, and subject to changing fundamentals in both markets. In light of the numerous unknowns and possible changes in technology, global energy consumption, and macroeconomic factors, it appears likely that the relationship between crude oil prices and the US dollar will continue to be as elusive and unpredictable in the future as it has been in the past.

Prajwal Pitlehra, a FRE candidate at the NYU Tandon School of Financial Engineering, assisted in the production of this article.

Brett Friedman has built and managed three risk management organizations, and two trading startups, and has transacted on numerous exchanges and OTC markets. He is with Winhall Risk Analytics and is an OptionMetrics contributor.