Stocks rallied strongly on Thursday and Friday in the belief interest rates have reached their zenith in the current hiking cycle, states Ian Murphy of MurphyTrading.com.

We’ve been here before only to see powerful rallies crumble in the face of some poor earnings report or unexpected geopolitical event.

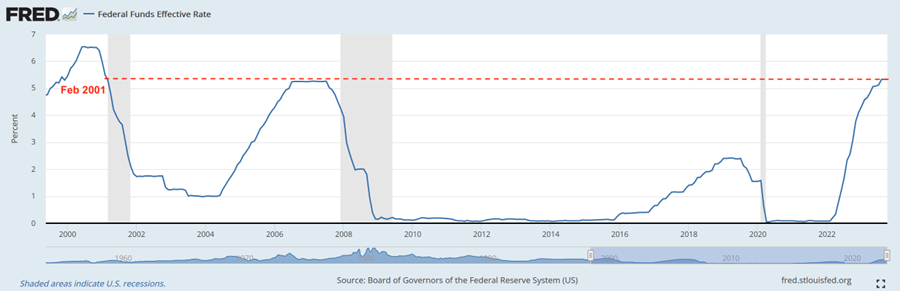

Source: Federal Reserve Bank of St. Louis, November 5, 2023 (Click images to enlarge)

The current effective US rate of 5.33% has not been this high in over 22 years and the Fed has given no indication of starting to cut it any time soon. They want to see an economic slowdown in the data first and the gray areas on the chart above are what a ‘slowdown’ looks like. Notice how the gray areas are always preceded by a leveling out in rates…just saying.

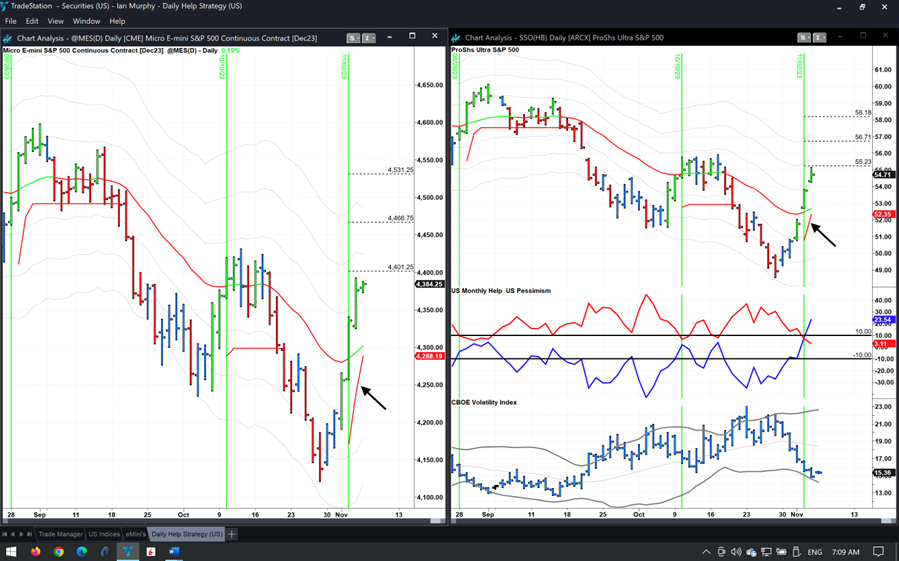

Nevertheless, as we traders say, ‘Let’s make hay while the sun is shining’, and the Help Strategy made a valiant attempt to reach the first targets on ProShares Ultra S&P500 2x Shares (SSO) and Micro E-mini futures on Friday but came up short on both instruments. Thankfully the trailing stops moved up quickly because the initial rally was so powerful.

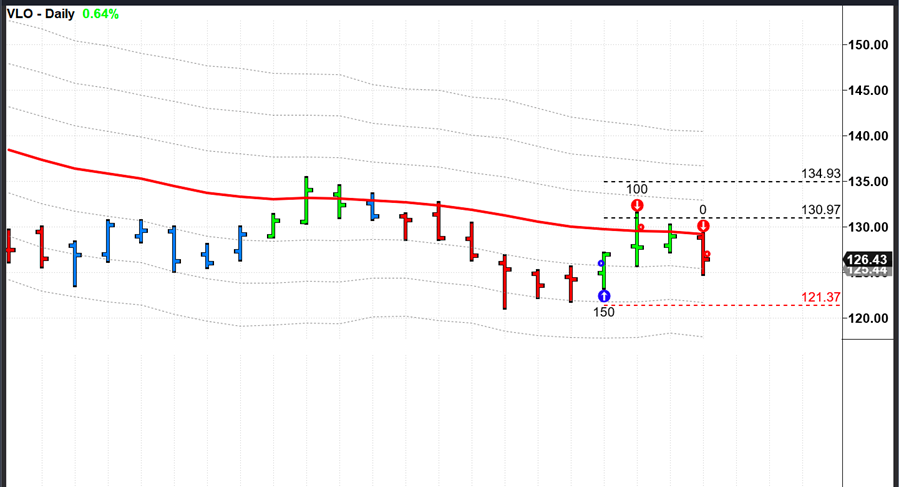

The Valero Energy (VLO) trade from last week stalled on Friday after hitting the first target. Technically this trade has done nothing wrong and there is no reason not to stick with it, but in my personal account, I closed out the trade early at $127.08. A request has come in to detail the actual profit (or loss) on this one, so here goes:

Bought 150 shares at $126 (plus $5 commission) = $18,905

Sold 50 x $129.97 (-$5) = $6,493.50

Sold 100 x $127.08 (-$5) = $12,703

Profit $291.50 (1.54%)

Learn more about Ian Murphy at MurphyTrading.com.