Triggers for daily swing trades in stocks tend to occur in clusters because the strategy requires a specific set of signals to line up at the same time to produce a valid trigger to enter, states Ian Murphy of MurphyTrading.com

Because the market moves in cycles on different time frames simultaneously, this means we frequently alternate between periods of getting no trading signals to days when we get up to a dozen triggers on different stocks and we don’t know which to take.

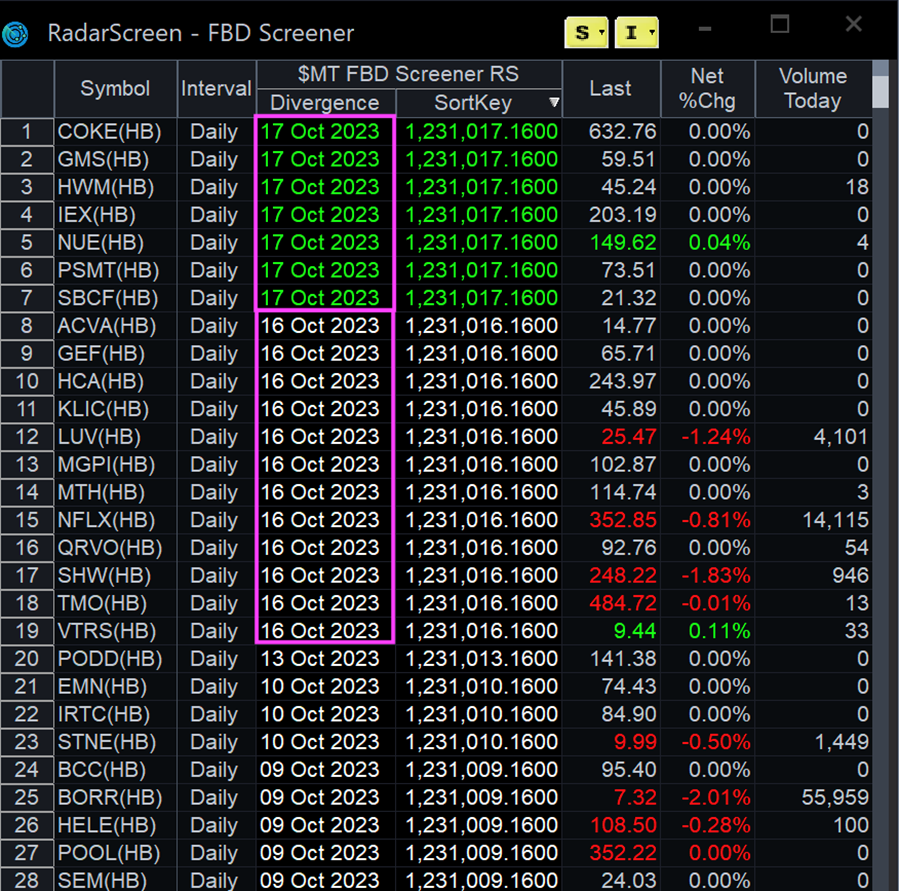

Recent market conditions in US stocks offered a perfect example of this, as can be seen above. The scanner I use cycles through my current list of 2493 stocks every 30 seconds looking for signals, and at the end of the day the valid triggers stay on the list. Notice how we can go for days without anything and then we get a cluster of triggers on the same day.

This clearly demonstrates why patience and discipline are so important for traders as we must wait for the triggers to occur and then act when they do. However, there is an added layer of complication now because we are in the middle of earnings, and we should not hold a daily swing trade through the announcement.

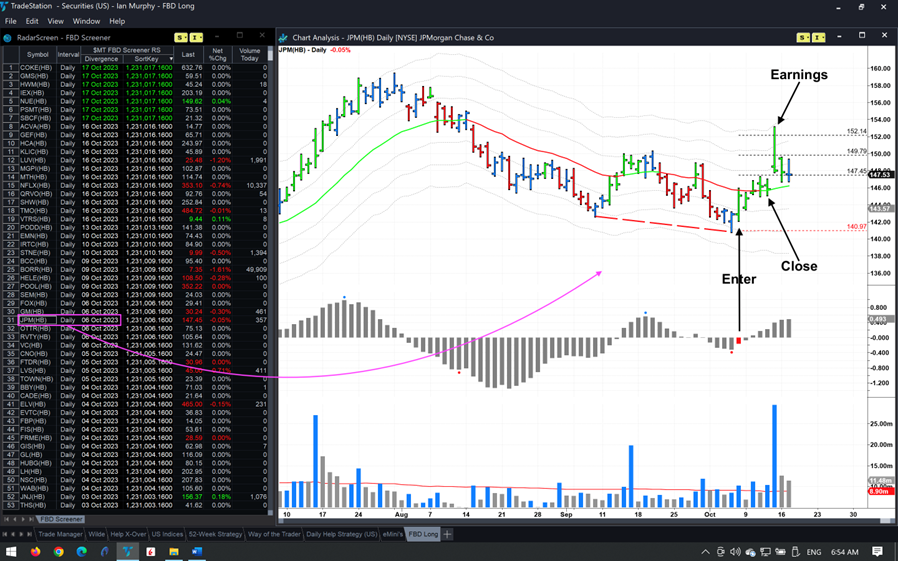

JPMorgan Chase & Co (JPM) was a recent example. There was a trigger on October 6 (a Friday), and another opportunity to enter the following Monday, but the trade failed to hit targets as the week progressed and we had to close out the position before earnings on Oct 13, and sure enough all three targets were hit that day! Very frustrating!

This can be a super challenging experience, but holding a daily swing trade through an earnings announcement is a 50/50 gamble and it can go horribly wrong.

Learn more about Ian Murphy at MurphyTrading.com.