After a litany of bearish developments in the crypto space last year—the Terra Luna crash, the Celsius crash, and the FTX collapse—the first half of 2023 concluded with similarly anti-crypto sentiments as the SEC announced the filing of charges against Coinbase for “operating as an Unregistered Securities Exchange, Broker, and Clearing Agency", says Jason Appel of ElliottWaveTrader.net.”

Additionally, the SEC also announced the filing of charges against Binance for “operating unregistered exchanges, broker-dealers, and clearing agencies; misrepresenting trading controls and oversight on the Binance. US platform; and the unregistered offer and sale of securities.”

As noted in my most recent update from March, “While these failures [FTX, Celsius, Terra] have demonstrated some of the risks of the larger crypto space, what is also apparent is Bitcoin's strength and stability in the face of adversity.”

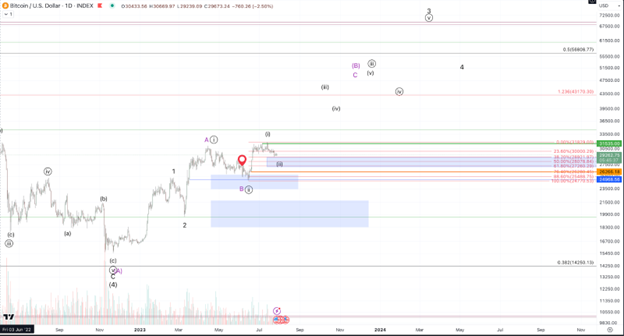

Similarly, the market seemed relatively unconcerned about these actions from the SEC. Please note the chart below and the red “balloon” where the news was announced. BTC completed a minor correction and started a new impulsive rally from the June low.

And, while the SEC’s charges did not pertain to Bitcoin, the continued threat of regulatory action in the space is not altogether inspiring wider adoption of crypto. The takeaway here is that Bitcoin’s price continues to “shake off” the bearish news.

While our forte in Crypto Waves is not to predict the news, there’s a real question as to whether the tide is turning on the news front. Two weeks ago, on July 13, the announcement was made that, in the SEC’s case against XRP, a summary judgment was made in favor of Ripple Labs, ruling that XRP is not a security. It should be noted, however, that this was not a complete victory, as the sales of XRP to institutional investors met the standard for the Howey Test, which is used to ascertain whether an investment is or is not a security.

Nevertheless, this news is a welcome change from the negative tenor in the past year+.

Let’s take a look at the technical picture of the current stance.

In the previous update, we noted that we tentatively considered the uptrend intact from the 2018 low, and while the November 2022 low briefly broke beneath ideal support, that its strong rebound and continuation higher in 2023 constitutes an overall successful test of support.

On a smaller timescale, from the 2022 low, prices have formed an uptrend in what appears to be a series of impulsive rallies and corrective declines. Based on the proportions among the individual waves, I’ve shifted the internal composition of my bullish perspective from the previous updates from a larger wave one of (five) forming, to a series of nested one-twos that is getting near a more significant breakout.

(Reposting the chart from above for reference)

On the micro level, the price has a good impulse up from the mid-June low and appears to be filling in a corrective retrace from the top. Fibonacci support for upside followthrough in this count is $27.2k-$28.9k. So far, prices have tested the upper end of this region but the corrective decline from the July high appears incomplete.

Whether Price intends to follow the black vs. purple path is still a larger and more significant question. We tentatively hold a bullish view for the price to head to new all-time highs in this rally that’s commenced from the 2022 low. However, even in the more bearish case–presented in the purple count–the shorter timeframe action is aligned within this perspective for a move up to $46k-$50k before a more oversized top is likely to be struck. That forecast portends approximately a 60% gain from current levels and even more from an entry in the noted support. Also, this setup is technically valid so long as Bitcoin's price remains above the June low. However, a sustained break below $26k would signal a likely failure. And while a breakdown below the June low still has some bullish potential later on into 2023 upon a successful retest of lower support, the immediate setup would be invalidated.

Jason Appel is an analyst at ElliottWaveTrader.net where he co-hosts the Cryptocurrency Trading service and hosts the site's beginners’ forums and webinars.