Although it’s hard to tell by reading only the financial news, there was a mutiny last weekend in Russia, states Brett Friedman of Winhall Risk Analytics.

This was one of the big international news stories so far this year; Russia (the Soviet Union) hasn’t had a coup since 1991, and this recent attempt could have touched off a nasty civil war within a country with thousands of nuclear weapons, not to mention an ongoing war in Ukraine. The effect of the coup on the future conduct of the war, and by extension its possible effects on financial markets, should not be minimized.

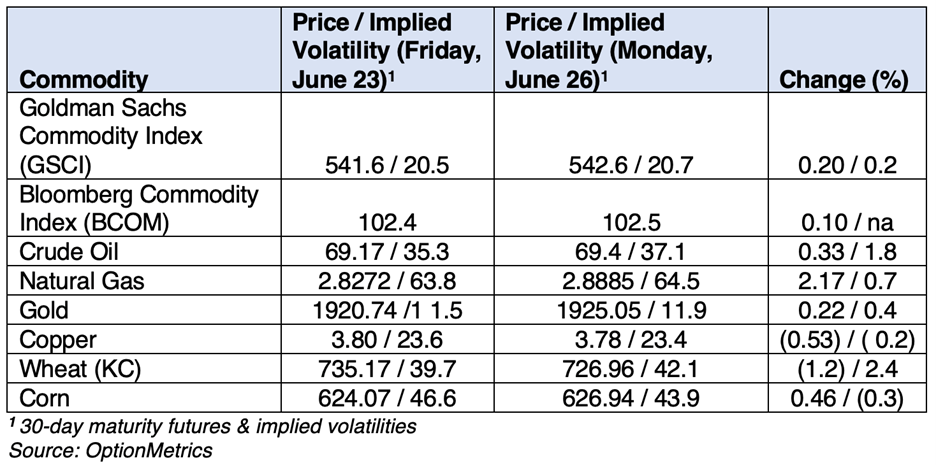

Since the beginning of the war had a significant effect on commodity prices and volatilities, you would reasonably expect that anything to hasten the war to an end would yield a strong reaction. As it turned out, you would have been quite wrong. Across all commodity sectors, and even in those most affected by the war (energy), the reaction was minimal to nonexistent:

The commodity markets ignored the coup and declared “business as usual” (natural gas (HH) rallied due to the heat wave currently in Texas and the Southeast). Prices and implied volatilities only showed marginal changes.

Why was this? One should not read too much into the market's benign reaction. Two factors that reduced the potential volatility were at work here. First, the coup was aborted and did not metastasize into a full-blown conflict. Second, it occurred on Saturday morning, relatively early into the weekend, and was over by the beginning of trading in Asia on Monday morning. If the same events had occurred during a normal trading day, the outcome would have been much different.

The coup hints at events that might unfold in the months to come. At its most basic level, the coup was a power struggle that was a direct byproduct of the war. The continued stalemate will only highlight the Russian regime’s weaknesses and encourage other military or political challenges. To shore up the regime, either the war has to be won or a favorable settlement reached. The Russians don’t have many options on how to accomplish either, but eventually, the regime’s survival will force a solution. On the other side, the Ukrainians can view the most recent turmoil as an opportunity to intensify their operations while Russia’s attention is diverted elsewhere, eventually attempting to force favorable negotiation. In one fashion or another, the coup may increase the probability of the war concluding earlier than previously thought.

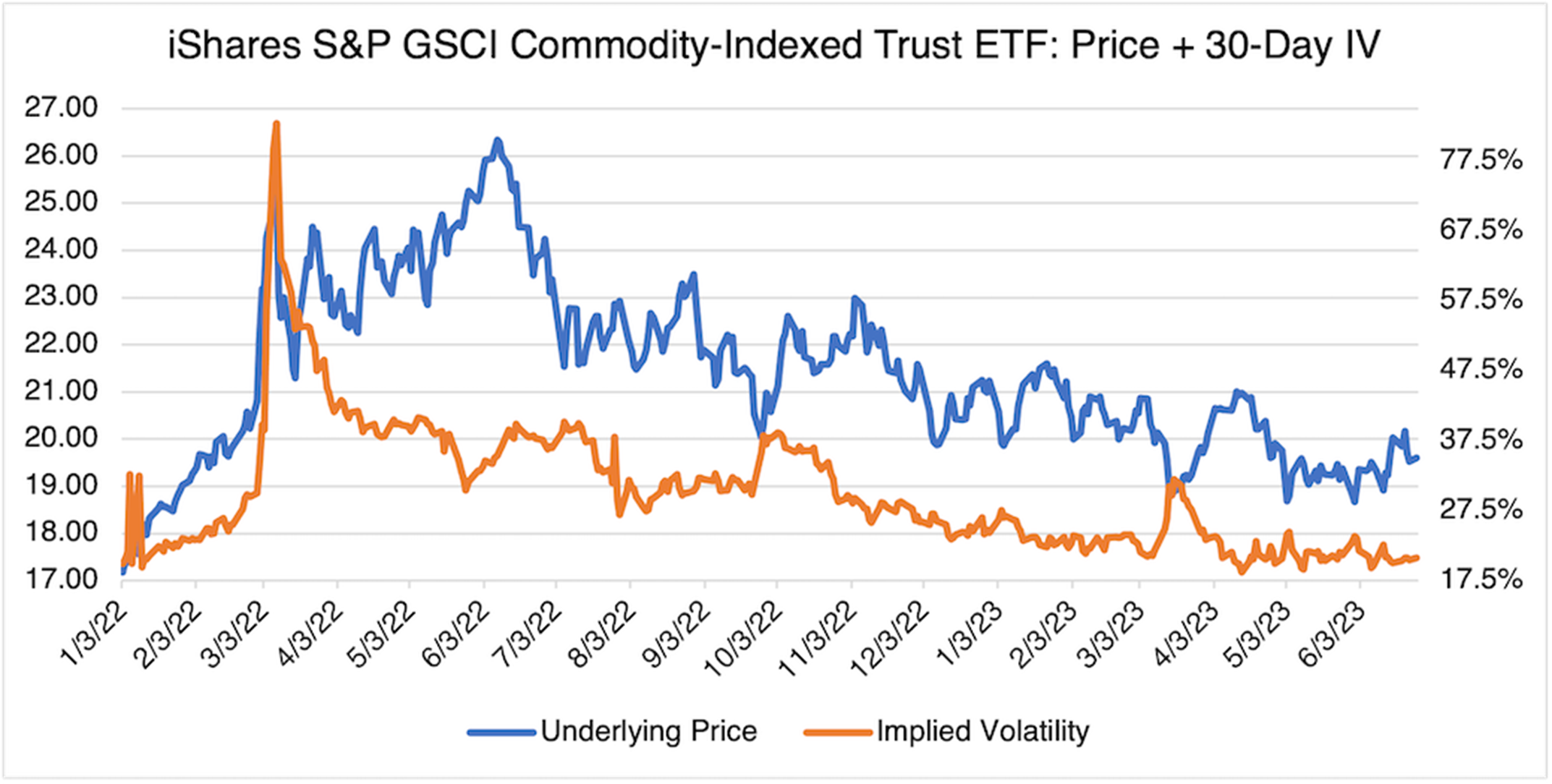

Although not likely in the near term, what would a settlement of the war in Ukraine mean for commodity markets? First, it would depend on how the settlement came about in the first place. If it was the result of an intensification of hostilities, by either or both sides, to gain leverage in future negotiations, increased disruption to shipping and transport infrastructure will likely occur. As a result, the first impulse to the war’s endgame could be bullish for commodities. However, if the increased hostilities drive the parties to a settlement, which would include the lifting of sanctions, then the overall result would be bearish. This would be in keeping with commodities’ downward trend since June 2022. to illustrate, below is the iShares S&P GSCI Commodity-Indexed Trust ETF (GSG):

Source: OptionMetrics