The crafting and managing of our covered call writing trades are directly dependent on our pre-defined goals, states Alan Ellman of The Blue Collar Investor.

In this article, we will analyze a Tesla (TSLA) covered call trade where the strike was about to expire in the money (ITM) and exercise was inevitable if no action is taken. This trade was shared with me by a BCI member.

Trade Information

- TSLA is viewed as a long-term buy-and-hold with a bullish assumption moving forward

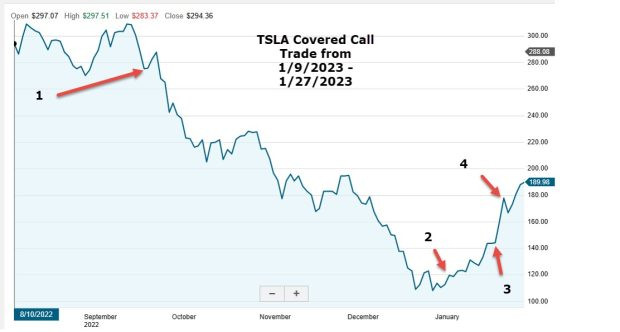

- TSLA was purchased at the end of September 2021 at a basis of $270.00 per share (number one in the chart below)

- 1/9/2023: TSLA trading a $119.77 (number two)

- 1/9/2023: Sell one x 1/27/2023 $160.00 call (number two)

- 1/25/2023: TSLA reports favorable earnings (number three)

- 1/27/2023: TSLA moves up to $177.90, leaving the $160.00 strike-deep ITM (number four)

- Should the option be rolled or allow exercise and re-purchase on Monday?

TSLA Six-Month Price Chart

Trade Analysis

When writing covered calls on shares we intend to hold for the long term, the strategic approach is known as portfolio overwriting, where we use only deep out-of-the-money strikes to avoid exercise. That was properly structured in this case, with shares trading at $119.77 and the strike of $160.00 with a two-week expiration.

However, the BCI earnings report rule was breached, with contract expiration occurring after the ER date. The favorable report caused the share price to accelerate well past the $160.00 strike. Now what? Do we roll or allow exercise and re-purchase the shares on the Monday after expiration Friday?

To Roll or Not to Roll

It is true, that if we roll the option, we are paying a minuscule time-value price (pennies) to buy-to-close the near-term option. However, if we allow assignments, we are exposing ourselves to weekend risk. If the share price moves much higher by Monday, we lose. Of course, the opposite also holds, but do we want to take the chance?

The Elephant in the Room

This dilemma was caused by writing a covered call through an earnings report. As an alternative, a 1/20/2023 weekly call could have been written with no covered call in place for the 1/27/2023 expiration date. After the week of the ER, calls could have been written on a new basis ($180.00 range).

Discussion

Before entering and managing our trades, we must identify our goals. We always avoid earnings reports. If we are portfolio overwriting, we only use deep OTM strikes and, if faced with the exercise of ITM strikes at expiration, rolling the options will avoid weekend risk.

Learn more about Alan Ellman on the Blue Collar Investor Website.