Throughout May the US equity market made a valiant attempt to break out of the bearish trend which began in 2022, and in the process, individual stocks are starting to swing to the upside, states Ian Murphy of MurphyTrading.com.

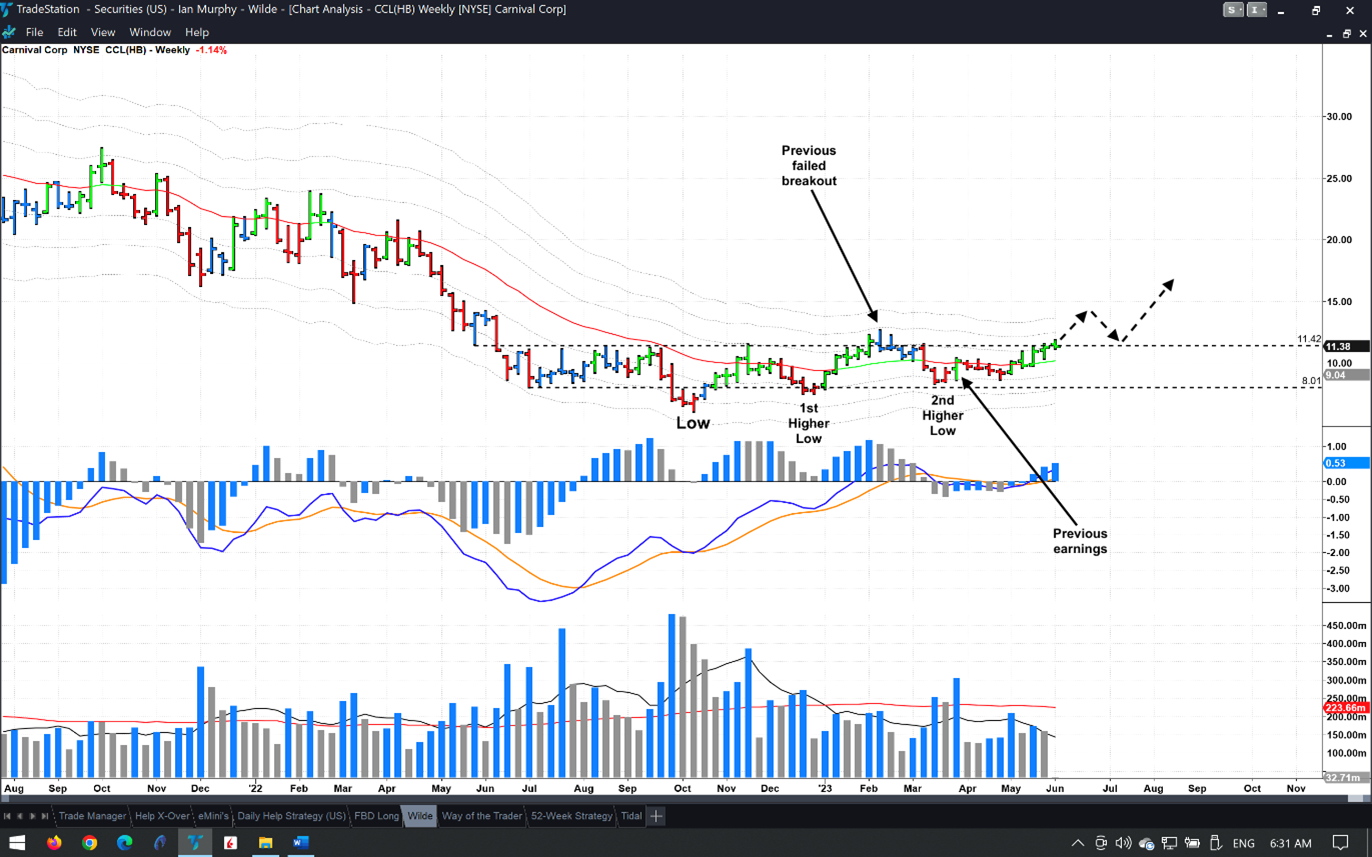

Carnival Cruise (CCL) may be one of them. Previous newsletters looked at the world’s largest cruise ship operator as we waited for a bottom to form on the share price. The stock has remained on the watchlist and is back in focus this week because the price is attempting to break out of the gutter for a Wilde Trade. If not familiar with the strategy check out the website, but the strategy identifies stocks that have been beaten down and go on to recover.

Carnival had been in a downward trend since 2018 and started hemorrhaging cash following the serious knockout from Covid, but the firm has deep pockets, and the rate of loss has started to slow. So-called ‘revenge travel’ and falling oil prices could be behind the recent run-up in price, but the stock is challenging its upper gutter level again. It has also made two higher lows and the last earnings announcement was received positively by the market.

Taking a closer look at the gutter, a previous attempted breakout failed in February only to see the price fall back into the gutter. So ideally, we would like to see a breakout above $11.40-ish followed by a pullback that finds support at that level before we enter (dashed arrows). It doesn’t always work out as textbook as that, and the breakout could fail again, or it could explode upwards and not pull back for months. We don’t know how it will play out so the most important thing is to have a level in mind where we will exit if the breakout fails again.

The price is currently testing resistance at the upper gutter line, which conveniently coincides with the 1ATR channel at $11.33. CCL would technically be in a new bullish trend if trading above that level but remember these are weekly price bars so there are three trading days left to finish the current bar. The next earnings announcement is due around June 26, so we have three price bars before then. If entering this week, a good place to draw a line in the sand and get out again would be a close below the -1ATR line which is currently at $9.04.

52-Week Strategy

We have been patiently nursing this trade in ProShares Ultra S&P500 2x Shares (SSO) since it was first mentioned in the March Newsletter. Strictly speaking, it’s more of an ‘active investment’ than a trade because it’s a pure play on the US stock market where we are trying to get in early on a new bullish trend (if one is forming) and use the 2x gearing of the ETF to sweeten the deal.

I refer to it as a ‘trade’ because there is a defined technical price level on the chart where I will exit the position if the price falls below that level, whereas investors tend to exit based on fundamental data or information. I will be ignoring all that and exclusively watching the price action for the exit signal. So, it’s sort of an investment being managed like a trade!

An entry signal on this occurs when the number of stocks making 52-week highs less than the number making 52-week lows closes above zero for two consecutive weeks, as marked by the vertical green lines. TradeStation conveniently offers a native index to plot this, but it can be found on other platforms too or can be manually calculated from free websites.

The price bars printed in May climbed steadily higher, but SSO has failed to close above the magical 1ATR line where bullish trends technically begin. The soft trailing stop on this moves up to $46.90 based on the current week’s price bar.

MoneyShow® Class

Last month’s newsletter discussed how best to manage a daily swing trade on the Help Strategy. This led to a flurry of queries about this reliable profit provider. Introduced in 2019, this daily swing trading strategy has consistently offered traders a steady flow of bankable profits.

A pure play on the US equity market, the strategy can be traded with a geared ETF which tracks the S&P 500 (SPX), or by leveraging the power of E-mini futures. This offers the huge advantage of not having to screen a list of stocks looking for something to trade. During this comprehensive session, I will introduce the strategy and explain why it remains one of my go-to money-makers with real-life examples of recent trades. Click the image above to reserve your FREE place for Wednesday, June seventh, 2023, at 10:05 am EDT.

Learn more about Ian Murphy at MurphyTrading.com.