The US dollar index was on course to end higher for the third straight week, although well off its best levels as it fell back in the first half of Friday’s session to relinquish the gains made in the previous day, states Fawad Razaqzada of Trading Candles.

Given the long weekend break ahead of us and the key event risk—i.e., US debt ceiling deal or lack thereof—investors were probably happy to book some profit on their long dollar positions that they had accumulated this month. Attention is turning to US core PCE, the Fed’s preferred gauge for inflation, due for publication shortly, and US debt ceiling negotiations, where the two sides appear to be closing in on a deal.

The dollar is on Course to Rise for Three Weeks

Boosted by revived expectations of a final rate hike by the Fed, thanks to US data remaining surprisingly strong, the dollar has risen across the board in recent weeks. Expectations that the Fed could hike rates again in June were lifted after a series of stronger-than-forecast data, including an upward revision to Q1 GDP.

Weakness in foreign data also boosted the dollar as the EUR/USD fell on the back of more disappointing German data, where Business sentiment continued to weaken with the Ifo business climate index breaking a six-month rise and tracking the ZEW economic sentiment indicator lower. Elsewhere, the kiwi slumped as the RBNZ delivered a dovish 25bp hike to 5.5% and signaled it could be their last hike this cycle due to falling demand and cooling fears that the government’s budget was not as inflationary as feared, as my colleague Matt Simpson reported.

The USD/JPY crossed the 140.00 mark on Thursday, while the EUR/USD slumped near 1.0700 and the GBP/USD near the 1.2300 handle before we saw the dollar retrace in the first half of Friday’s session.

Dollar Index Testing Major Resistance Zone

Are we going to see more weakness in these pairs moving forward, or is the US dollar strength about to come to an end? A lot will now depend on the US debt limit situation and incoming data – and there’s plenty of that in the week ahead, as we have discussed below.

But from a purely technical point of view, the Dollar Index (DXY) is now near the upper end of the recent range, testing key resistance between the 104.00 to 105.00 area. It will need to climb through this zone to keep its bullish trend intact. But if we go back below this week’s low at 102.96 in the coming days, then this would likely trip big stops in the major pairs and so we could see renewed weakness for the greenback.

Source: TradingView.com

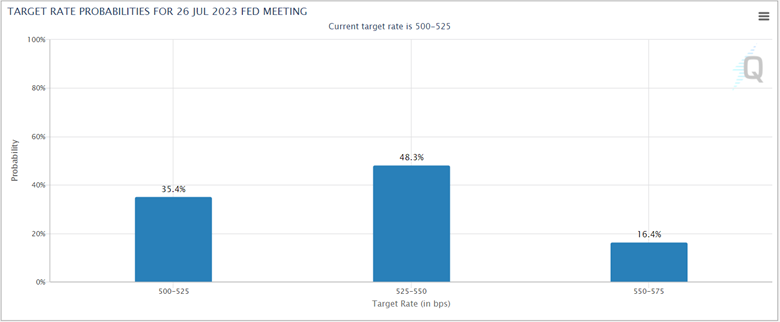

Fed expected to deliver another 25-bps hike

According to the CME’s FedWatch tool, the odds that US interest rates will be staying at their current 5.00% to 5.25% target range by the Fed’s July meeting have fallen to 35%. In other words, a 25-basis point rate hike in the next meeting in June or by July is now expected, although potentially not fully priced in yet. It doesn’t make sense for the Fed to pause in June and go at it again in July. So, I reckon that if they were to hike again, it will be in the June 14 meeting.

Source: CMEgroup.com

Traders have also pushed back expectations that interest rates will be cut as early as September. They now foresee the first rate cut not at least until November.

The key risk for the dollar bulls is if the Fed decides against a rate hike in June. That would hit the dollar hard. Also, most of the hawkish repricing might already be reflected in the current exchange rates. So, for the dollar to make further headway, we might need to see continued strength in US data or a major risk-off event that would boost the greenback’s safe-haven appeal.

Deal or No Deal?

If the US announces a deal debt during the weekend, then Monday could be an interesting day for the markets as we have public holidays in much of Europe and the US. As volumes will be thin, this will require less effort to move the market.

But the stalemate could continue well into the next week, with Thursday, June first being the deadline. A debt-ceiling deal or lack of is a major source of potential volatility for FX and stock markets.

Upcoming US Data Could Move Fed Rates Expectations Again

In addition to US jobs data, we have key inflation data for Australia to aid them with their next ‘finely balanced’ rate decision in June, as well as German and Eurozone CPI estimates and some more Chinese manufacturing data all to look forward to.

The following are the top three macro data releases to watch next week.

Chinese manufacturing PMI

Wednesday, 11 May

02:30 BST

Global demand concerns have dragged on sentiment toward commodity and risk-sensitive FX pairs in recent weeks, following the release of several disappointing data pointers from China. This puts the latest PMIs into focus as they provide a leading indicator of economic health.

German CPI

Wednesday, 11 May

NOON BST

Recent weakness in data hasn’t stopped the ECB hawks from warning of higher interest rates in the Eurozone. German CPI will be released a couple of days ahead of Eurozone CPI on Thursday. Together, these data releases could have big implications for the June 15 ECB policy decision.

US non-farm payrolls

Friday, the second of June

13:30 BST

JOTS job openings, ADP employment, initial claims data, and the employment index from the ISM manufacturing PMIs will all arrive ahead of Friday’s Nonfarm payroll report. With markets sensitive to US economic data, USD bulls will want to see continued strength in employment figures.

To learn more about Fawad Razaqzada visit TradingCandles.com.