There is little to add to Friday’s note regarding an update on strategies, so with Josh’s permission I thought a glimpse at how he has been struggling with a trade might be helpful, states Ian Murphy of MurphyTrading.com.

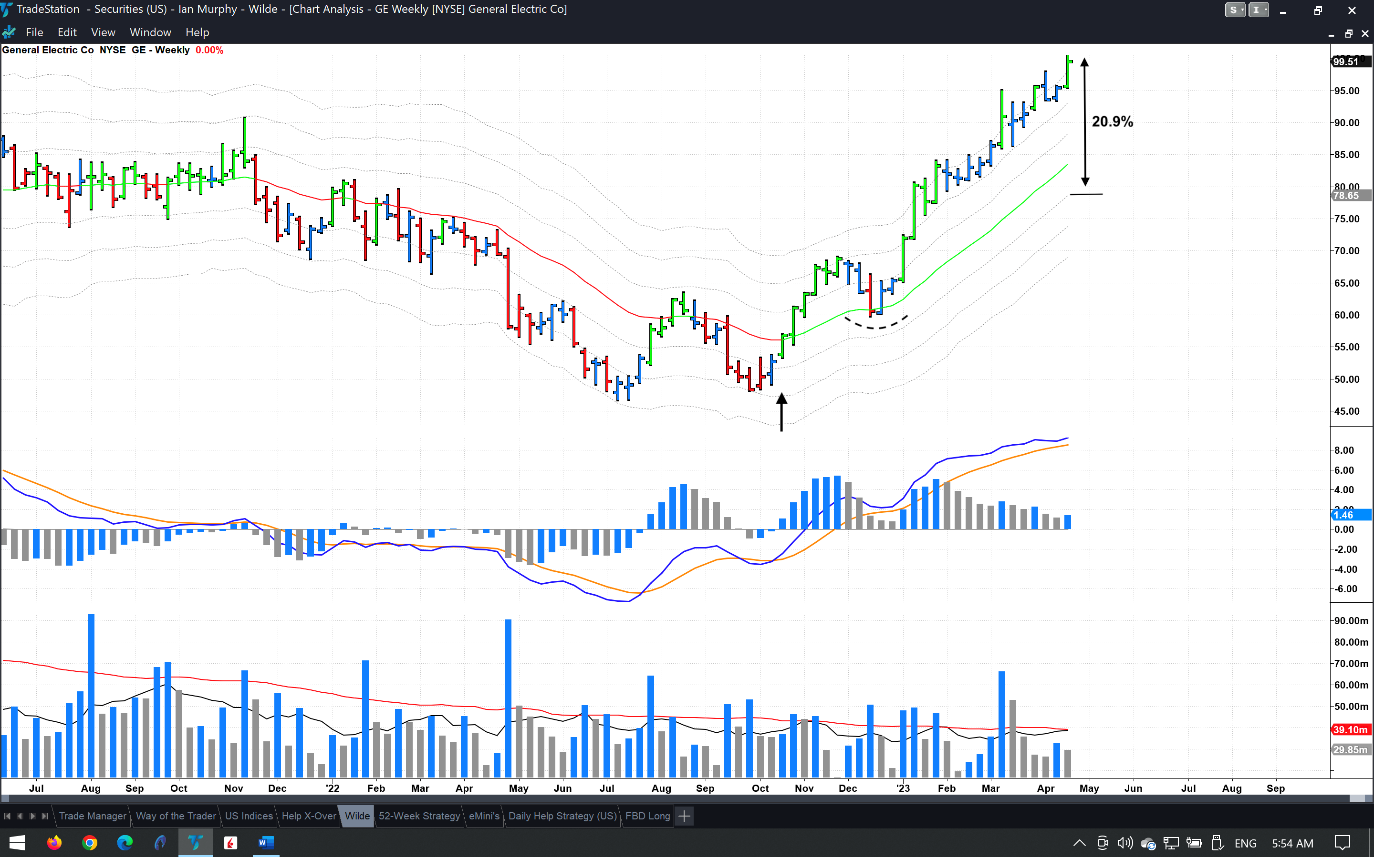

General Electric (GE) is among a handful of stocks that appear to be impervious to negative sentiment, and this industrial giant has powered up the exchange since last fall. Josh entered at $55 (arrow) as GE broke above the moving average, and he is using a weekly trend-following approach to manage the position. He will exit on a close below the -1ATR on this weekly chart.

Now he faces a difficult challenge! He notes how the stock has been trading above the 3ATR line since January, and this is the point where we should be taking profit or even closing out on a swing trade. Also, based on Friday’s close he would suffer a drawdown in excess of 20% before being stopped out if GE reversed course in the coming weeks. Finally, earnings for GE are due, so today might be the last opportunity to bank the profit.

When investing or trading in stocks it’s imperative we understand the game we are playing. This is classic Weekly Trend Following—it’s highly profitable and easy to learn but emotionally challenging to manage!

Up to this point, Josh has exercised wonderful discipline and patience to stay in the position, especially during the pullback in December (dashed arch). I advise him to reduce the size of his position to a level where he can sleep at night and to let the rest of the shares run as before. This trend might end in a month or so, or it could keep going for years! Trending stocks always last longer than anyone expects and there is no reason to believe GE won’t keep going.

Learn more about Ian Murphy at MurphyTrading.com.