Despite the gloom and doom and increased volatility, money seems to be moving into the stock market, states Joe Duarte, editor of In the Money Options.

On the surface, there is high anxiety in the markets. Certainly, the potential for more problems in banking remains well above average as rumors surfaced late in the week suggesting Deutsche Bank (DB) may become the next European bank to fail. And although the problems in commercial real estate have been overshadowed by the banking crisis, there has not been a resolution to that issue either. All of this adds up to what may be driving the stealth positive money flows into stocks; expectations that the Fed is done raising rates.

Dueling Messengers and Unintended Consequences

It doesn’t get much stranger than this. On 3/23/23 after the Federal Reserve raised interest rates by a quarter point, as expected. Chairman Jerome Powell during his press conference was able to, for once, keep the stock market from unraveling as it often does when he speaks. Unfortunately, Treasury Secretary Janet Yellen did the job for Mr. Powell when she testified in front of the US Senate and noted that there were no plans to increase deposit insurance funds to alleviate the banking crisis.

So while Powell’s press conference was reassuring, Yellen’s unexpected remarks triggered a 500-plus point loss for the Dow Jones Industrial Average which spread throughout the market. Interestingly, the treasury secretary reversed her comments on the following day. But the market’s message was clear, as the price chart for the KBW Bank Index (BKX) shows.

But one sector’s losses can create gains for others, which is what seems to be happening with homebuilders and technology stocks being the beneficiaries, as I describe below.

Bond Yields Tumble as Traders Factor in Recession Odds and Fed Easing

The stock market grabs the headlines but the action in the bond market suggests that traders are increasingly betting on a recession and a Federal Reserve easing of rates in the US. The US Ten Year Note yield (TNX) failed in its most recent attempt to rebound and by week’s end was back below 3.5%.

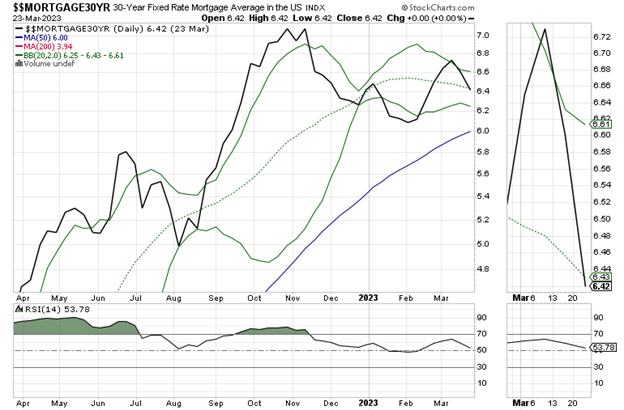

This decline in yields will be felt throughout the economy as related commercial rates (mortgages, auto loans) will follow. This is already evident in the housing market as potential homebuyers have been quick to react to falling mortgage rates.

News Travels Fast: Existing Home Sales Surge as Mortgage Rates Fall

As I often write when describing the MELA system, news travels fast. That’s because most people are connected to the news cycle. Thus, when bond yield fell in December 2022, potential home buyers who had been on the fence took the plunge and this is what led to the increase in existing home sales two months later. Here are the details:

- Sales in the South were the strongest. Overall, sales rebounded 15.9% in February from January to an annual rate of 2.11 million, a 21.3% decrease from the prior year. The median price in the South was $342,000, an increase of 2.7% from one year ago.

- Midwest region: Sales were next with a 13.5% increase from the previous month to an annual rate of 1.09 million in February, declining 18.7% from one year ago. The median price in the Midwest was $261,200, up 5.0% from February 2022.

- Western region: Existing-home sales rose 19.4% in February from the prior month to an annual rate of 860,000, down 28.3% from the previous year. The median price in the West was $541,100, down 5.6% from February 2022.

- Northeast region: US sales improved 4.0% from January to an annual rate of 520,000 in February, down 25.7% from February 2022. The median price in the Northeast was $366,100, down 4.5% from the previous year.

As you can see, the general regional trends continue with prices remaining stable or rising in the South and the Midwest while falling in the Northeast and West. The number of houses sold in the South also continues to outpace the other three regions, as the Great Migration continues.

Homebuilder Megatrend Remains Intact

Homebuilder stocks continue to show significant relative strength. This strength is supported by field observation. In my neck of the woods, the Dallas Fort Worth area, the recent decline in mortgage rates has brought buyers off of the sidelines. A newly constructed townhome development near where I live had three vacant homes for the past two months as rates rose. Now, as rates have dropped, they are all under contract.

Other developments in the neighborhood and surrounding areas are also showing signs of rising activity as well. And the number of out-of-state license plates I see on my commute remains high. Homebuilder stocks are core holdings at Joe Duarte in the Money Options.

Technology Stocks are Stealth Money Magnets

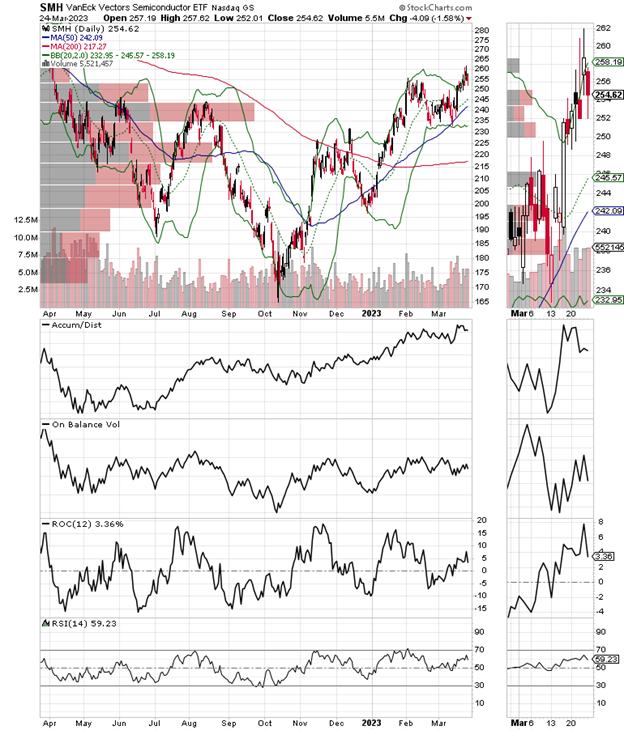

Just as homebuilders are in a good position, the technology sector is also gathering interest. The Van Eck Semiconductor ETF (SMH) is tracing a bullish trading pattern as investors focus their interest on longer-term issues such as the reshoring of chip factories to the United States and the potentially positive effects of those moves on the US economy.

Moreover, the continued expansion of data centers and communications-related activity is bullish for the chip sector as servers, routers, switches, and related infrastructure are all powered by semiconductors.

Note the bullish action in the price chart SMH accompanied by a steadying of both Accumulation Distribution (ADI) and On Balance Volume (OBV). Aside from the homebuilder and semiconductor sectors, other areas of the stock market bear watching.

Bullish Money Flows are Taking Hold

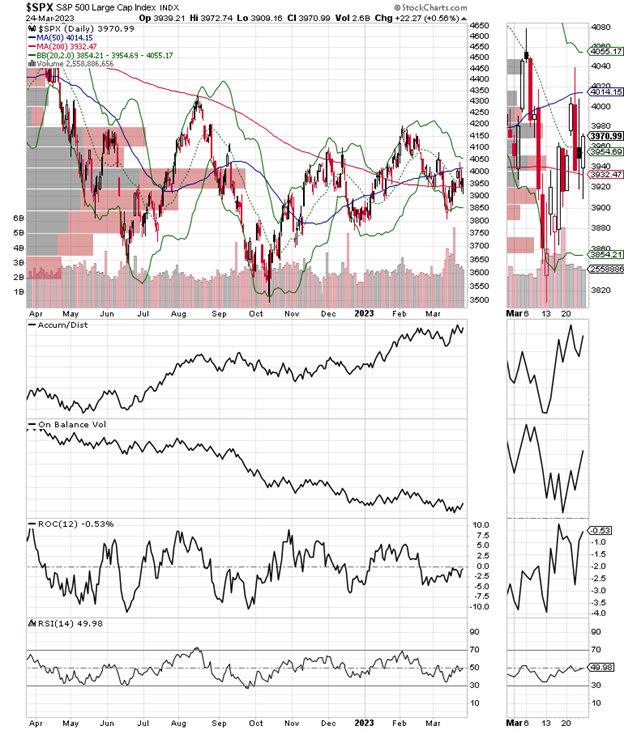

Aside from the positive sector dynamics discussed above, the technical environment for stocks seems to be stabilizing following the prior week’s banking crisis-related negativity. The New York Stock Exchange Advance Decline line (NYAD) 200-day moving average held just below this key support level.

Meanwhile, the S&P 500 (SPX) remained above its 200-day moving average. On Balance Volume (OBV) and Accumulation Distribution (ADI) are starting to turn up on SPX which is very bullish if it continues.

For its part, the Nasdaq 100 Index continued to outperform SPX as money flows into technology companies persist. As in SPX, above, there is a bullish uptick in both ADI and OBV as short sellers bug out and buyers start moving in.

The CBOE Volatility Index (VIX) also rolled over suggesting that bearish sentiment is decreasing.

When VIX rises stocks tend to fall as rising put volume is a sign that market makers are selling stock index futures to hedge their put sales to the public. A fall in VIX is bullish as it means less put option buying, and it eventually leads to call buying which causes market makers to hedge by buying stock index futures raising the odds of higher stock prices.

Most importantly, the market’s liquidity also showed some improvement as the Eurodollar Index remained above support between 94.5 and 94.75. A move above 95 will be a bullish development for sure. Usually, a stable or rising XED is very bullish for stocks. On the other hand, in the current environment, it’s more of a sign that fear is rising and investors are raising cash.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.