The broadest measure of European equities just hit new 52-week highs last week, states JC Parets of AllStarCharts.com.

As you can see here, Europe went nowhere for 20 years, mostly due to its lack of exposure to high-growth stocks like the United States. And now that those growth stocks have been out of favor, and it's the more Industrial and cyclical stocks leading the way in this bull market, Europe is the global leader once again. It's the US that's laggard.

Here's the Euro STOXX 600 hitting new 52-week highs and coming out of a multi-decade base:

And if you're wondering whether or not this index will see new all-time highs soon, I would encourage you to check out what some of the individual countries are doing. Take France for example already hitting new all-time highs:

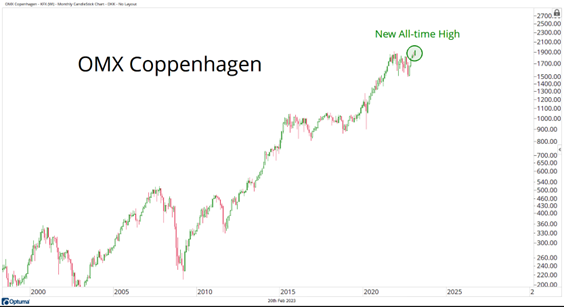

Industrials represent 23% of the French stock market. As we've mentioned many times, industrials are the leaders in this cycle. Technology is the opposite of leadership. Fortunately for France, Tech only carries a 5% weighting. Meanwhile, Denmark is 26% Industrials and only 3% Tech. So naturally, here's Denmark already making new all-time highs...

Denmark is 40% Healthcare also, which is interesting to note. Also, make sure to check out the London FTSE 100 making new all-time highs. Its 0% weighting in Tech certainly helps:

There are a lot of stocks that are going up in price. Historically, this is a regular occurrence during bull markets. I would encourage investors to be open-minded. Just because some people choose to invest in indexes with too much exposure to growth stocks, doesn't mean that it's a bear market.

It's not the stock market's fault that someone chooses to only analyze indexes that have way too much growth exposure, and not enough Industrial stocks. I can't help that people only want to see what they choose to see. We need to invest in the market we're in. Not in the one that we may have had a good experience in several years back.

It's 2023. Deal with it.

To learn more about JC Parets, please visit AllStarCharts.com.