The first two weeks of January were up and away for all 11 market sectors fueled by the grand reopening of China, a rally in bonds, a selloff in the dollar, and crude oil catching a fresh bid, explains Bryan Perry, editor of Cash Machine.

The third week of January had the market giving back most of the gains, except for Friday’s rally that smacked of options expiration manipulation and short covering on strong earnings from a video streaming company and news of tens of thousands of techies losing their jobs to slash costs.

The optimism a soft read on the Producer Price Index (PPI) generated last Wednesday turned to despair as the narrative radically changed. Wall Street took to heart the very negative reports on retail sales, manufacturing, and industrial production against the furthering of the Fed’s drumbeat that short-term rates are headed to 5.0%, regardless of the alarm bells going off along the yield curve. The ten-year Treasury yield is down to 3.48% from 4.34% exactly three months ago. In the meantime, the six-month T-Bill is paying 4.83%. The one-year T-Bill is at 4.69% and the two-year T-Note is at 4.18%.

We’re talking serious inversion as “provisions for credit losses (PCLs) among the top four lenders in the United States ballooned to $6.2 billion in the fourth quarter of 2022—the most in over a decade, bar the Covid-19 pandemic’s earliest months. PCLs collectively booked by Bank of America, Citi, JP Morgan, and Wells Fargo were up 35% compared with the previous quarter and marked the third-largest amount since Q4 2012.” The 10/2 spread closed Friday at -66 bps, off the high of -84 bps set on December seventh, but nowhere near a level that suggests the bond market isn’t highly worried about the Fed overtightening.

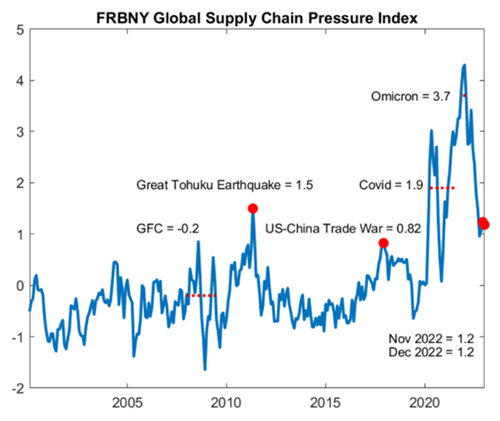

On the flip side, some of the root causes that were responsible for the spike in inflation, namely supply chain disruptions, soaring commodity prices, and shipping costs, have all eased materially from a year ago. In supply chain circles battered by more than two years of upheaval, the word “normal” is creeping into the outlook for 2023.

In the latest Logistics Managers’ Index, “September’s future predictions hint at normalization and a return to business as usual over the next year.” Analysis from Sea-Intelligence, gauging the amount of bogged-down shipping capacity, shows “all three models suggest we should be back at the ‘normal’ 2% capacity loss baseline by early 2023.” The year-to-date improvements in New York Fed’s Global Supply Chain Pressure Index “suggest that global supply chain pressures are beginning to fall back in line with historical levels.”

Federal Reserve Bank of New York - January 13, 2023

It has also been reported that ‘someone above’ must give a hoot about Europe because that region has effectively skirted tough winter conditions as warm weather has brought huge relief from the threat of gut-wrenching heating and power bills for businesses and consumers alike. Here too, what was a highly anticipated inflationary hyper-catalyst never really materialized.

Although still high, inflation across Europe dropped for the second consecutive month in December, according to preliminary data shared by Eurostat, the European statistics agency. Eurozone annual inflation was down to 9.2% year-on-year last month from 10.1% in November, finally dropping from the realm of double-digit-percentage figures reached for the first time in October, when it surged to the 41-year high of 11.1%.

In yet another positive development, commodity prices are easing off the 2022 highs that peaked in May 2022. Although up from the low of September 2022 due to the anticipated reopening of China, prices for most commodities, especially those in the agricultural sector, have stabilized, even as the war in Ukraine carries on.

tradingecoomics.com

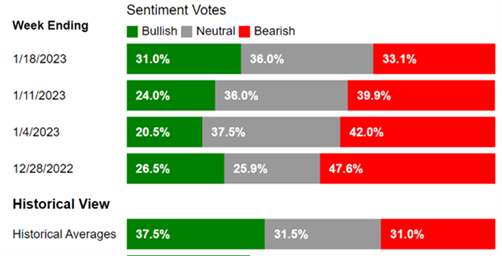

Against this backdrop of the Consumer Price Index (CPI), PPI, industrial production, retail sales, and personal savings trending lower with a counter lever of a rebounding Chinese economy driving demand for US goods and services, one can argue the proposition of the S&P 500 maintaining a trading range is reasonable. But this assumption comes with the fact that investors are flying blind into earnings season where evidence of cautionary spending by both consumers and businesses could call into question the soft-landing narrative that has been touted by the Fed and embraced by a growing read on investor sentiment based on recent surveys like that of the American Association of Individual Investors (AAII).

www.aaii.com/sentimentsurvey

Stock indexes could very well be weighed down by underperformance by the mega caps that rule the major averages. And at the same time, one out of five companies will likely beat expectations and raise guidance, making this a quintessential stock picker’s market, at least for the next few months, until the economy proves it will avert a recession altogether and effect a soft landing that results in a broad revenue and earnings recovery accompanied by the Fed’s reduced rates amid falling inflation with the yield curve normalizing.

Again, the market is driving into the thick fog of earnings season. The market went from a very downtrodden finish to December 2022, to a euphoric first half for January 2023, followed by a sharp pullback this past week based on a reality check that bad economic news isn’t good news for inflation and stocks—but instead, is bad news for corporate profits. And nothing can spoil the party on Wall Street more than the price-to-earnings (P/E) contraction, which hammers valuations and stock prices in kind.

So, welcome to the fourth-quarter earnings season. In the words of head risk manager Eric Dale, played by Stanley Tucci in the now-cult movie “Margin Call” based on the 2007-2008 mortgage meltdown on Wall Street, as he is handing a zip drive to his protégé after being fired: “Be careful.” I couldn’t agree more.