Each year, the market brings new opportunities. Trends develop as money is put to work. Today I’ll circle back on our top five most accumulated stocks in 2022, states Lucas Downey of Mapsignals.com.

My hunch for 2023 is that many of the best-performing stocks yet to be revealed will have a recurring bid for their shares. Even in last year’s bear market, there were plenty of under-the-radar outperformers. I’m sure most of you are ready for the new year. I know I am. Awful sentiment, a challenging macro environment, and earnings uncertainty are just a few worries on investor’s minds.

No question, the stock market has been challenging with the S&P 500 falling nearly 20% last year, while the Tech-heavy NASDAQ 100 (QQQ) plunged 32%. That’s never fun! But here’s some good news—even in a rough tape, lots of stocks under-the-surface were in healthy bull markets. Some equities saw double- and triple-digit gains in one of the roughest years in recent memory.

As January gets underway, volumes are set to increase as fund managers place their bets. In the coming weeks we’ll likely see new Big Money trends developing. At MAPsignals, we are one of the few that think stocks can be a good bet in 2023. If that’s the case, there will be ample opportunity for investors once the macro tape improves.

Now let’s dive into our top five from 2022. Chances are, you might not be familiar with some of them!

Top Five Most Accumulated Stocks in 2022

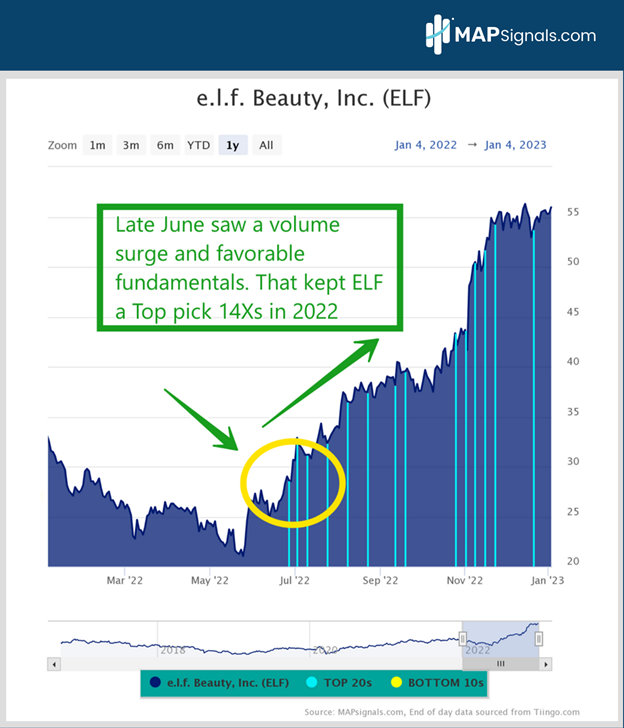

Our first most accumulated stock in 2022 was e.l.f. Beauty (ELF). The skin-care company first came on our radar in late June as volumes surged in the shares. The stock ranked high in our data because of strong fundamental scores. Examples would be the five-year sales CAGR of 11.3% and a five-year net income CAGR of 32.6%. Strong fundamental scores landed this company on our Top 20 report (blue bars) 14 times in 2022:

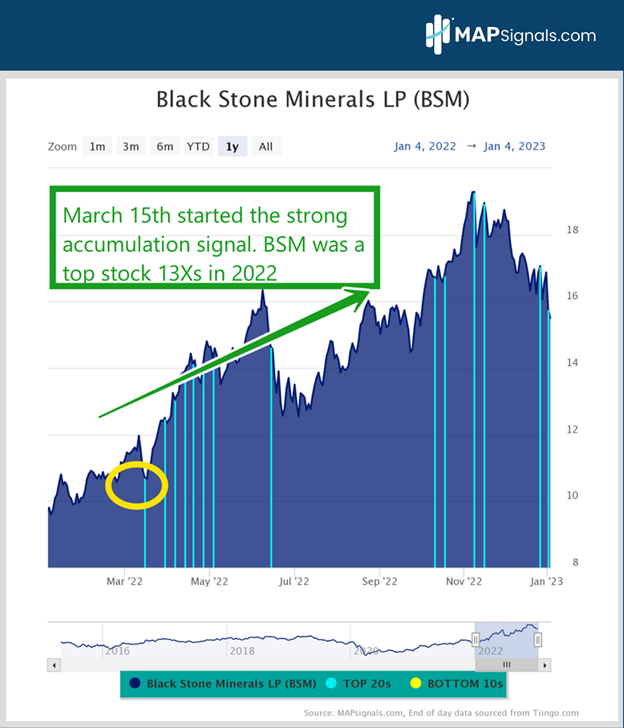

Let’s now hop over to the energy patch. The number two most accumulated stock was Black Stone Minerals LP (BSM). This limited partnership is a large owner of oil and natural gas interests in the US. Energy was our top sector in 2022, so it makes sense we’d have strong buys in the space:

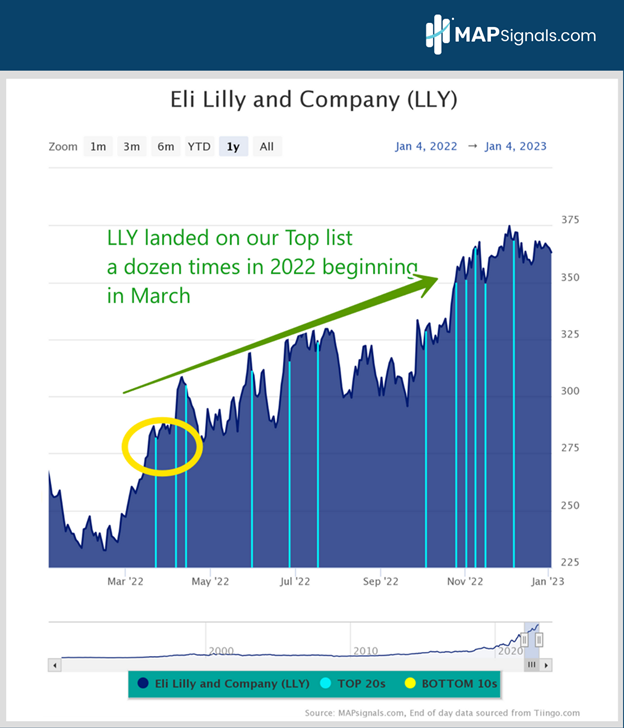

Our number three most accumulated stock lands in the healthcare space. As early as April we saw strong buying in the space. Dividend-growth and defensive powerhouse Eli Lilly (LLY) leapt to our top ranks as volumes exploded in the shares. The firm is expected to make $8.44 per share in 2023. That has investors excited to own it:

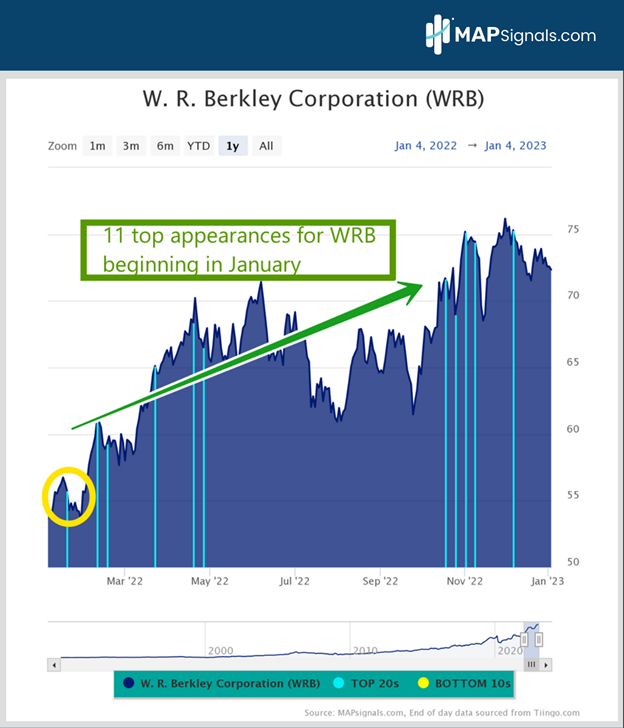

Now for number four, we found healthy buying in insurance company W.R. Berkley (WRB). As rates rise, it can be a big tailwind for insurers as they invest their float in higher yielding assets.

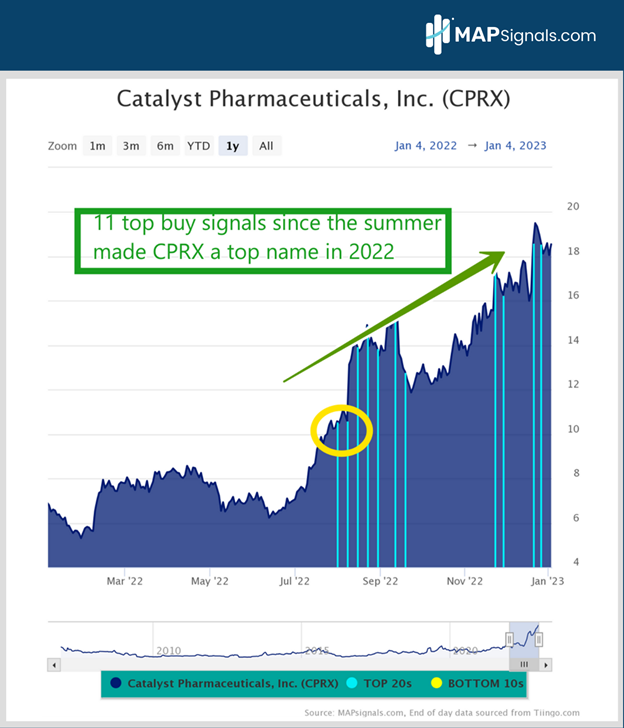

And finally, let’s dive into a newer name to our data, Catalyst Pharmaceuticals (CPRX). Back in the summer, this small-cap pharma name came on our radar around the $10/share level. It’s now in the 18s. Eleven top signals since the summer put this company front and center as one of the top five most accumulated stocks in 2022:

Keep in mind, these stocks were found using our portal. It’s a powerful scanner for where the Big Money is flowing. Let’s wrap up.

Here’s the bottom line: The bear market of 2022 is behind us. Even still, there were big winning stocks. Following big volume signals helps spot them. We believe 2023 will also find promising stocks. Let data be your edge. Here’s to a healthy and wealthy 2023!

To learn more about Lucas Downey, visit Mapsignals.com.