If you're still asking what it will take to spark a sustained rally in equities, it's only because you're not paying attention, explains JC Parets of AllStarCharts.com.

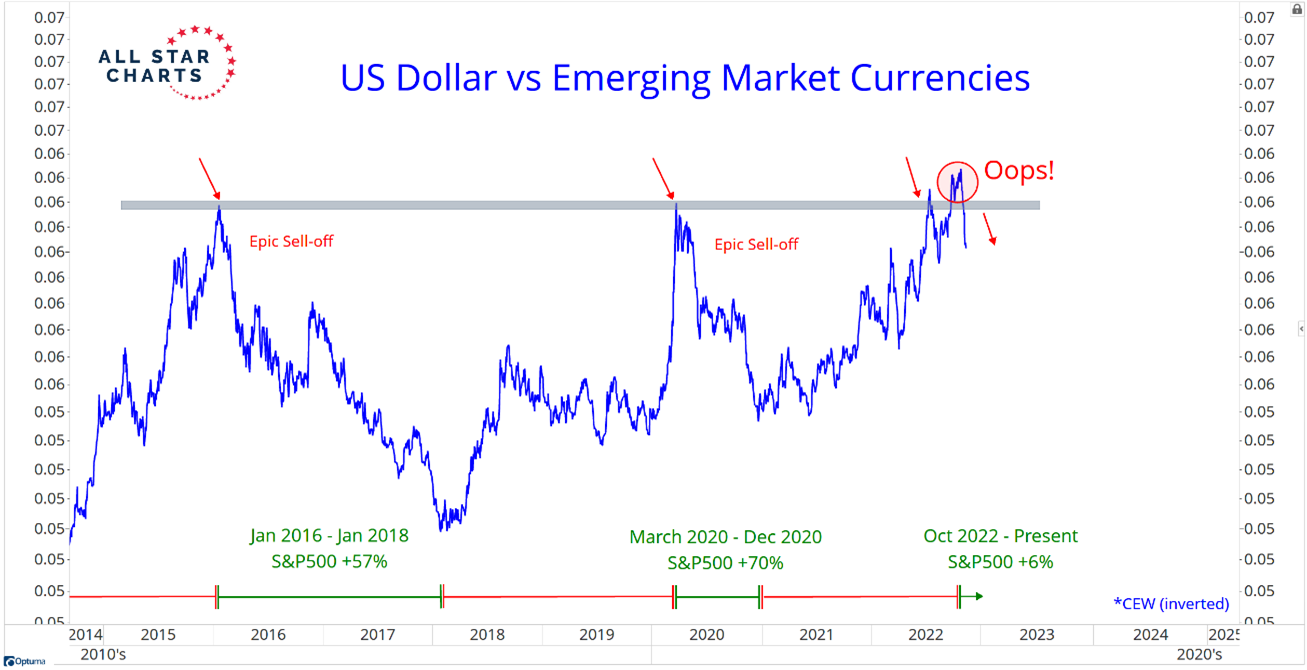

How is it not the US dollar? Find me a stronger negative correlation with equities over the past half decade or so. Today’s chart focuses more specifically on the performance of US dollars relative to emerging market currencies. Notice how whenever the dollar goes down, stocks absolutely love it:

Could this be an epic failed breakout in the US dollar leading to another epic collapse in prices? If so, just think about how well stocks will do in that environment. Are you positioned for another ripper in equities? Well, if the dollar really sells off, you better be positioned for it. These are real opportunities. And since we know the catalyst, we know what to focus on.

I've said it a thousand times and I'll say it again: Investors are going to have a hard time making money long stocks if the dollar remains strong. We've seen just a little bit of dollar weakness and look how well stocks have done. What if we get real dollar weakness? The stage is certainly set.

To learn more about J.C. Parets, please visit Get.AllStarCharts.com.