Let’s be honest, the last few months for stocks have been challenging, says Lucas Downey of Mapsignals.com.

The S&P 500 (SPX) fell 4.2% in August, only to plunge another 9.3% in September. No doubt, it’s been tough sledding. But often, when selling rises to unsustainable levels, opportunities develop.

To recap, back in September we signaled extreme oversold readings. Capitulation was seen across the board. Then I noted how weak market breadth triggered a rare bullish signal just last week. As tough as those moments were, the message was simple: Better times are likely ahead. When everyone’s selling, it’s often a good idea to take the other side. Today I bring good news! Buyers are stepping in. The latest lift in our data signals a big rotation underway. Check it out.

Money Is Rushing into Small Cap Stocks

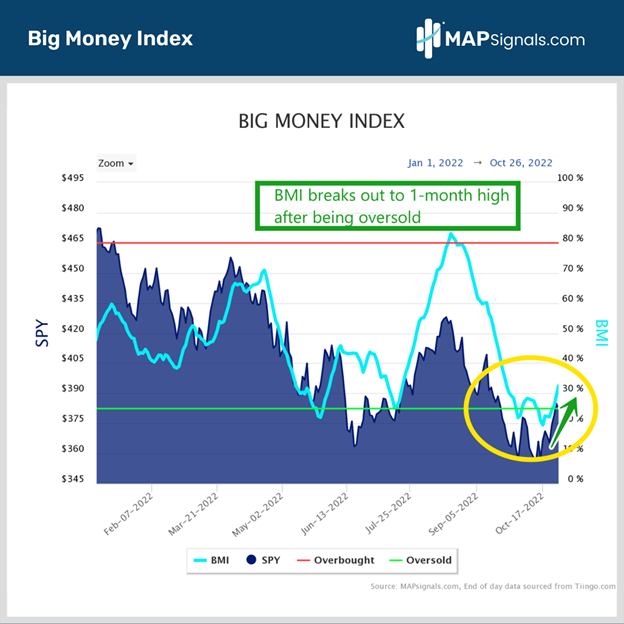

When a new trend develops, pay attention. Just last week, our Big Money Index was well into the green zone, meaning stocks were heavily oversold. The BMI is our top-level barometer for the market. It gives us clues as to the overall health of money flows. As you’ll notice, it’s spiking, reaching a one-month high:

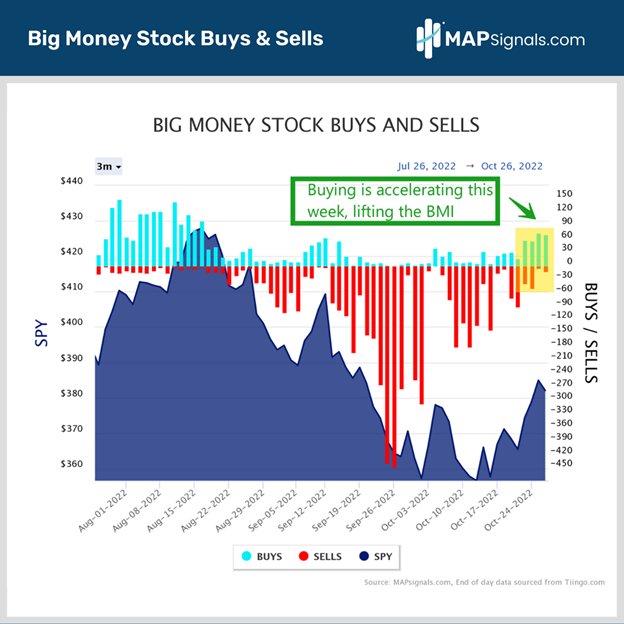

To have a rip in the BMI, buying must be accelerating from depressed levels. And it is. To get an accurate gauge of the improving breadth, we need to look at the daily activity. Below is our Big Money Stock Buys and Sells chart. It plots the daily action. Just this week, buyers have trounced sellers. Tuesday and Wednesday cumulatively saw 143 stocks bought compared to just 17 sold. That’s nearly 90% action on the buy side. This is the main reason the BMI is violently surging. Look:

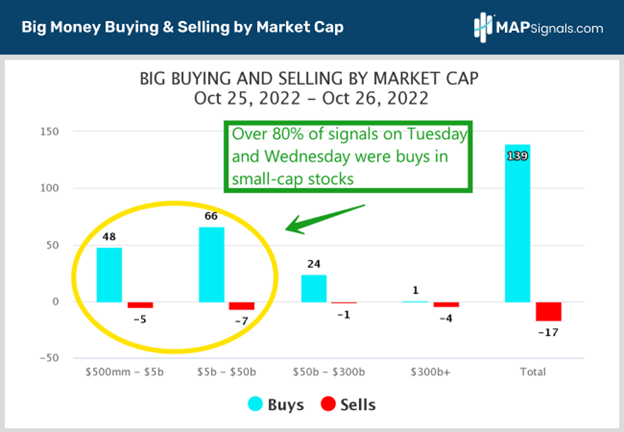

Without question, money is being put to work. But where? When we view the last two days of data by market cap, a clear trend emerges: Money is rushing into small-cap stocks. The below chart plots Tuesday and Wednesday’s Big Money action by company size. Over 80% of the signals are buys in companies with market-caps sub $50B:

This is the reason for the massive jump in the Big Money Index. Many under-the-radar names are ramping in price as volumes accelerate, indicating substantial accumulation. Finally, new life is emerging after a rough couple of months. Chunky buying is evident in smaller groups like Energy, Healthcare, Materials, and Staples. These have been some of the top names in our research for months.

These trends should continue to put upward pressure on the BMI in the coming days and weeks, presenting ample opportunity for stock pickers. Talk about a welcome change! Let’s wrap up.

Here’s the Bottom Line

Markets are breaking out of oversold levels. Money is rushing into small-cap stocks. Energy, Healthcare, Materials, and Staples companies are the beneficiaries. Odds are the Big Money Index is set for higher levels near-term. Data makes these shifts easier to spot in real time.

To learn more about Lucas Downey, visit Mapsignals.com.