A question I often receive is about the margin requirements of a brokerage when selling put options, writes Markus Heitkoetter of Rockwell Trading.

From what I’ve seen, many traders are getting it wrong, and this could lead to some costly trouble. In this article, I’m going to break this down and explain things so you understand how it works. By the end, I’ll make sure you know exactly what is required in order to sell a put option and how margin requirements work. Let’s get started!

What Are Margin Requirements and Why Are They Important?

Let’s start with what margin is when it comes to trading. Margin is the amount of money that you hold in your account to enter into a trade. It is used as collateral to borrow money from the brokerage to increase your buying power.

When you open a margin account, you typically have access to twice the buying power of the balance of your account.

Here’s an example:

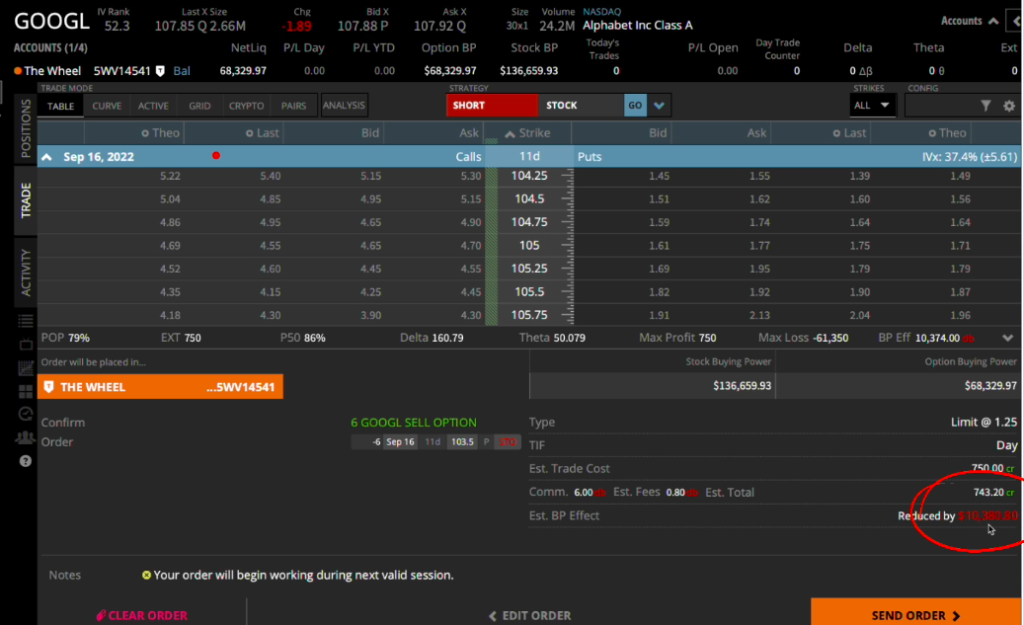

In one of my accounts, my current cash balance is $68,329.97. Since it is a margin account my actual buying power is $135,659.93. But is that the same thing as option buying power? For stocks, it is twice as much, i.e. $135,659.93. But what about the option buying power?

At first glance, it seems that I don’t have any leverage when buying options since the option buying power is exactly the same as the cash I have in this account.

But that’s not exactly true.

Let’s take a look at an example.

How Margin Requirements Work When Selling Put Options

As we all know, I love trading ‘the Wheel Strategy.’ Just as a quick review, here are the three steps for the Wheel Strategy:

- Sell put options and collect a premium on those positions.

- Eventually, you might get assigned to the shares you are selling puts against.

- Now you sell covered calls on those shares and collect more premiums.

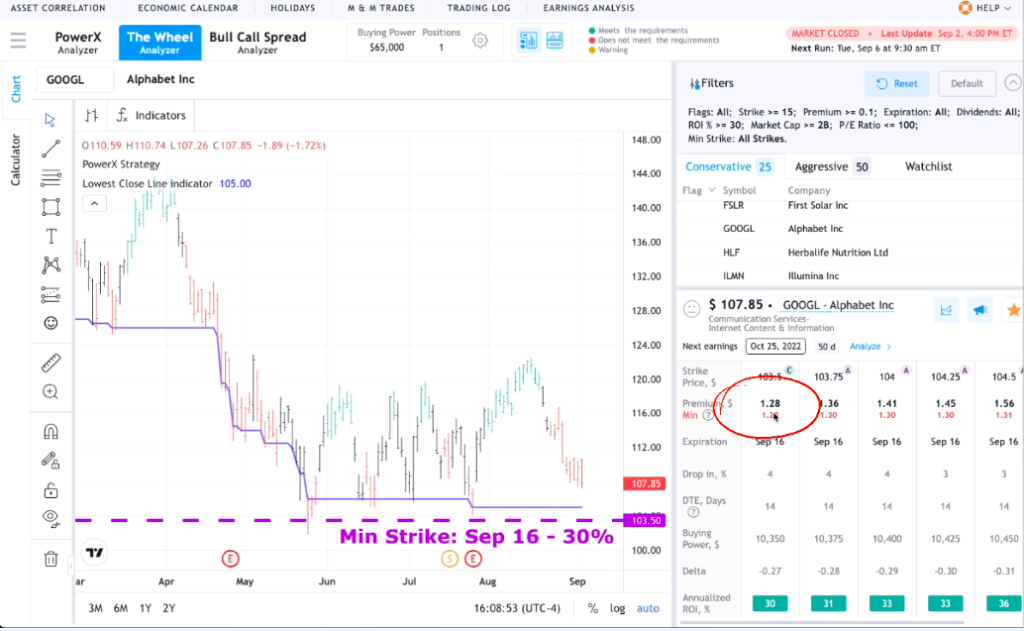

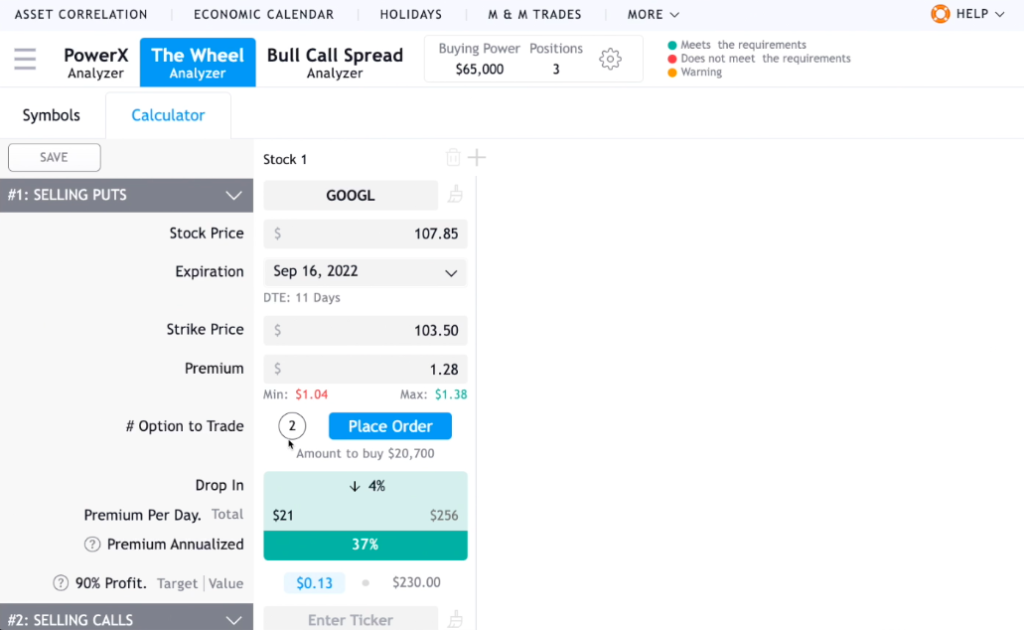

For the first part of the Wheel Strategy, I’m selling put options. Here’s an example trade for the stock Alphabet (GOOGL).

Okay, so on my scanner, GOOGL showed up with a recommended strike price of $103.50. If I sell this put, I will collect about $1.28 in premium or about $128 per contract. Remember that options contracts are bundles of 100 shares of the underlying stock.

So, if I set my account size to $65,000 just to make things easy, I can see that the PowerX Optimizer suggests trading 6 GOOGL contracts. Just as a note: I usually like to trade up to five different positions per account. For this example, I set this number to one to make things easier.

Okay so back to the GOOGL trade. The expiration for this option is September 16. If GOOGL is trading below $103.50 on September 16, I would have to buy 100 shares of GOOGL at $103.50 for each option that I sold. If I have to buy 100 shares of GOOGL for $103.50, I’ll need to have at least $103.50 * 100 or $10,350 in my account.

But remember, the PowerX Optimizer suggested I can trade six options. So multiply $10,350 by six and you get about $62,100. So obviously I have enough money in my account for this trade.

It’s Important to Understand Margin Requirement

Now here is where some traders get in trouble. If we actually put this trade in, we will see how much margin the broker requires for this trade:

So Tastyworks only requires me to have $10,380.80 for this trade. If we divide that number by the $62,100 that is actually required if you get assigned, then we get 16.7%.

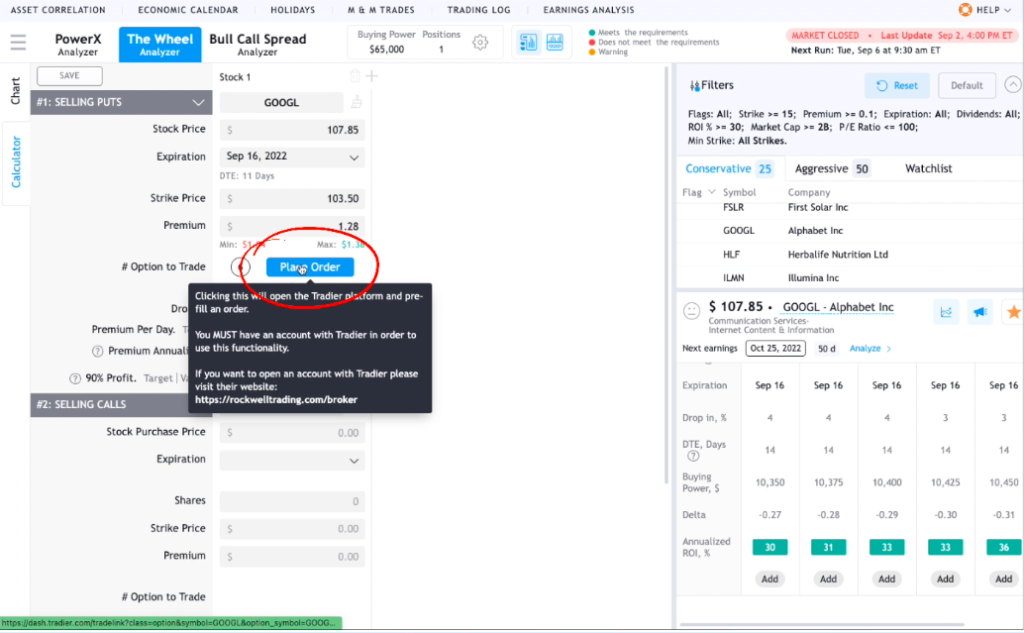

Before I explain what this means and why it can cause some trouble, let’s look at another broker. Remember that each broker has its own margin requirements. Okay, this trade I’ll check this in the platform Tradier. Now, this is super easy and if you use Tradier, it integrates directly with the PowerX Optimizer software. Instead of entering all the data as I did for Tastyworks, I only had to push this one button:

As we can see, Tastier requires $13,567.50. It’s still not a lot but it is more than Tastyworks. Just something to keep in mind if you have more than one brokerage account! If we divide this number by the $62,100 then we get a rate of 22%. So that begs the question: why do these brokers only require a fraction of the cost to enter this trade?

Why Do Margin Requirements Exist?

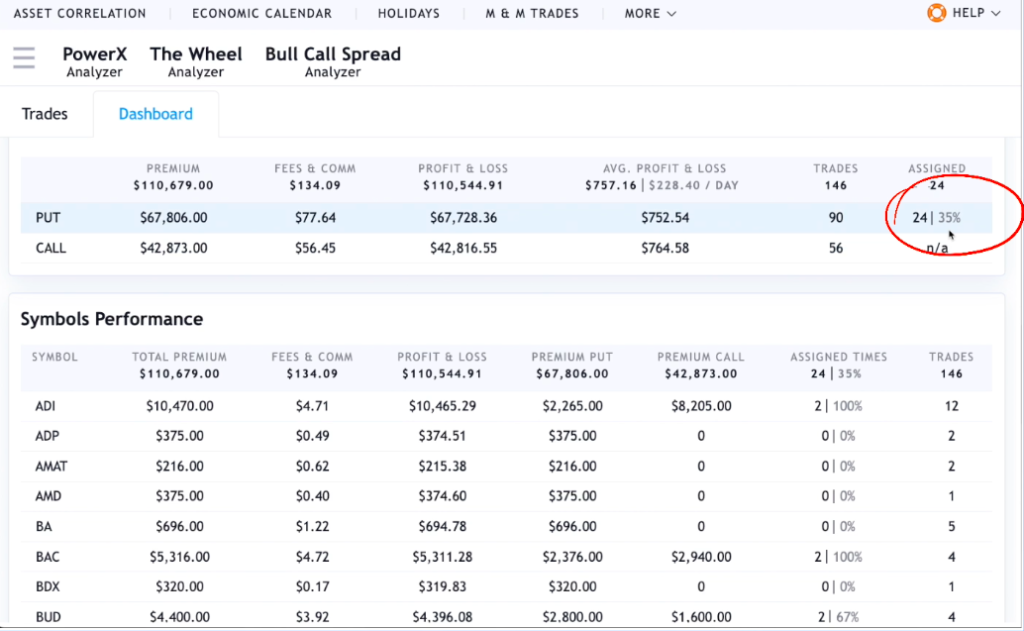

It’s simple…for the most part. Options that are being sold either expire worthlessly or are being bought back before expiration. This means the trade is closed without shares being assigned or called away. But for me, I personally want to get assigned. Does that sound weird? I make more premium from selling covered calls than selling puts. If we look at my stats, I’m also getting assigned about 35% of the time:

And here’s where things get dangerous for some traders:

If you have an account of, say, $65,000 and your broker only requires you to have $10,000–$13,000 to enter the trade then you might naturally think you still have $52,000 left in ‘option buying power'.

It might seem safe, and you might want to put in more trades with that money. But of course, that’s not the case. If you do this, and then you get assigned to more than one position, you won’t have enough money to cover the stocks that you have to buy. This will result in a margin call, and this is something we need to avoid at all costs!

That’s why the PowerX Optimizer is great because it suggests a position size based on your account and the number of positions you can have.

So here we go. If you want to enter up to three trades, then the PowerX Optimizer suggests only trading two put options of GOOGL. So, this would require having $20,700 in your account. It accounts for you getting assigned and still having enough to avoid the margin call. I hope this makes sense!

Summary: Margin Requirements When Selling Put Options

What did we learn? When selling put options, the margin requirements are much lower than the actual cost of the trade. If this is not understood well, then this can lead to traders over-trading their accounts. This leads to some very costly problems and could result in a margin call.

When selling a put option, make sure you are aware of your margin requirements. Stay within your risk parameters to avoid a potential margin call. Using the PowerX Optimizer is a great way to control the trades you enter and stay within your margin requirements.

Learn more about Markus Heitkoetter at Rockwell Trading.