I get asked a lot about moving averages. Many people think they are this incredible indicator that will lead to riches. Unfortunately, they’re the furthest thing from that, states JC Parets of AllStarCharts.com.

These are just invisible lines that people like to paint different colors to exaggerate their meaning. There are all different kinds of moving averages: some are shorter-term, some are longer-term, some give more weight to recent prices while others are equally weighted. I like to say that if you have enough moving averages on your screen, one of them will work!

Today I’d like to share with you in simple terms how I use them:

A moving average is simply a smoothing mechanism for changes in price. That’s all it is. A simple moving average is a lagging indicator that we only use to help with the trend recognition process. We consider it to be an invisible line, meaning that there is no direct relationship with price history. Support and resistance levels are based on previous exchanges of stock shares (or any asset) between buyers and sellers. Since a moving average is just a smoothing mechanism, meaning it smooths out the period-to-period price fluctuations (noise), the classic principles of polarity do not apply.

As a definition, a simple moving average is just an unweighted mean of a given set of values. For example, a 200-day simple moving average takes the average closing price over the previous 200 days. After each new day’s close, the data from 200 days ago gets removed from the calculation and the most recent day’s closing price is added. This is plotted at the end of each period so it creates a line over a period of time. This is why they call it a “moving” average.

Here is the basic calculation if you’re a math dork like me:

Formula: [(Period 1 + Period 2 + Period 3 + … + Period 199 + Period 200)/200]

The shorter the time horizon for your simple moving average, i.e. ten-day SMA, 20-day SMA, etc, the more volatile it is and the less noise that it filters out. I have an intermediate-term time horizon. To me, that means that while I don’t care what happened today, I also don’t care what happens next year. I want to make money this quarter. So we look out for weeks and months. The 200-period moving average, therefore, works best for my specific purposes. For daily charts, I use a 200-day simple moving average and for weekly charts, I use a 200-week simple moving average. Again, only to help with trend recognition.

It can be argued that the slope of the moving average is more, or at least just as, important as where the price is relative to it. You often hear things like, “XYZ closed above its ____ day moving average today”. This statement is 100% irrelevant if not put into context. Is the moving average trending in the same direction as the stock or the opposite? Is it flat? How long has it been flat?

Priority number one in Technical Analysis is to identify the direction of the primary trend. That’s all we’re doing here. We’re not looking for some holy grail. Which way is the stock going? Up or down? Answering that is step one. Then we want to look for either signs of strength or signs of exhaustion. But we must first identify which way it is heading before doing anything else. Price is the most important technical indicator we have. Moving averages are therefore a supplement to price behavior in the trend identification process.

If prices are making higher highs and higher lows above an upward-sloping 200-day moving average, it’s most likely not in a downtrend. Any short sales in that environment should be strictly for mean reversion trades and not anything more substantial than that. If prices are putting in lower lows and lower highs below a downward sloping 200-day moving average, it is most likely not in an uptrend. Any purchases of stock within that environment should be for upside mean reversions, and nothing more. The point is to identify the trend and invest mostly in that direction, with exceptions only in extreme scenarios. We want the wind at our backs and the moving average helps identify which way the wind is blowing.

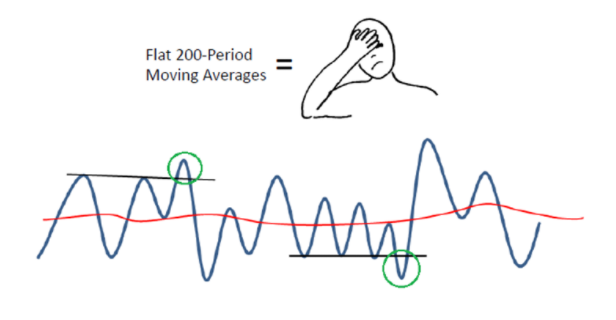

Something we want to avoid is when a stock (or any asset) is trading near a flat 200-period moving average. This is typically an environment that lacks any trend. Aggressively positioning yourself when price is near a flat 200 day, let’s say, is a recipe for a headache. Whipsaws (failed breakouts or failed breakdowns) are commonplace in this environment. Breakouts tend not to hold on to their new highs, and quickly mean revert. It’s the same thing with breakdowns, they tend not to hold on to their new lows and quickly rally back. When price is near a flat 200-period moving average, both the bulls and the bears get frustrated. This is where we would rather be selling premiums in the options market or looking for mean reversions when prices reach several standard deviations away from the mean. If you can, your best bet is to just stay away from it completely. Trust me.

Personally, I prefer to use a 200-day simple moving average. There are other types of smoothing mechanisms like an exponential moving average or a geometric moving average that changes the weighting of each period based on the specific smoothing mechanism’s formula. While this might be beneficial to some, my sole use for a moving average is to help identify the direction of the primary and/or secondary trends in a given market. This is not for buy and sell signals. People will try and sell you on models that buy or sell based on moving average crossovers. The media will often quote prices crossing these moving averages. They call them Golden Crosses and Death Crosses. I kid you not. Don’t just walk away from content like that. Run away!

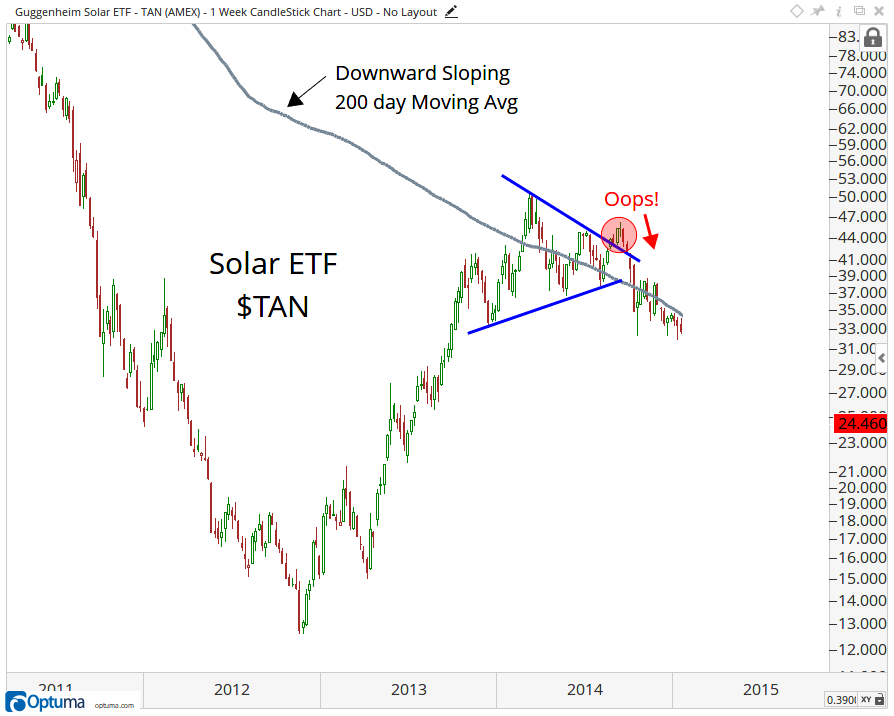

Let’s take a look at some examples. Remember, it’s the direction the moving average is heading that we are also concerned with. Here is a weekly chart of the Solar Stocks ETF $TAN. This was a nice and clean symmetrical triangle that failed after breaking out to the upside. The downward-sloping 200-week moving average would have warned you that this breakout was unlikely to hold. A swift sell-off was the result of all the downside selling pressure that you will find in a typical downtrend, which this 200-week moving average helps define for us nicely:

The S&P500 in 2012-2013 has been a good example of the media getting all excited about the 200-day moving average, but failing to notify investors/traders of its direction. This is not a new event. It’s noise. Feel free to go back and read the headlines from those days. Both of these “breaks” of the 200-day moving average were nothing but buying opportunities. The upward slope of the moving average would have helped you define that we were still in an uptrend. So initiating short positions upon a break was a terrible idea. Ignore this type of content. It’s toxic.

And finally here is a good example of a lack of trend. I don’t envy anyone trading Emerging Markets between 2013-2014. Look at the flat 200-week moving average and look at the lack of trend in price. The flat 200-week moving average tells us this market will be filled with headaches. I don’t like headaches:

So that’s how I use the 200-period moving average. There is no right or wrong way to approach any of our technical tools. At the end of the day, it all comes down to disciplined risk management. I just think that defining the direction of the underlying trend helps big time with that. So it’s not just where price is relative to the 200-day, but it’s the slope of the smoothing mechanism that I am also interested in.

Learn more about JC Parets at AllStarCharts.com.