To have a true rally in stocks, you need one ingredient: institutional buyers, says Lucas Downey of Mapsignals.com.

Our data is seeing the biggest buying all year. This leads me to believe that a new bull market has started.

Our data is clear as day. Risk is being added by portfolio managers. The recent shift in our data points to a healthy appetite for stocks. And as I’ll show you, the rally is broad-based.

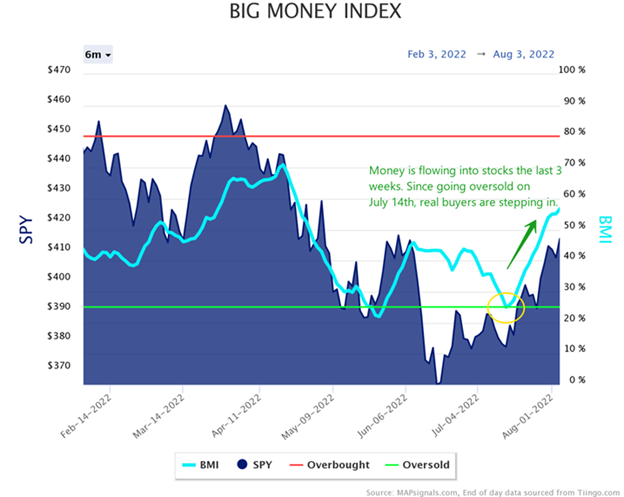

The past three weeks have gone from extreme oversold conditions to my suggesting there’s further upside for stocks. I’ll admit that the data is changing fast. However, there’s no denying the real buying that’s taking place.

Today’s message further points to higher prices for stocks in the coming weeks and months. All prior rallies in 2022 have been missing one major component, buyers. That’s not the case with the latest upswing. Real money is being put to work.

Every day that passes is looking more and more like the market lows are in. Prior shunned groups are leading the charge.

Now, let’s dive into the data and you can judge for yourself!

A New Bull Market Has Started

The Big Money Index has vaulted straight up since going oversold on July 14. It’s now breaking above 56% as buyers have now overtaken sellers on a five-week moving average.

This tells us clearly that the trend of money is flowing into stocks:

Normally, when the BMI is trending higher, you want to lean long. Typically as money pours into stocks, prices rise.

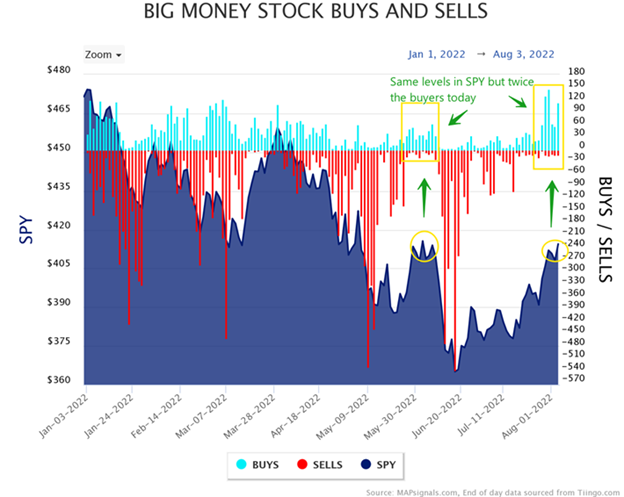

But, what’s different about the latest climb in equities is that real buying is behind the move. This is something we haven’t seen in 2022 until recently. Let me show you what I mean.

Below are the daily counts of buys and sells for stocks. The blue bars plot the total number of stocks bought in a day, while the red bars are sells. Check out how the past week saw the most buys all year. More importantly, the last time the S&P 500 ETF (SPY) was at the $415 level, buyers were few:

This is significant and indicates a major shift change. And it’s apparent when you dive deeper and look at which sectors are magnets for capital.

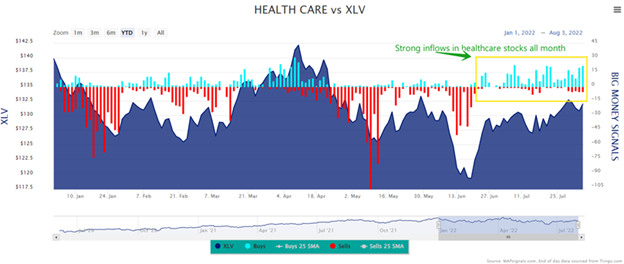

First, we’ll look at Health Care (XLV). For over a month, buyers in medical devices and insurers have led the charge. Yesterday saw nearly 10% of our institutional universe get bought. This has been a very strong theme recently:

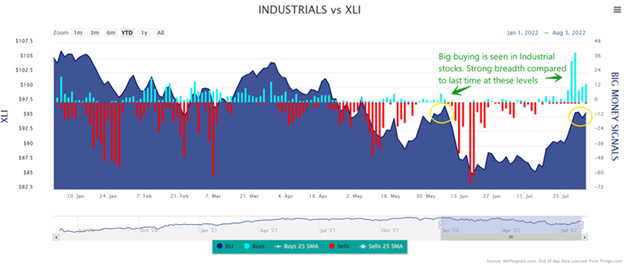

Next up, is the Industrials sector. Look how the Industrial ETF (XLI) is near the same levels as early June of $96, but the number of stocks ramping with Big Money is much broader:

This past week saw the most buying in the group all year. From the standpoint of data, a new bull market has started. Let’s keep going.

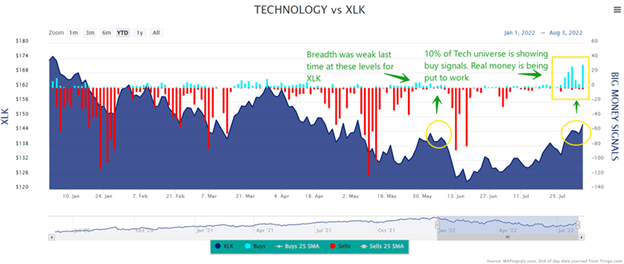

Even Technology (XLK) stocks are joining the rally. In the past week, more tech stocks were bought that any other time in 2022.

This is exciting because those blue bars represent many prior leading growth stocks. The ones that used to power markets higher for years are starting to get their mojo back. This is exactly the kind of action you want to see in a rally.

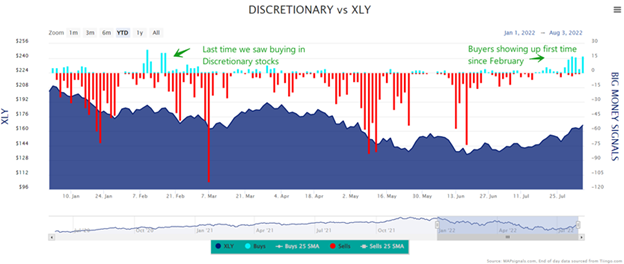

Finally, let’s check in on another beaten-down group: Discretionary (XLY). The last few days have seen a surge in green activity. This is the most buying we’ve seen in six months:

Both discretionary and technology stocks have been the Achilles heel of the market in 2022. Macro headwinds including rate hikes, high inflation, and recession fears have sent these stocks tumbling. To see buyers finally stepping in, that’s a sign of money managers having conviction in this latest rally.

Who knows—maybe stock picking isn’t dead after all!

Leadership is changing as high-quality growth stocks vault to the top. These are the clues that a new bull market has started.

Let’s wrap up.

Here’s the Bottom Line

I’ve been beating the bullish drum for weeks since reaching oversold conditions. Finally, the last piece of the Big Money puzzle is coming together: Real buying is taking place. We haven’t seen this level of conviction all year.

Sure, markets aren’t going to go up every day in a straight line. We’ll bob and weave along the way. But if you’re looking for a signal that this latest rally is different than the others—this is it. Big Money buyers are confirming this move higher.

Chances are that a new bull market has started…at least initially. Let me know your thoughts. Drop me a comment.

Finally, our buy lists are already showing growth stocks rising to the top. If you’re a stock picker, consider a MAPsignals subscription today.

To learn more about Lucas Downey, visit Mapsignals.com.