Yesterday's stocks were up and the investment media (CNBC and the like) are sharing details on why that is the case and why you should consider being bullish, notes Steve Reitmeister of Reitmeister Total Return.

Note that Monday stocks fell and those same media outlets put out scary headlines telling you why to be bearish.

The investment media does not care about accuracy. Nor about helping you invest better. They just want maximum eyeballs on their information to sell advertising space.

This means there is no accuracy...no consistency...no value!

What should you do instead?

No doubt the FOMO rally yesterday seemed very tempting to participate in. It just kept rolling higher minute by minute because in general computer-driven traders are momentum based and they just piled in on top of each other.

Unfortunately, yesterday’s gains have very little to do with the long-term picture...which remains bearish.

Simply nothing has happened to make anyone in their right mind think that the bear market is over as inflation is a deadly economic disease that is still far too virulent. On top of that, you have a Fed that is gung-ho in squashing inflation by means of aggressive rate hikes that most certainly will dampen an already weakened economy (-1.6% in Q1 and Q2 GDPNow estimated at -1.5%).

This process is far from over. This is why economic decline is far from over. This is why the share price decline is far from over.

This is a very short version of the much more in-depth discussion I had on this topic during the July 11 Platinum Members webinar.

Note that I originally felt that this bear market would end sometime in the 2nd half of the year making it shorter than the average 13-month bear market. (Measured from the previous peak to bear market bottom).

That outcome may still be possible. Unfortunately, this past month lingering above the recent bottom is starting to have me pondering that this may be more of the elongated bear market like we endured from 2000-2003.

The great similarity is that in both scenarios stock valuations got a bit stretched for the overall market. Especially true for the most exciting growth stocks that rallied to great heights only to plummet back down to earth.

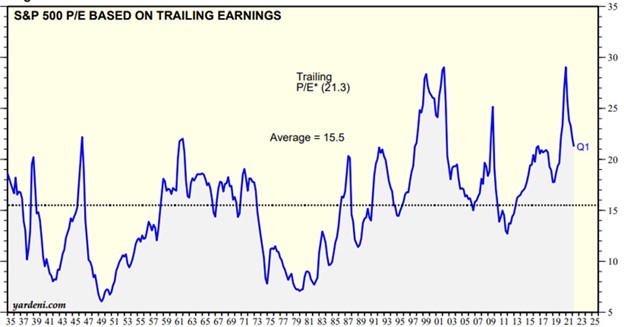

I know some of you are thinking that valuations were much more extreme during the tech bubble of the late 1990s and thus not a good comparison. However, when you see the chart below you will see that the overall PE of the market was quite similar showing that valuations got too stretched across the board.

I have shown this valuation slide on webinars in the past much to everyone’s shock just how eerily similar the peak PE in early 2022 was versus the tech bubble back in 2000. And yes, we have come down from that peak...but still well above the long-term average PE of 15.5 which we should go below at the bear market bottom.

Now that we appreciate the similarity in the heights of valuation we now can appreciate how the path of the current market may mirror what we saw back in 2000 to 2003. That was a long winding road with many drops...followed by many false rallies until the final bottom was found about three years later in the spring of 2003.

So for as much as I have talked about the modern market moving faster than in the past...mostly because of the rise of computer-based trading...maybe this one is the long slow burn like 2000-2003.

No this is not the base case right now. Still think it will work out quicker than that. However, it is interesting to contemplate the possibility as each bear market has its own unique properties. Just opening eyes to the possibilities and thus increasing everyone's patience for the gains in our inverse ETF positions not immediately filling up like a jackpot.

Is it Possible the Bear Market Is Over?

Yes, it is possible. But it is highly unlikely for the reasons already stated.

Again, my July 11 webinar presentation goes into detail about the nature of bear market bottoms. And how many drops/rallies/drops cycles it takes until the final bottom is found. So, there is truly nothing special to me about today’s bounce.

Now add to it that we are coming out of a bit of a stock valuation bubble thanks to the low rate TINA (There Is No Alternative....to stock investing environment of the past few years). And just like the last time we had to deal with excessive valuation levels from 2000 to 2003, it may take longer to let all the air out of the bubble.

This knowledge gives me the necessary patience to not get pulled into these suckers' rallies at first blush. But, yes, there is a limit to that patience as indeed the bear market bottoming process is different every time and there is always the possibility that the next bull market has emerged.

In my book, I would not seriously contemplate that bottom has been found until we test the 100-day moving average which currently rests at 4,148. The interesting thing about this spot is that it corresponds with where stocks bounced to in early May after the first time we dropped into the bear market territory.

Breaking above that 100-day moving average level in combination with any serious signs of moderating inflation and I could be tempted to get back to being bullish. Or at least a much more balanced portfolio than the straight-up shorting of the market that we are doing now.

It's funny. During a bull market, investors have tremendous patience to wait through all kinds of pullbacks and corrections for the next leg higher.

Yet during the bear market...there is virtually no patience to be found. Kind of hypocritical when you think about it as they are both long-term processes that take a while to work their way to completion.

This tells us to be students of history. To appreciate the economic cycle has not been fully played out to the downside which would include earnings decline and job loss.

When those shoes drop...and they will...then investors will quickly give up any false bullish aspirations. This will produce wave after wave of downside. And just when it seems like there is absolutely no hope...that is the bottom...and that is when the next bull market will emerge.

When you appreciate these lessons from history it is hard to make any serious statement that we have already found the bottom and that this is ripe soil to grow the next long-term bull market. We need more downside for that to happen. And that means we need more time.

Be patient my friends. This may take a lot longer than previously believed. But still says that our bearish portfolio strategy is still on the right side of history.

Portfolio Update

The market bounce this past week has not been kind to our portfolio. As per usual the number of emails from customers pondering if we should switch gears has increased...greatly.

Answer #1 to these queries is provided in the Market Commentary section above.

Answer #2 is to appreciate the honest perspective that the S&P 500 (SPX) is down -17.40% this year. Remember those are the most conservative stocks. Whereas the Ark Innovation ETF (ARKK) by Cathie Wood filled with everyone’s favorite 2021 growth stocks is down -51.89% on the year.

In that light, our recent portfolio decline to -7.21% on the year seems quite tame.

It should also help you muster the patience to stay the course as we are by no means behind the curve. Heck, one more push towards the previous lows and we will easily be back in positive territory on the year while most other investors suffer from ever deeper losses.

The above tells you why our positions have not performed as well of late. But also tells you why there is no change in strategy...and no change in positions

This bear market will require patience. I hope you have it in you so as not to get sucked in by these rallies only to get spit back out.

Closing Comments

Our next RTR commentary will be on Tuesday 8/2. That’s because next week my family is going on a week-long cruise to Alaska. Truly a bucket list trip. And for those who know me...yes, I got some salmon fishing lined up.

As always with my vacations, I will have my laptop handy and ready to send off any alerts or trades as need be. However, that is highly unlikely at this stage because of what I shared with you in the Market Commentary section.

If we are lucky this bear ends in three-six months. However, odds are increasing we may be in for a longer-term battle filled with many more drops...and many more suckers rallies before a true and lasting bottom is found.