Mike Larson, editor of Safe Money Report asks; is a recession coming down the pike?

Later in 2022 or early 2023? That’s been my expectation for a while...and a key reason why the market has been struggling mightily.

But what if the recession is already here? As in happening right now? That’s what more and more on Wall Street are whispering nervously about.

Why? Soaring energy and food prices are sapping disposable income. Retailers are overloaded with inventory they’re trying to unload. The housing market is slowing thanks to unaffordable prices are rising mortgage rates.

Meanwhile, jobless claims are starting to tick up. Plus, the Federal Reserve is relentlessly hiking interest rates to fight inflation. It’s a toxic mix for the economy—and professional “Nowcasts” are taking notice.

What’s a Nowcast? A real-time estimate of the economy’s performance, based on the most recent available data released by the government and private sources.

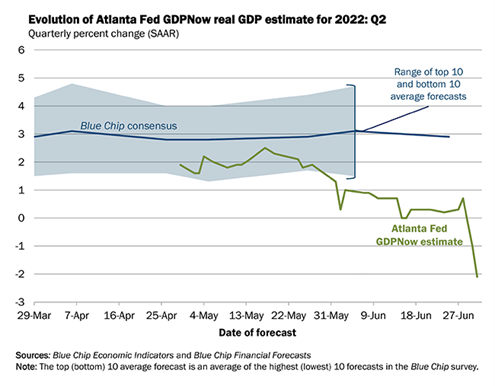

Take a look at this “GDPNow ” page from the Federal Reserve Bank of Atlanta’s website, for instance. Their economic model estimates what GDP growth is in the current quarter. Here’s a screen grab of what it showed Tuesday:

Notice anything interesting? Professional economists keep whistling past the graveyard, publishing forecasts that show second-quarter GDP growing around 3%.

But the actual data is getting worse by the week. It’s getting so bad, in fact, that the Atlanta Fed’s model is now predicting a Q2 GDP decline of around 2.1%.

More recent reports could change the forecast. But if they don’t, that 2.1% decline would be even worse than the 1.6% slump in the first quarter. We would also have two consecutive quarters of declining growth—the generally accepted (though not technically accurate) definition of a recession.

So, yeah, this is a rough environment. It’s no wonder the S&P 500 lost 20.6% in the first half of 2022, its worst start to any year since 1970. And it’s no wonder the bear market rally I wrote about last week is already fading, just like I said it would.

Bottom line? Whether we’re in a recession now or will be soon, the market is struggling and will likely continue to struggle until economic worries fade. That makes following “Safe Money” investing strategies more important than ever!