We’re in the midst of a bear market rally, states Mike Larson, editor of Safe Money Report.

I’ve seen countless similar moves in my quarter-century career—and here’s what I’d share about them:

They come out of the blue.

They can be extremely powerful.

They lure investors in like the Pied Piper.

And after a short period of time, they inevitably fail.

So, what’s the smart investor play? Use the rally for what it’s good for: Lightening up! In other words, sell any lousy stocks you’ve been lugging for the better prices the rally gives you.

Another wise move? Take advantage of the rally to rotate more money out of losing sectors and into winning ones.

Before I get to that, though, let’s talk about why I call this a bear market rally versus the start of a new bull run. The biggest reason is that the economic and policy backdrop hasn’t changed.

Start with the Federal Reserve. It’s still hiking interest rates, and not by a small amount. One 75 basis point hike is already in the bag and another 75-point move is all but certain to follow at the Fed’s July 26-27 meeting.

At the same time, the economy is starting to weaken. Initial jobless claims have been gradually trending higher since April, while housing has been slowing down sharply.

Then last week, we got certifiably ugly data on manufacturing and service sector activity. A benchmark S&P manufacturing index plunged to 52.4 in June from 57 in May. That not only missed economist forecasts by a country mile, it also nearly left the index at a two-year low.

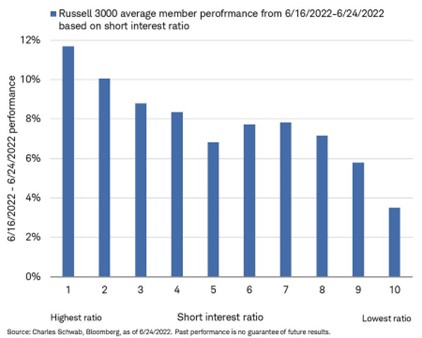

Now let’s get into the nitty-gritty of this rally. The stocks that posted the biggest gains recently were also the ones that are the most heavily shorted, as you can see in this chart.

In other words, it wasn’t high-quality stocks leading the charge. It was stocks with underlying fundamentals so bad that short-sellers have been circling like vultures. That’s classic bear market rally behavior.

Then there’s this chart. It’s a ratio chart showing how the iShares Russell 2000 Value ETF (IWN) is performing relative to the iShares Russell 2000 Growth ETF (IWO).

When the line is rising, it’s a sign that value stocks are outperforming growth stocks. That’s been the case for more than a year now, in part because the growth index is packed with all those over-owned, overloved, overvalued tech stocks I’ve been telling you to avoid like the plague.

But during this rally, the dogs had their day. The growth stocks that have been annihilating investor capital finally rallied, while value stocks took a breather. That’s another development telling me this is nothing more than a bear market rally.

So, what should you do? Hop on over to the Weiss Ratings website. Use the tool at the top of the page to screen your stocks, ETFs, and mutual funds. If any of them sport “Sell” Ratings, use this rally to dump ‘em at better prices.

Meanwhile, get out of any remaining growth stock garbage names and put your money to work in cheaper, more cycle-appropriate value stocks. Sectors like pharmaceuticals, utilities, and consumer staples make a lot more sense in this weakening economy than technology, industrials, or financials.

That’s the bear market rally playbook that I’ve developed in the many years I’ve been at this. And it’s a playbook that should pay off for you now and in the year to come.

Until next time,

Mike Larson