Rolling-down is one of our frequently used covered call writing exit strategies, states Alan Ellman of The Blue Collar Investor.

During the January 2022 contracts, there was a 5% market decline due to Covid-19, inflation, and interest rate concerns.

This article will highlight a rolling-down strategy I implemented with Healthcare Select Sector SPDR (XLV) in one of my portfolios where a 4.68% share loss was mitigated down to a 2.8% loss. The BCI Trade Management Calculator will show trade entry, initial calculations, trade adjustments, and final results.

Rolling-down trade overview:

- 12/20/2021: Buy 200 x XLV at $135.83

- 12/20/2021: STO 2 x $137.50 1/21/2022 calls at $2.20

- 1/7/2022: BTC 2 x 1/21/2022 $137.50 calls at $0.44 (20% guideline)

- 1/11/2022: STO 2 x 1/21/2022 $136.50 calls (rolling-down) at $0.80

- 1/21/2022: XLV shares worth $129.47 (a loss of 4.68%)

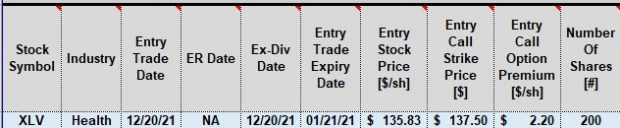

BCI Trade Management Calculator: XLV trade entry

XLV: Covered Call Trade Executed

BCI Trade Management Calculator: XLV initial calculations

XLV: Initial Covered Call Writing Calculations

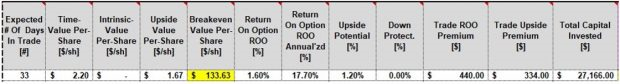

Rolling Down with XLV (Broker Screenshots)

XLV Roll-Down Trade

BCI Trade Management Calculator: XLV Adjustment Entries

XLV: Rolling-Down Trade Entries

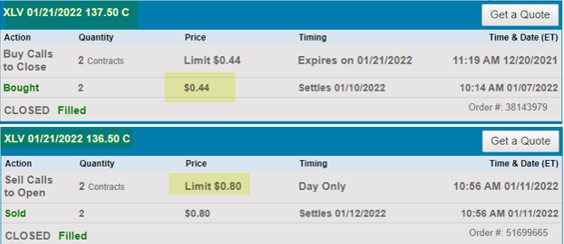

BCI Trade Management Calculator: XLV Final Results

XLV: Rolling-Down Final Calculations

Discussion

Writing covered calls and then mitigating losses by rolling down decreased a 4.68% loss in share value down to an unrealized loss of 2.80% due to an option net credit of $512.00 or 1.88%. Position management is the third of the three required skills (along with stock and option selection) that must be mastered before risking even one penny of our hard-earned money.

Learn more about Alan Ellman on the Blue Collar Investor Website.