We’re in one of the most challenging market environments in years, says Lucas Downey of Mapsignals.com.

Stock prices keep falling. Sentiment is awful. Volatility remains amped. But here’s the positive news: The Big Money Index should hit oversold within days.

Look, there’s no denying the pain many investors feel right now. Not only are most stocks falling hard, but there’s a real chance the US slips into a recession. The consumer is under immense pressure.

Out-of-control inflation has investors spooked, clocking in at levels not seen in 40+ years. We’ve all felt it. Food and energy prices have risen sharply. And to make matters worse, the latest earnings reports from Walmart (disclosure long) and Target showed huge misses on the bottom lines.

The two retail giants both guided to increased pricing pressures, which resulted in lowered forward EPS expectations. Wall Street wasn’t happy with the message. Since stocks follow earnings, the weak reports sent their stock prices plunging. It kicked off the nasty selloff in markets yesterday.

These results show just how difficult investing has been in 2022. This bear market is sinking just about all stocks…even the stalwarts. But there’s a silver lining for long-term investors: Relentless selling is what it takes to reach an oversold market. History shows that these are the times to look for bargains.

Big Money Index Should Hit Oversold Within Days

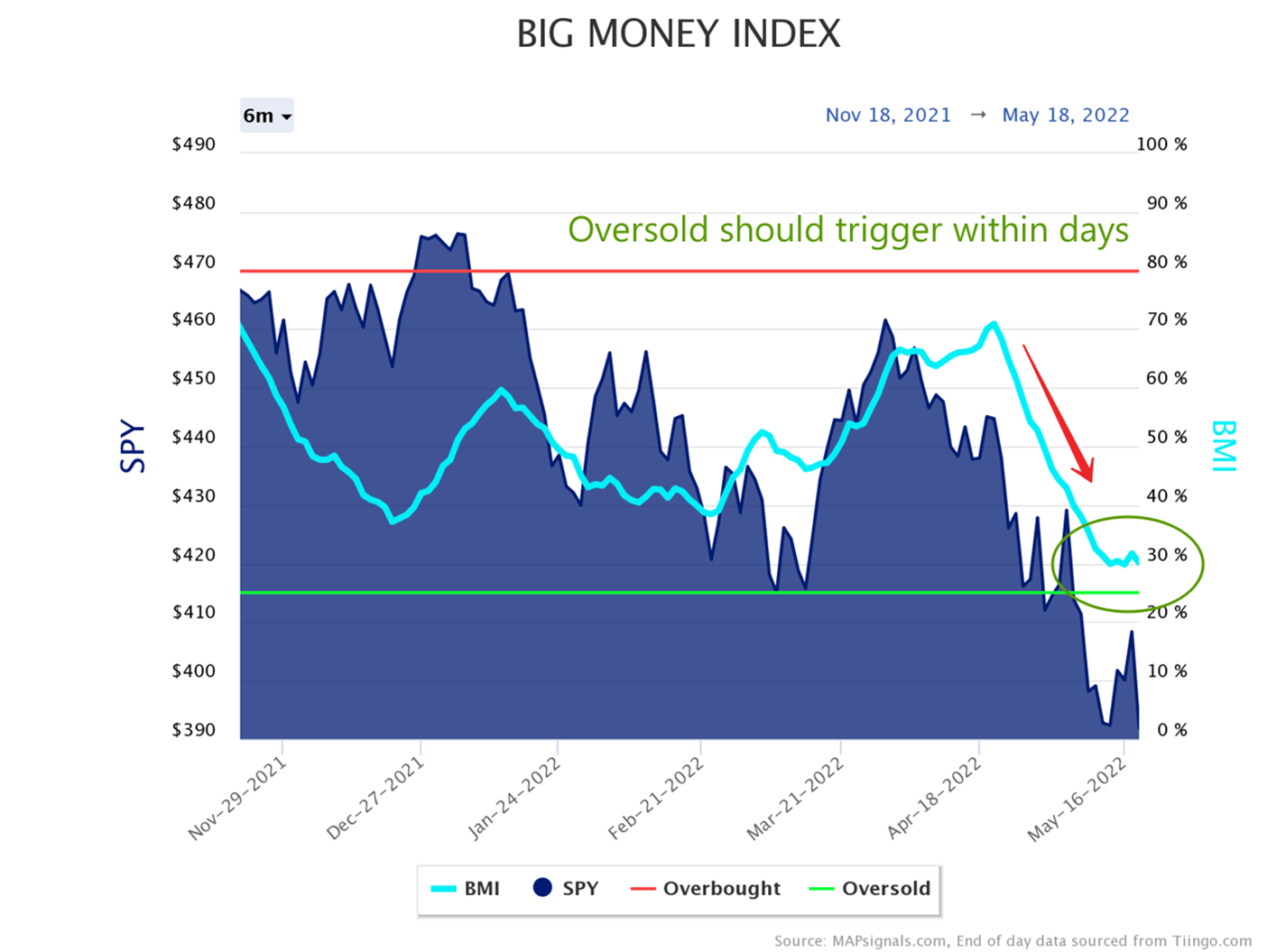

It’s hard to nail down the exact moment when markets will trigger oversold. I tried to do it back in January, but Mr. Market had other plans. Eventual leadership in Healthcare, Energy, and Materials caused the BMI to stall its fall. Then, big investors flocked to defensive areas. That type of rotational action kept the BMI range bound. Only when buyers disappear, can we get a true oversold reading. We’re reaching ever so closer to the green line. The BMI currently sits at 30%:

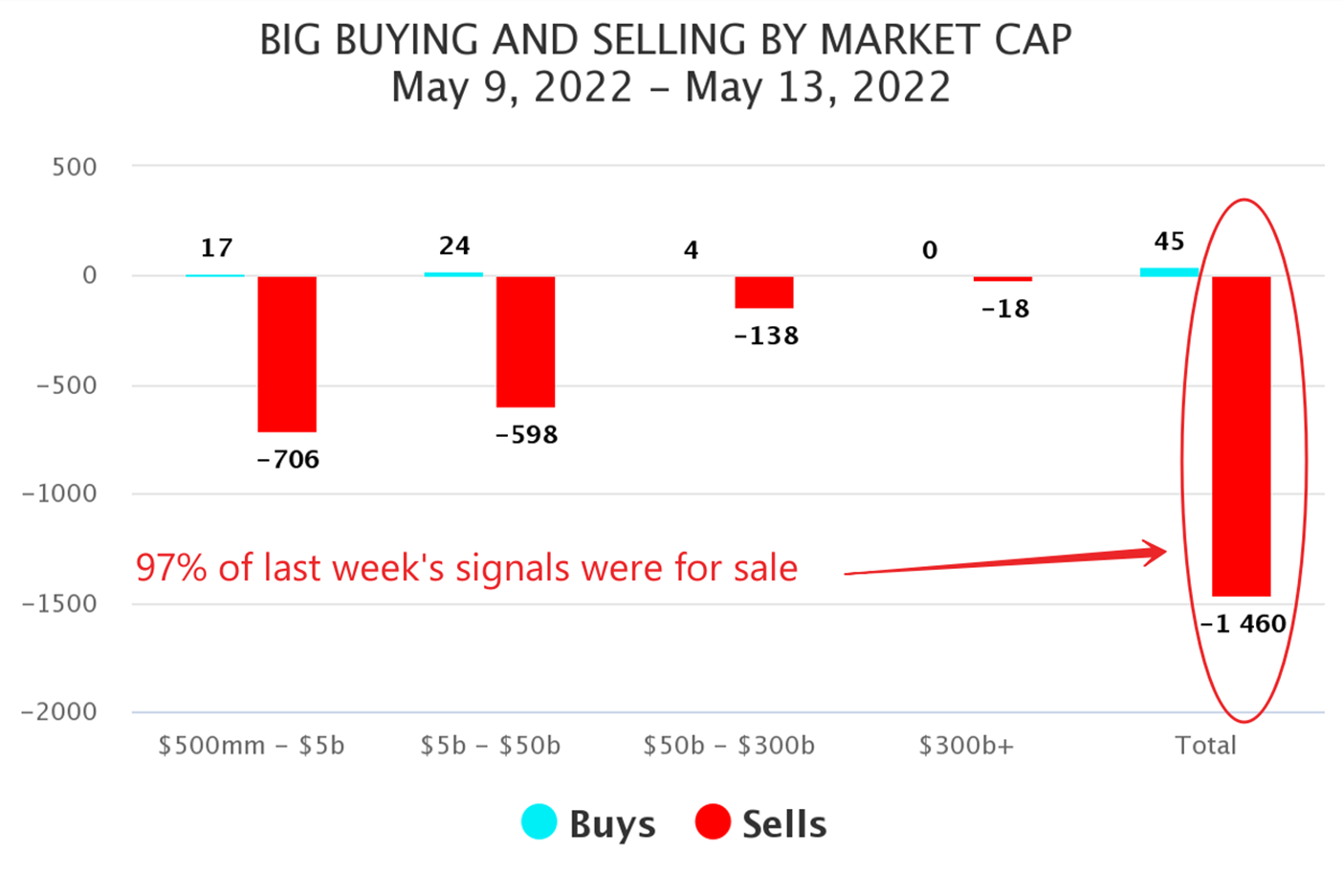

As a reminder, the BMI is a five-week moving average of buys to sells. It’s a slow-moving line that was designed to reach the green zone ONLY after buyers vanished. And recently they have. Get this: last week saw 97% of our signals for sale. The below snapshot is a breakdown of that action by market cap from May ninth to May 13:

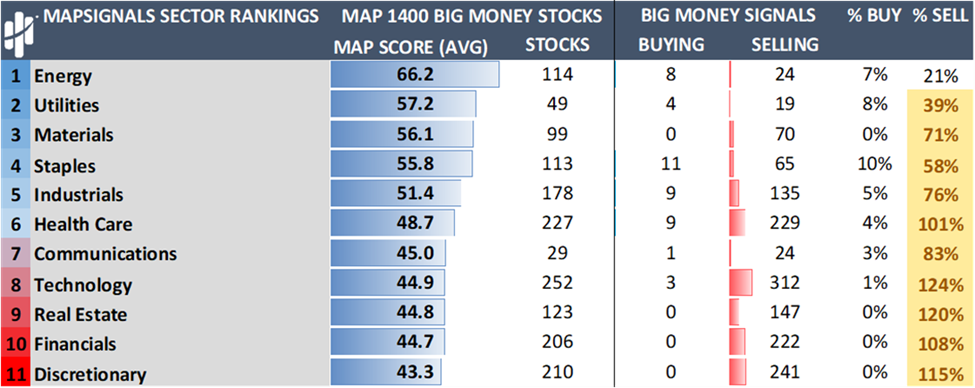

Sellers outnumbered buyers by a ratio of 31:1. That’s a “correlation of one” type of action, meaning everything was sold. De-risking was across the board with ten out of 11 sectors feeling outsized selling. Let’s look at that next. Here’s last week’s sector action in our weekly MAP View report. As you’ll notice, each sector is ranked from highest to lowest by score (left side). Off to the right is what’s important. In yellow displays any time a sector has >25% of its universe bought/sold.

All groups were sold hard except Energy:

Source: FactSet, MAPsignals

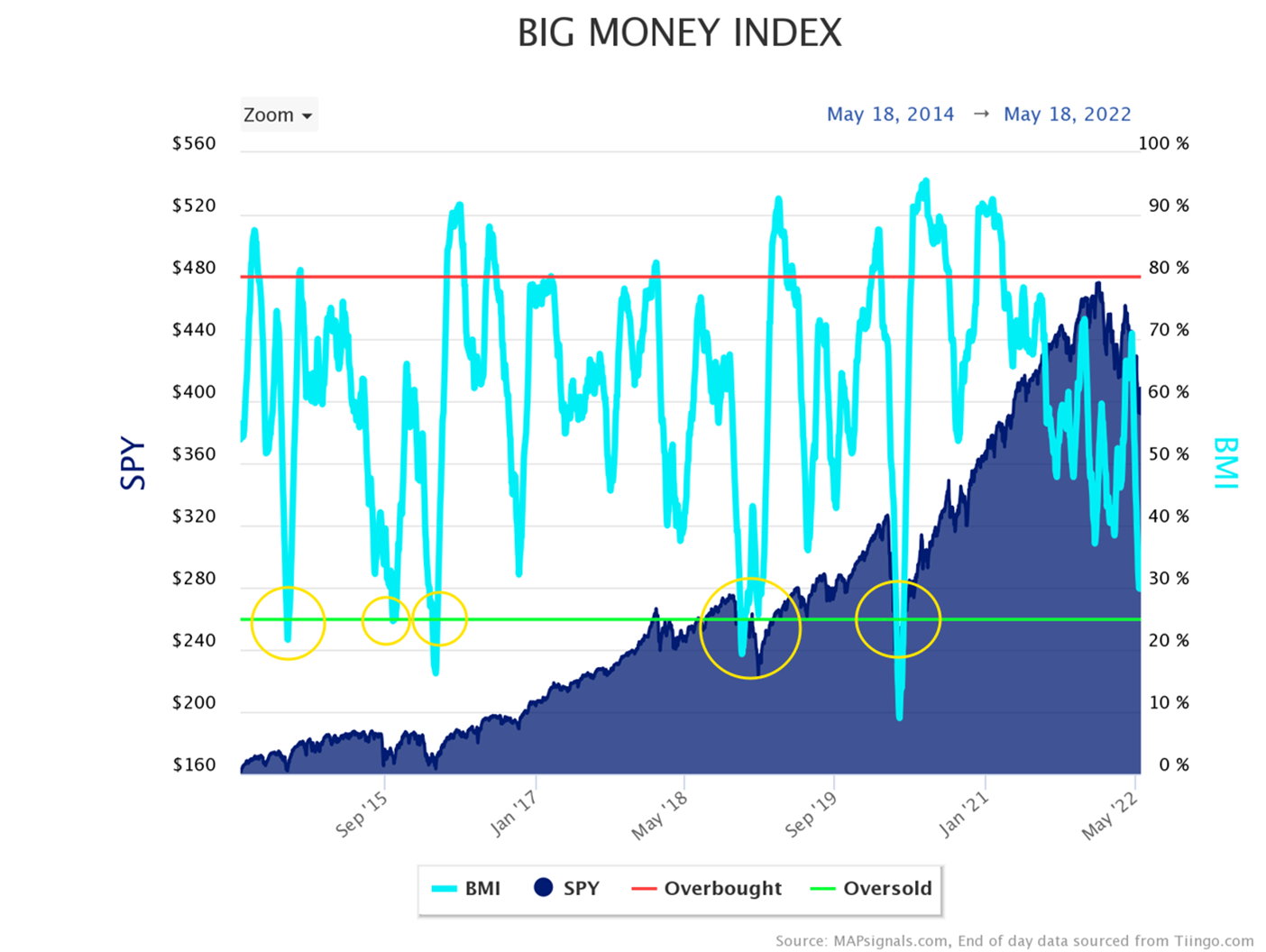

We’d have to go back to the pandemic lows to see similar action. And that’s also the last time we saw true oversold conditions. Here’s a reminder of the last few prior oversold instances. I’ve circled them in yellow:

Each of those yellow areas were depressed periods for stocks, very similar to today. I remember them vividly. Headlines were gloomy just like now with awful sentiment. Most felt the investing world was ending. But the world didn’t end. Businesses ultimately thrived. Markets eventually recovered. Out of despair, new heights were formed. So, as we get ever closer to oversold conditions, here’s a reminder of what we have to potentially look forward to.

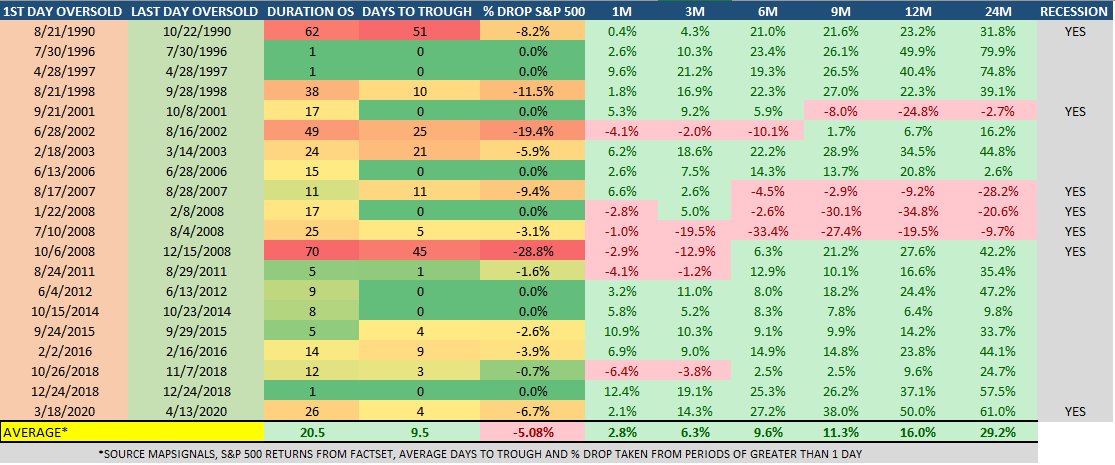

Below are the 20 oversold instances going back to 1990. The left side of the diagram shows a few things. First, oversold conditions typically last three weeks (20 trading days) and markets generally trough two weeks later. On the right side is the bigger message: These are some of the best times to buy stocks for the long term.

That’s right. On average, the S&P 500 (SPX) is up 9.6% six months after reaching oversold. Twelve months later stocks gained 16%. Two years later markets saw a whopping 29.2% surge. Only time will tell if “this time” will lead to big gains. My bet is there’s opportunity in a sea of red.

Let’s wrap up.

Here’s the Bottom Line:

Our data is signaling a massive buy opportunity is near. We’re in the midst of a market washout. All stocks are getting hit hard. Correlation is one. The Big Money Index should hit oversold within days.

Going through painful pullbacks is never fun. But history has proven that over the long run, markets eventually work themselves out. I believe companies will grow again. I can’t tell you what stocks are going to do tomorrow or the next day. No one can. But I’m confident that oversold environments won’t last forever. As a long-term investor, now is the time to be greedy rather than fearful.

That’s the winning attitude.

To learn more about Lucas Downey, visit Mapsignals.com.