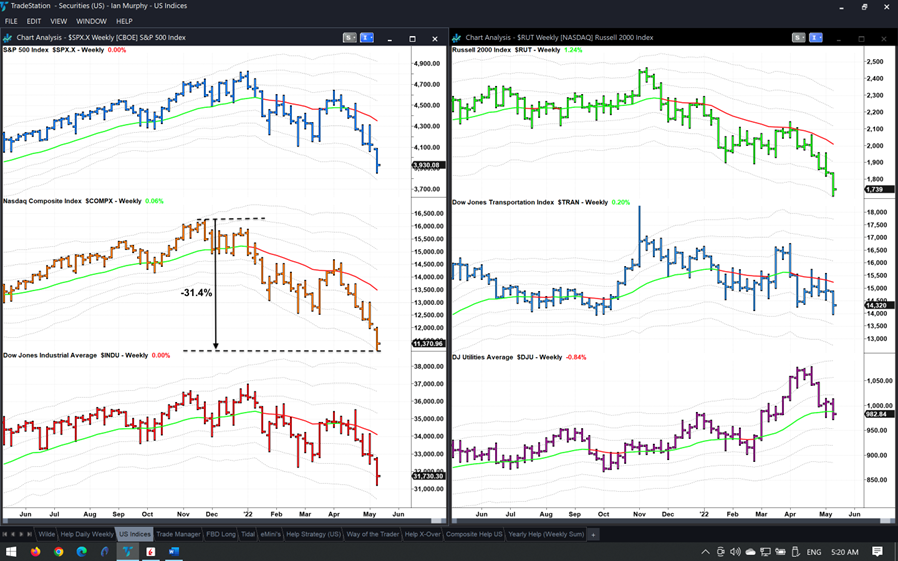

High-profile tech firms are bearing the brunt of the selloff which saw the NASDAQ (NDX) index down 31% from its November peak in yesterday’s session, observes Ian Murphy of MurphyTrading.com.

This is not surprising when you consider these are the same stocks that drove equity markets to all-time highs last year.

Click the chart to enlarge

The old market adage, ‘Sell in May and go away’ appears to be true for 2022, but tech is not the only sector experiencing a stampede for the exit. As discussed in yesterday’s Client Webinar, the cryptocurrency space is awash with red this week as ‘stable coins’, which are pegged to the dollar, have failed to hold parity. We are beginning to see the first real test of cryptos as the market is finally asking: are they purely for speculation or are they a new investable asset class?

The summer months will offer an answer.

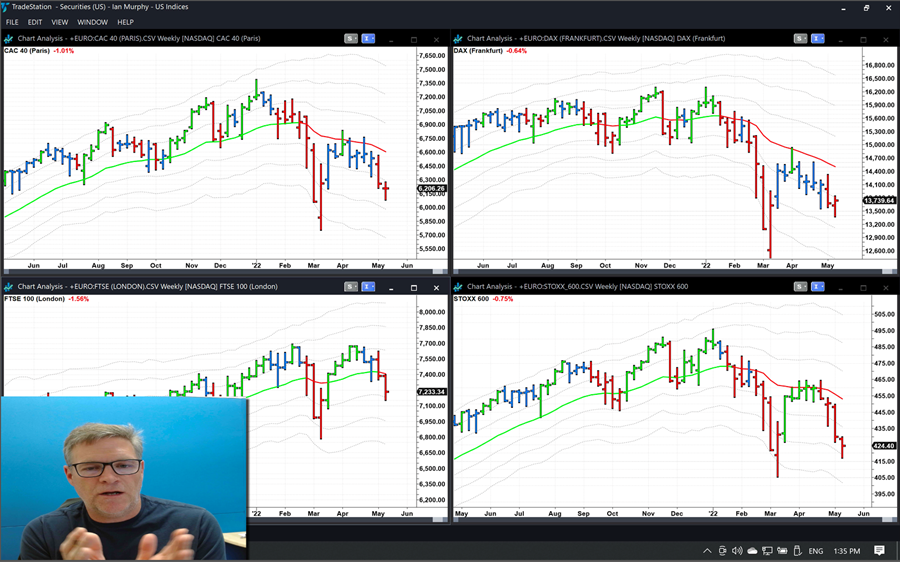

Click the chart to enlarge

Over half of all US stocks made a new 20-day low in yesterday’s session with just nine firms making a new 52-week high (and only six of those have sufficient liquidity to be tradable). The conditions for a powerful market bounce are starting to set up once the weak hands have been washed out.

Learn more about Ian Murphy at MurphyTrading.com.