Trader indecision and confusion are making this market nearly impossible to trade, states Joe Duarte, editor of In the Money Options.

The result is that fewer and fewer players will likely participate, and that illiquidity will increase, further increasing volatility. In addition, the market’s breadth as illustrated by the New York Stock Exchange Advance-Decline line (NYAD) remains bearish.

That said, bear markets don’t last forever. In fact, bear markets tend to last much less time than bull markets. And as I detail below, there will be plenty of time to make money on the long side once the current actions of the Federal Reserve are reversed.

Nevertheless, when the stock market trades up or down 1000 Dow Jones Industrial Average (DJI) points on a nearly daily basis, there is no trend. Moreover, when the action in the options market is the major driver of the daily trading in stocks, the intraday volatility becomes chaotic.

As a result, disciplined traders have likely been stopped of multiple positions and cash levels are starting to rise. That’s not a bad thing, as the rising cash levels will eventually fuel the next rally once the Fed stops its attempt to massacre the MELA system. See below for full details.

That’s because stocks have always hated higher interest rates. And since the stock market is the major fuel for the economy, when stocks get clobbered for a long enough period, the economy follows. As a result, as I stated in my Flash Alert to subscribers, regarding the Fed’s May fourth interest rate increase, I recommend the following steps:

- Prepare for persistent volatility

- Stay vigilant—a move above 35 on the COBE SPX Volatility Index (VIX) index and new lows on NYAD will likely signal that even more aggressive selling is likely.

- Keep a close eye on your sell stops—if a stock you own is not stopped out, keep it.

- Stay hedged—our SDS position has provided a nice cushion over the last few weeks.

- Prepare to be at 100% cash at some point in the future if the bear trend goes on long enough.

To summarize: when it comes to individual stocks, if any one of your holdings is working, there is no reason to sell it

And here is an additional suggestion: make a shopping list because this bear trend won’t last forever. In fact, the harder the selling, the more bargains will be created at some point in the future.

The MELA Crush: Here’s How We Get to a Recession

The impact on the MELA system (M= markets, E= economy, L= life decisions, A=artificial intelligence) from the Fed’s move toward higher interest rates is best expressed by the action in the US Ten-Year Note Yield (TNX). Specifically, higher interest rates are the death knell of bull markets in stocks.

And since a significant portion of the US population uses the status of its 401 (k) plans, IRAs, and trading accounts, including crypto holdings as a gauge toward spending habits, it’s not hard to figure that spending, especially on big-ticket items such as houses and automobiles, is likely to get hit.

That’s because the housing sector, which is directly related to TNX via the bond yield’s connection to mortgage rates, is anywhere from 15% to 18% of the US economy. Thus, by hurting the housing sector, as is inevitable due to rising mortgage rates, the Fed is basically removing the contribution to GDP of nearly 1/5 of the US economy.

That’s without counting the negative effect on the automotive sector - auto loans which will reduce the 3.5% contribution of the automotive sector to GDP and the negative effect on credit card and consumer loan rates which will likely impact banking earnings and the banking sector’s nearly 8% contribution to GDP.

In other words, higher interest rates could reduce the contribution to US GDP by as much as nearly 30%.

When Does This All End?

As I said above, bear markets tend to last much less time than bull markets. In fact, by some measures bull markets last five times longer than bears. So that means that this one will end as well.

And when it does, it will likely correspond to a time when the economic statistics show that inflation is receding and the Federal Reserve says it will stop raising interest rates. Until then, however, we can expect some version of the current market chaos.

NYAD Breaks to New Lows Signaling Further Trouble is Possible for Markets

Unfortunately, the New York Stock Exchange Advance-Decline line (NYAD) remains in a bearish trend, having made a new low on 5/6/22. So, until this pattern is fully reversed, the market remains in a bearish trend.

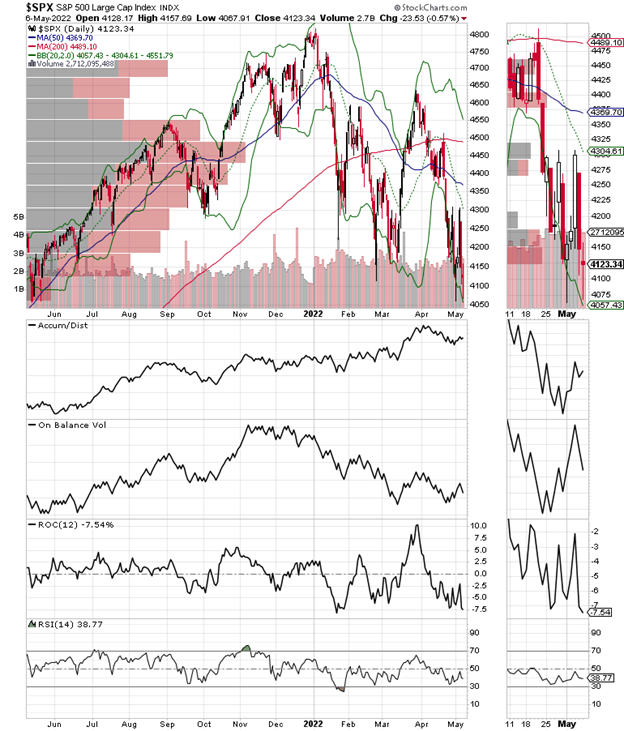

Both Accumulation Distribution (ADI) and On Balance Volume (OBV) have improved compared to last week, which means that some buyers have waded in.

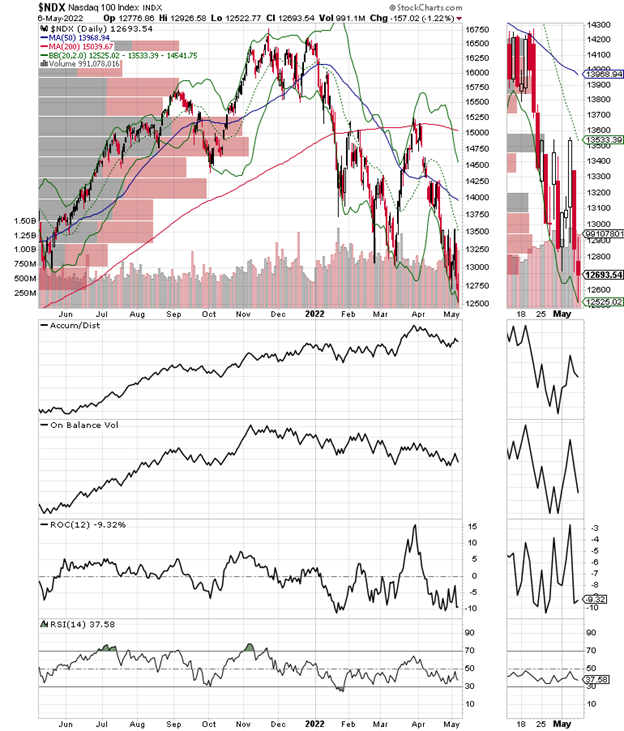

The Nasdaq 100 Index (NDX) shows similar action with support STILL near 13,000. However, the Volume by Price (VBP) bar at 13,000 still does not look very stout, so this level may not hold.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.