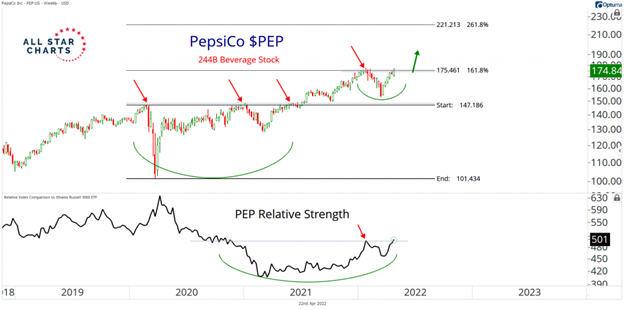

Sean McLaughlin of AllStarCharts.com states: we’re thirsty, and how can we not be when looking at this Pepsi (PEP) chart?

With everything the stock market has thrown at us over the past few weeks, look how well Pepsi has held up!

The team was recently talking about Pepsi in the Hall of Famers report: "After a base breakout in 2021, price has been coiling just below our initial target. While some consolidation here is more than welcomed, we see no reason why PEP shouldn’t continue its path higher. The stock is resolving a bearish-to-bullish reversal relative to the broader market. We think PEP could be in the early stages of assuming a new leadership role, especially if price makes a valid upside resolution on absolute terms. As long as we are above 175, we want to be long PEP with a target of 221 over the next three to six months."

Pepsi knocked its latest quarterly earnings report out of the way and the stock responded well. So now we’re ready to get involved. And with the potential for a “200-dollar-roll” lurking out there, we could have some “magnet” action pulling us up to that level.

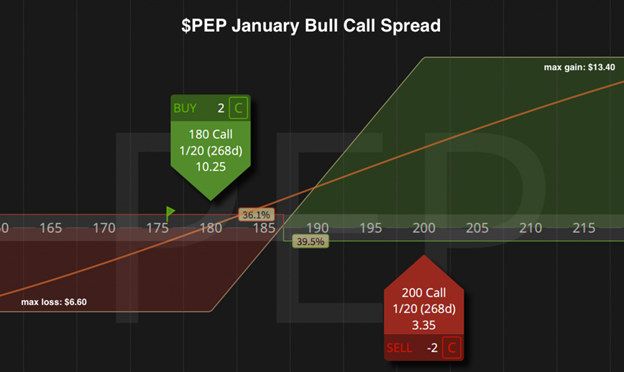

Even post-earnings, the implied volatility in PEP options are still a bit elevated, so we’re going to play with a bullish spread.

Here’s the Play:

We’re buying a PEP January 180/200 Bull Call Spread for an approximately $6.60 debit. This means I’ll be long the 180 calls and short an equal amount of 200 calls. And the net debit I pay upfront represents the most I can lose in the trade. But the nice thing here is we’ve got a pretty clear nearby risk management level to lean against.

Any $PEP close below $170 per share would be a clear indication that we’re early and/or wrong. Either way, I’ll want out. And the sooner that happens, the smaller our loss will be. So, if it’s going to happen, I hope it happens quickly.

Meanwhile, if PEP begins to follow through on this breakout and makes a run at $200 and beyond, we’ll be looking to close this spread for a profit when we can exit for $13.30. This would represent a doubling of our invested capital, and a capture of 50% of the maximum potential profit (only achievable if the position is held all the way to January expiration).

Learn more about Sean at AllStarCharts.com.