The first earnings surprise of the season came yesterday after the bell when Netflix (NFLX) reported a decline in subscribers of 200,000 in Q1 and expects to lose 2 million customers in Q2, exclaims Ian Murphy of MurphyTrading.com.

In pre-market trading the price is down over 25%. According to Refinitiv, 49 firms in the S&P 500 (SPX) have reported so far with 80% coming in above analysts’ estimates.

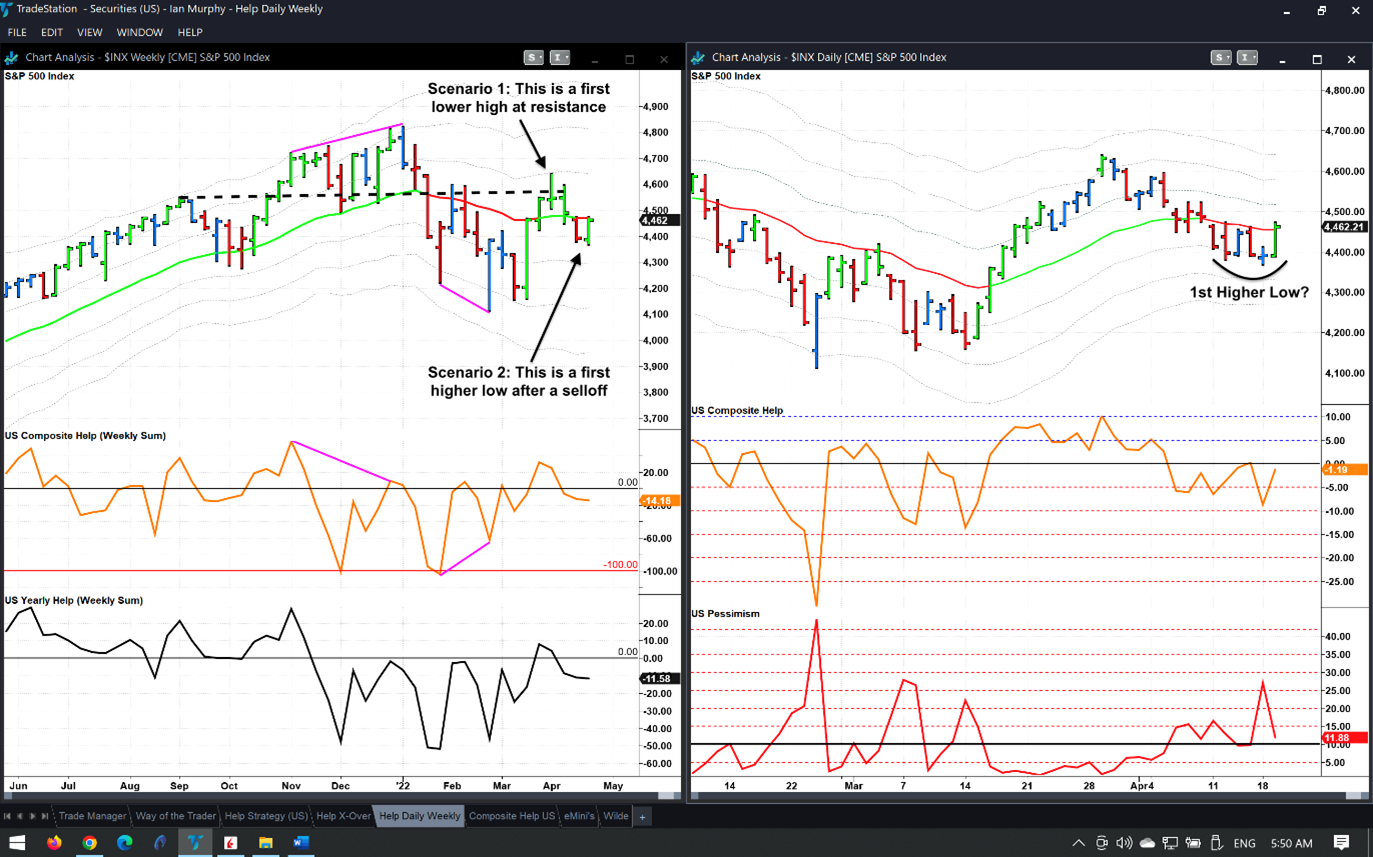

As a trend follower (markets, not fashion), I am no closer to knowing how the market will trend for the remainder of the year, but I see two likely scenarios starting to take shape.

Click the chart to enlarge

Scenario one is bearish. We had a first lower high form on a weekly chart at overhead resistance, and from here the path leads downwards. In the bullish scenario, we had our selloff and now we are building a base for the next leg up.

Three factors will determine the outcome: (a) How aggressively the Fed tighten at their May 3-4 meeting, (b) how things unfold with the Russian offensive in eastern Ukraine, and (c) earnings announcements.

Learn more about Ian Murphy at MurphyTrading.com.