Recent developments in crypto currencies since the beginning of the Ukrainian war are surprising, to say the least, and may indicate whether crypto currencies are indeed a viable trading and hedging vehicle for the long term, states Brett Friedman of Winhall Risk Analytics.

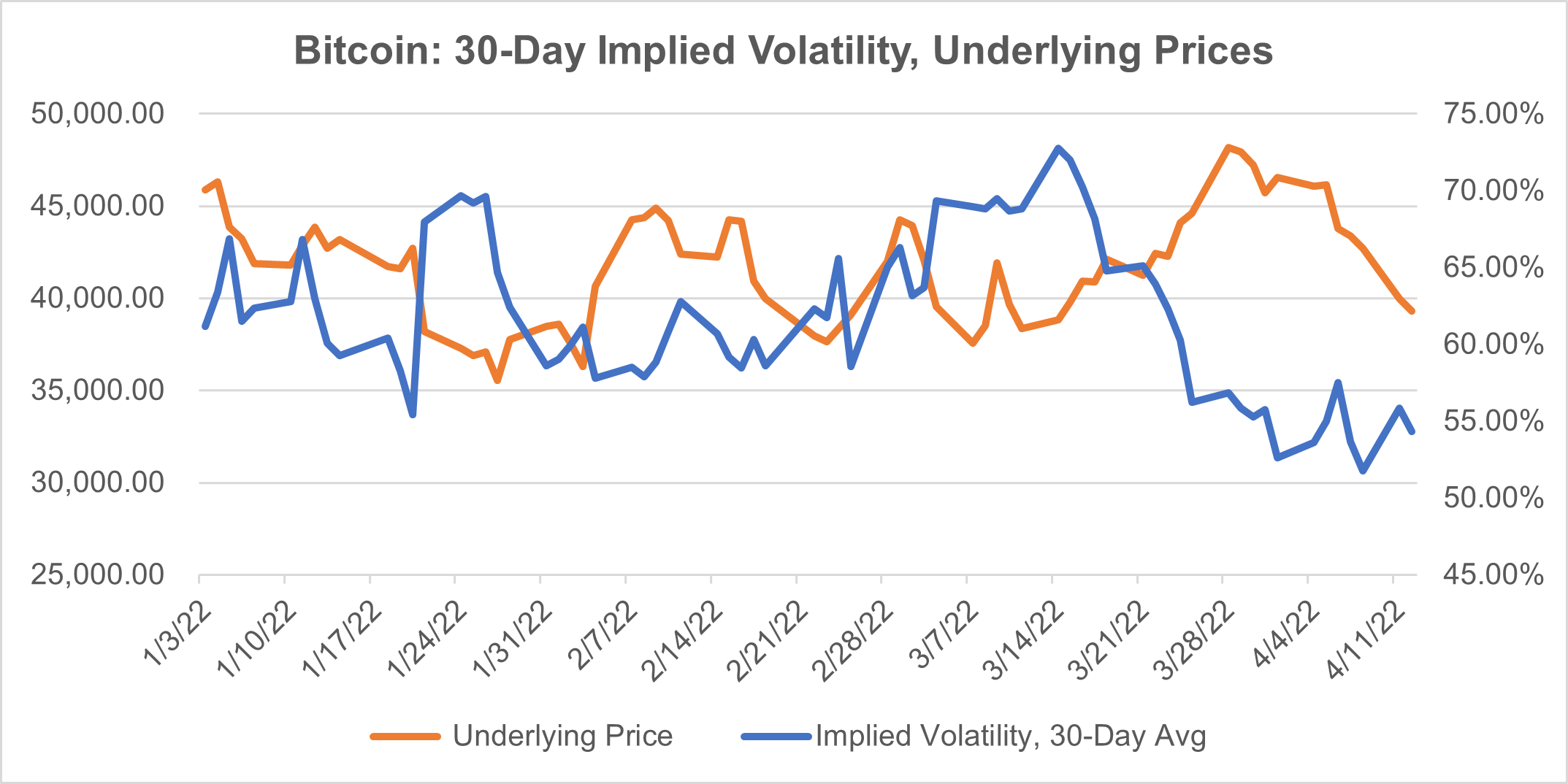

Surprisingly, early indications are that it might not be. First, a current chart of Bitcoin’s implied volatility and underlying prices (CME futures and options) since the start of 2022:

Source: OptionMetrics

When Bitcoin (BTC/USD) and its crypto cousins were first introduced, they were touted as the libertarian antidote to government regulations and tracking, currency devaluation, inflation, war, and sanctions. All of these factors have been magnified by the war in Ukraine. Inflation has accelerated, the Swift system has been weaponized, and sanctions continue to limit trade flows. In short, the perfect time for crypto currencies and the perfect setup for an impressive rally.

And yet, almost two months into the war, crypto currency adoption and price action have been unimpressive. Take Bitcoin. So far this year, it’s averaged approximately $41,750 and has traded mostly between $35,000 and $45,000. After rallying in late March to $48,190, it has since settled back down to $39,295 as of April 13. Its implied volatility has followed a similar trend and has declined from a peak of 72.9% in early March to 54.3% currently.

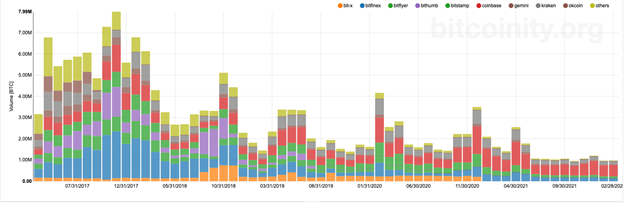

Finally, and on a longer-term basis, cash Bitcoin volume has been declining since roughly 2017:

Source: data.bitcoinity.org

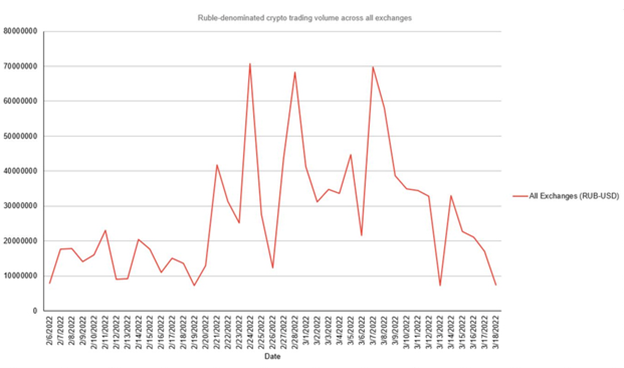

As a side note, one would have expected that the war-related crash in the ruble would have led to more crypto currency usage among Russians and Ukrainians. Unexpectedly, and after spiking early, ruble denominated volume has declined to pre-war levels:

Source: Bloomberg

In short, this should be Bitcoin’s Golden Age, but clearly it is not behaving as expected. That is, if the original justifications for crypto currencies were ever true in the first place. Current developments seem to indicate that they were not. A few comments:

- Since crypto has failed to capitalize from the current environment, it suggests that it could be essentially a niche speculative product, not a hedge against inflation, corruption, currency devaluation, or sanctions.

- If it is indeed a speculative vehicle, then its lackluster performance is due to the fact that speculators are simply trading products with better liquidity and ease of execution. In other words, traders aren’t flocking to buy crypto because it’s just easier to trade other products that have better potential and in which institutional investors can trade sufficient size to “move the needle.”

- Despite the attention that Bitcoin and its crypto cousins get in the press, volume is still relatively limited and a fraction of what is present in more established markets. Consider the volume figures below for 04/13/2022:

|

Product |

Volume |

|

E-mini S & P 500* |

1,255,845 |

|

10-Year T-Note* |

1,835,697 |

|

Crude Oil (WTI)* |

863,496 |

|

Japanese Yen* |

132,883 |

|

Gold* |

147,601 |

|

Bitcoin + Bitcoin Mini Futures* |

20,030 |

|

Bitcoin, Cash** |

25,114 |

Source: CME & data.bitcoinity.org

Even accounting for the fact that crypto trading is comprised of more than just CME Bitcoin futures and their cash equivalents, volume is still comparatively low. Needless to say, major, high-volume speculators will not be attracted by Bitcoin’s low-volume figures.

All of this presents a problem for crypto’s long-term future as a viable, traded asset class. If it is not an effective hedge and cannot attract institutional investors due to relatively limited volume, then crypto currencies will never live up to their potential.