S&P 500 (SPX) has pulled back from its late-March rally, and in doing so raised the possibility that the bear market is still in force, but the jury is still out on that, says Larry McMillan of Option Strategist.

The intermediate-term trend still appears to be down (blue lines on the accompanying chart).

Shorter-term activity, however, shows a more positive bias in that the "modified Bollinger Bands" (mBB) are now moving higher.

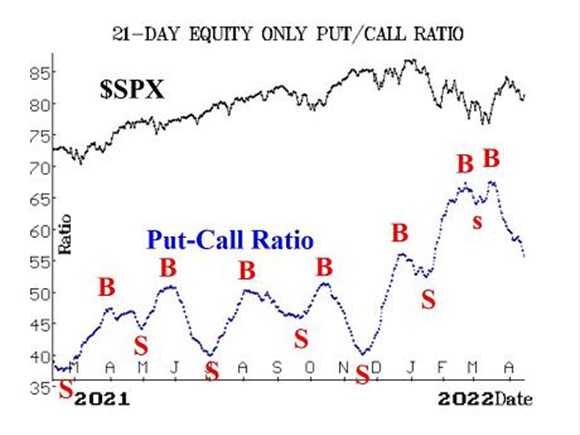

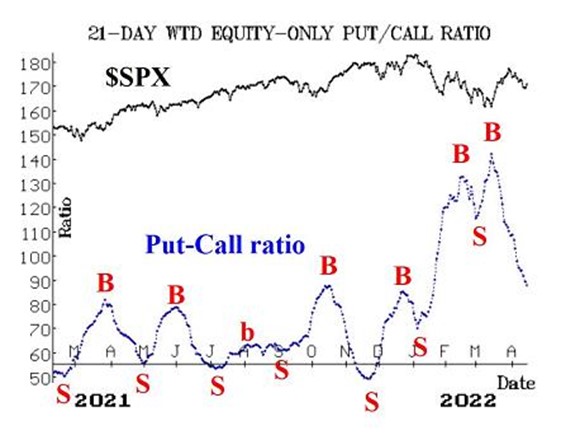

Realized volatility has begun to shrink modestly, and the Bands are pulling closer together. Equity-only put-call ratios continue to remain solidly on buy signals, as these ratios are dropping steadily on their charts.

The buy signals that originally took place in mid-March will continue to remain in place until the ratios roll over and begin to rise.

Market breadth deteriorated after the market made new highs in early April, and the breadth oscillators had been on sell signals since then.

Just yesterday (April 14), breadth improved enough to cancel out those sell signals and generate new buy signals. As always, this short-term indicator swings back and forth quickly, and none of the oscillator signals have lasted more than a few days in the volatile market that has been in place in 2022.

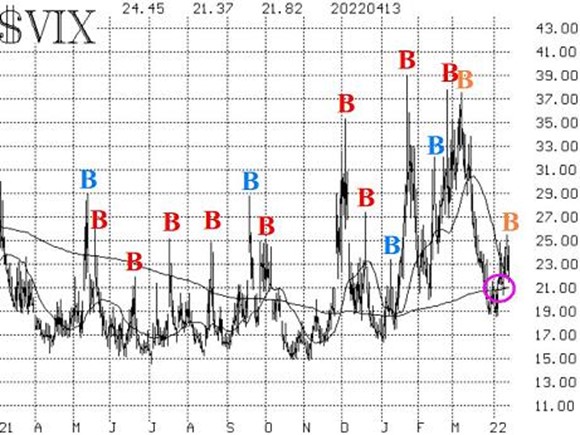

A new CBOE SPX Volatility Index (VIX) "spike peak" buy signal occurred at the close of trading on Thursday, April seventh. Countering that, to some extent, is the fact that the intermediate trend of VIX has turned upward again, and that is generally negative for stocks.

Both $VIX and its 20-day Moving Average are above the 200-day Moving Average of $VIX, and that 200-day MA is moving higher.

In summary, there are mixed indicators in place, which is not unusual when $SPX is swinging back and forth in a (wide) trading range. Both bulls and bears have been frustrated by the lack of follow-through. It certainly appeared that the bears had a chance this week when SPX closed below 4,420, but as has so often been the case, no further decline occurred.

The bulls experienced the same sense of futility when the breakout above 4600 a couple of weeks ago was not able to extend higher. So, we will continue to trade individual indicator signals as they occur, without being overly committed to either the bull or bear case right now.