Normally a newsletter goes out once a month, but we do a mid-month review when volatility picks up or something out of the ordinary is happening, and boy there is a lot happening, states Ian Murphy of MurphyTrading.com.

Russia and Ukraine

Tomorrow is a big day in the markets. Russia is expected to default on their foreign debt and a growing list of firms will take a hit. The losses will be painful but not an existential threat to the system. This will not be the first time Russia has defaulted and as Argentina has demonstrated on a few occasions, there is always a path to redemption when it comes to global finance.

6% of the population of Ukraine are estimated to have fled since the invasion and regardless of the outcome of the war, two things are certain; a new iron curtain has been drawn in Europe and the continent will accelerate plans to develop defense and energy independence. While Putin’s ‘special military operation’ in Ukraine grinds mercilessly on, listed firms are starting to quantify their exposure to Russia, and when rising commodity prices are also factored in, the picture for stocks in 2022 is less rosy than it was a month ago.

Fed and ECB

Also tomorrow, the Fed is expected to announce a 0.25% increase in US interest rates. The move has been signaled long ago but guidance on the number and size of increases for the remainder of the year will be closely watched in the follow-up press conference. The European Central Bank (ECB) have also announced it will end QE sooner than expected and possibly increase rates in the 17 countries that use the Euro currency before the year is out.

Chinese Equities

With western attention focused on Ukraine and the Fed, developments in Chinese equities may have passed unnoticed. Challenges are stacking up in the world’s most populous country. Issues in the property sector are no secret, and the deleveraging continues to apply pressure to government and household finances. However, cases of Covid-19 have climbed rapidly as the country’s ‘zero-covid’ policy has failed, and the important city of Shenzhen is locked down.

Click charts to enlarge

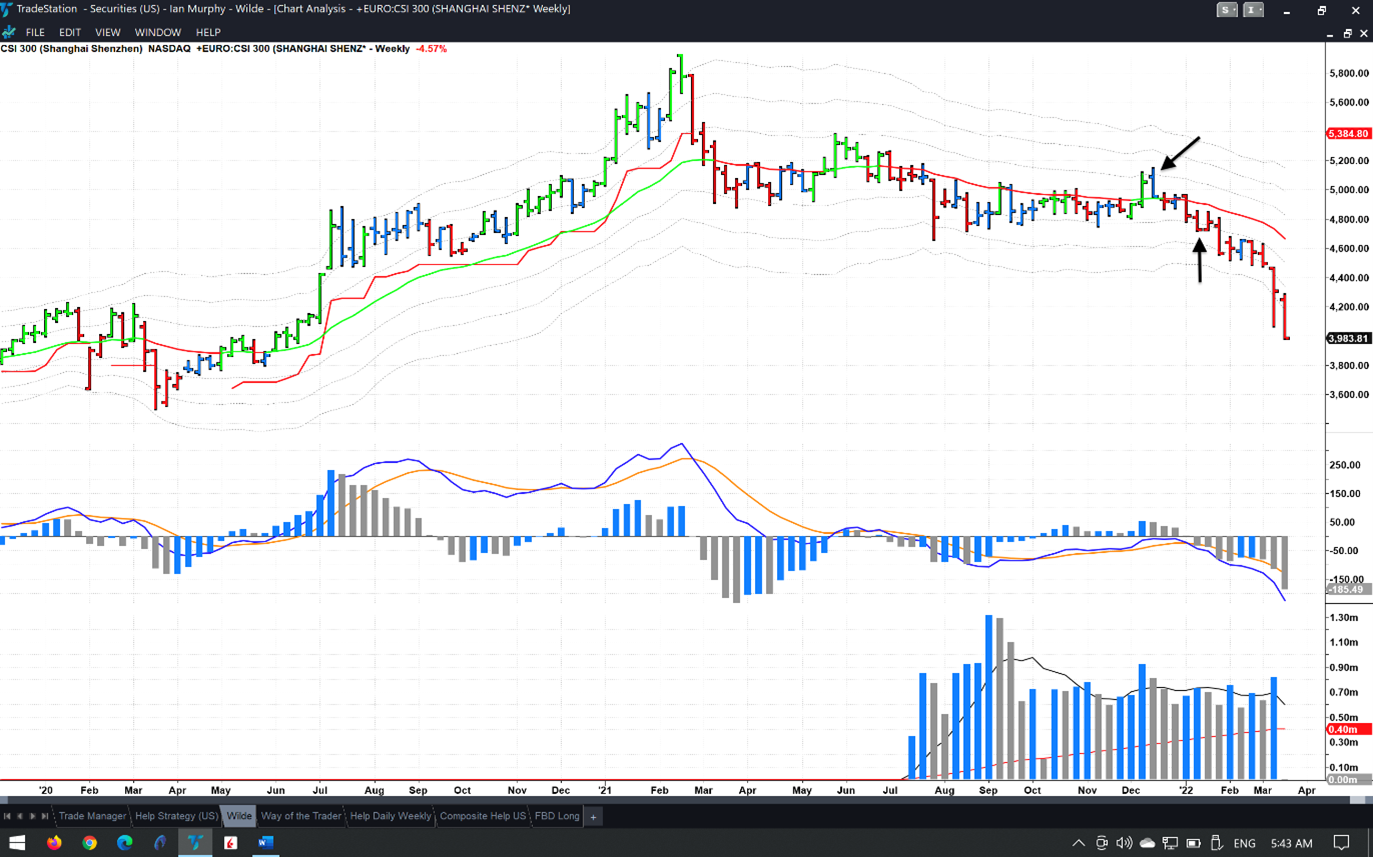

In a note sent to Subscription Clients last week we highlighted the CSI300 index (000300.SS) which tracks the largest 300 firms trading on the Shanghai and Shenzhen stock exchanges in mainland China. The index has been in a steep selloff since January 14 (bottom arrow) when it closed below the -1ATR line on a weekly chart. This is the point at which I define an index as being in bearish territory.

Prior to that, the CSI300 trended sideways with a downward bias throughout 2021 and dipped in and out of ‘official’ bear market territory (down more than 20%) on a few occasions. But the closing price on January 14 of this year was significant.

Admittedly the price closed below this line twice in 2021, but it recovered and tried to soldier on. However, the nail in the coffin was hammered home last December when this important index tried to rally but failed to close above its 1ATR line (top arrow). After that, there was only one place it could go, and that was down.

I suspect the last hurrah in December marked the end of the ‘distribution phase’ of the stock market cycle where institutional investors and large account holders unload stocks. Retail investors and traders are now starting to dump their long positions also.

Trading finished for today at 3:00 pm local time at the low of the session, and the index is now down 32.8% from the peak in February of last year.

Stocks on Sale

With all this negative news, one would be forgiven for tuning out from the stock market for the foreseeable future, that would be a mistake. It’s at times like this that great stocks come up for sale at a huge discount.

European and US stocks may bottom out in the next week or so and recover, or we could be only beginning a selloff and things could get a lot worse. Either way, we need to sit up and take notice right now because some solid profitable firms might be available at discounted prices, and we need to be there to pick up the bargains.

Click charts to enlarge

I’ve prepared a watchlist of stocks to add to my long-term holdings and have already taken a small bite of Pfizer (PFE) last week with 400 shares on the Interactive Brokers account (pink arrow). The trailing protective stop (red line) will be based on a weekly closing basis for the -1ATR (the same level mentioned in the CSI300 above).

The presentation will be on the Wilde Strategy and will cover how to identify stocks, when to buy, and how to manage and exit the positions when the time is right. Basically, how to develop a strategic approach to active long-term stock investing. Register now and look out for a reminder email next week.

Learn more about Ian Murphy at MurphyTrading.com.