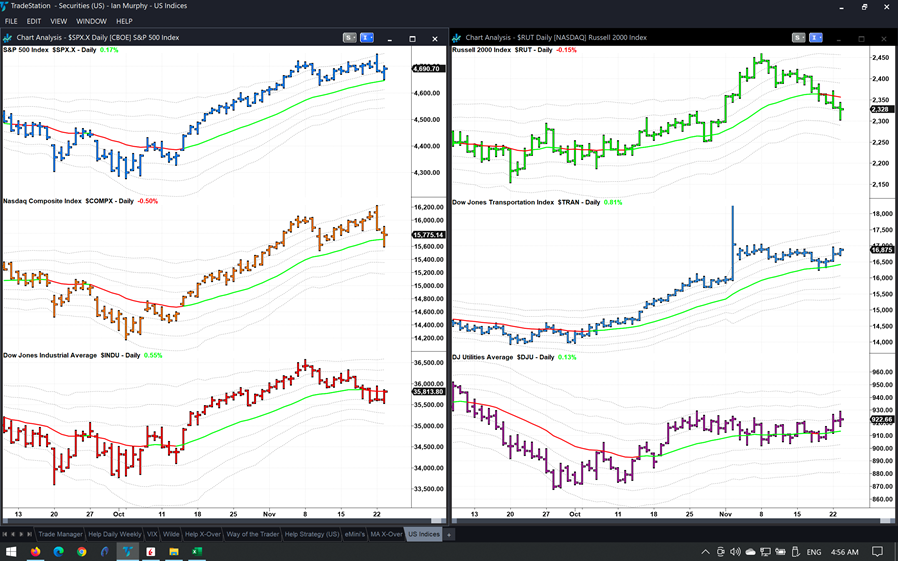

Major US equity indices are at an inflection point ahead of the week's last full trading session, states Ian Murphy of MurphyTrading.com.

The S&P 500 (SPX) pulled back yesterday (top left), found support on the rising 21EMA, and closed higher than the previous session’s close—a classic washout reversal.

The index failed to find enthusiasm for lower prices among sellers, so turned around and found interest among buyers.

Below it, the Nasdaq (IXIC) had a similar session, but failed to close high enough for a valid washout. The Dow (^DJI) found support coming in at the -1ATR line for the past four sessions. The Russell of midcaps (^RMCC) almost completed a reversal on the -1ATR.

If this market is going to bounce from here and rally for Christmas, I suspect the decision will be made today.

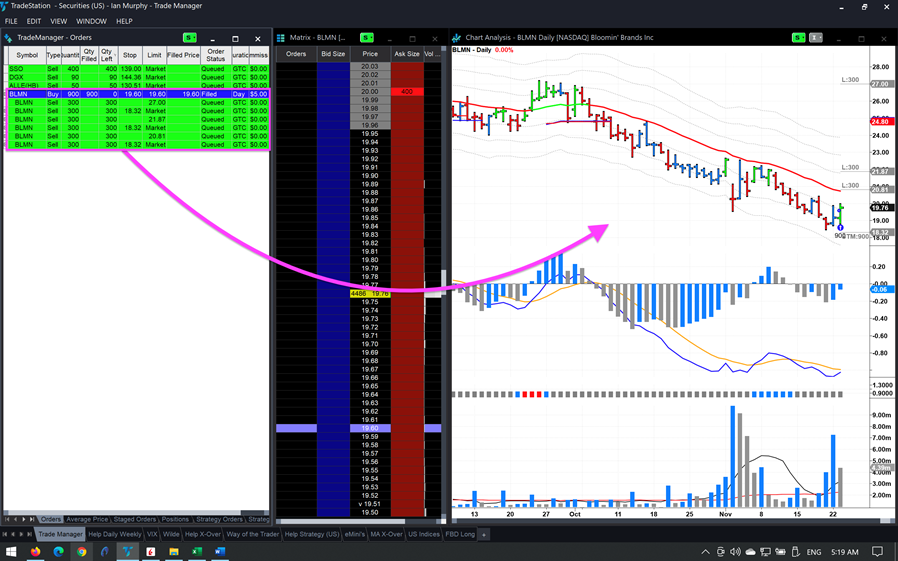

One stock from the new FBD watchlist grabbed my attention yesterday. Bloomin’ Brands Inc. (BLMN) met all the criteria for the strategy, except falling volume. I bought 900 shares; stops and targets are shown above. The stock has been in steep decline since October and met expected earnings on November 2. It has a short float of 17.5%, so if we get some upwards momentum, a short squeeze could cause this global restaurant owner to pop.

Learn more about Ian Murphy at MurphyTrading.com.