Stocks love free money, and with the Fed tapering starting in December, it is likely that traders will hang on to the hope that the infrastructure bill’s money will start trickling into the economy quickly, says Joe Duarte of In the Money Options.

That’s certainly a growing view in some circles. And while it does have some merit, in the short term the more likely reason for stocks to move higher is the fact that we are in the best seasonal period of the year, the months of November and December, as well as the bullish action in the market’s breadth, and the options markets.

I have much more on the latter point, just below. But here is a hint: more stocks are moving higher than those falling in price, and option players are buying more calls than puts, which raises the potential for short term gains.

Nevertheless, despite the short term bullish vibe in the stock market, I’m still of the view that when the Fed’s tapering reaches a certain point, whatever and whenever that is, the market will start to roll over. That’s because with less liquidity injected into the bond market, banks and related institutions will have less money to spend on stock buybacks and speculative derivative trades. This, in turn, will eventually work its way into lower trading volume, and at some point, outright selling.

The good news is that there is no indication that we are close to that point yet, as the Fed is just getting started by reducing its bond purchases by $10 billion per month, starting in December. All of which means that we continue to take the long side of trades, albeit with a few caveats:

- Take profits sooner.

- Use tighter sell stops.

- Don’t lose sight of the fact that the odds favor we are closer to the end of the current rally than many may realize.

There are still some stocks and option strategies which may yield sizeable gains when properly managed, even in negative markets.

Location, Location, Location: Matson Inc. Delivers the Goods as Pacific Logjam is Likely to Persist

I recently recommended shares of Matson Inc. (MATX), a Honolulu based logistics and transportation company whose geographic location is paying off in a big way.

We normally associate the phrase “location, location, location,” with real estate, but in this case, it’s well applied to the transportation sector, especially in the case of Matson Inc. That’s because the company is located in Hawaii, a strategic midpoint between China and the US West Coast, and a de facto shipping hub. As a result, aside from servicing the Hawaiian Islands, Matson’s shipping and logistics is essential to the delivery of goods to major US ports.

The stock, as I will describe directly below, has had a good run in 2021. But more importantly, since the port logjam situation is not likely to change for the next several months, the stock still has room to run.

And here is why. After beating expectations on its Q3 results, Chairman and CEO Matt Cox, noted the following:

- Expectations for “continued elevated goods consumption, inventory restocking, and favorable supply and demand fundamentals in our core markets” remain.

- No real end in sight for a “supply chain environment,” which “continues to be one of widespread congestion at many key points within ocean and overland transportation.”

- Growth in container volume in Hawaii, the West Coast of US, and in traffic between China and the US.

- “Volume demand in the quarter was driven by e-commerce, garments, and other goods heading into peak season. We continue to see sustained and elevated consumption trends and low inventory levels drive increased demand for our expedited ocean services.”

- “All elements of the supply chain infrastructure from origination in China to the distribution points in the US are in chaos.”

In other words, Matson’s business is in high demand. Moreover, they are literally delivering the goods, and therefore have pricing power—which may be in place for a longer period than one may expect, given the lack of slack in the entire supply chain. As Mr. Cox noted, he expects “elevated consumption demand and inventory restocking to remain largely in place, at least through mid-year 2022.”

After a bullish response to the earnings, the stock has formed a nice consolidation pattern, which offers an opportunity to enter the shares. Accumulation distribution (ADI) shows that short sellers have been building positions, while on balance volume (OBV) has been moving higher. This suggests that smart money has been moving in, and that short sellers are likely to get squeezed.

I own shares in MATX as of this writing.

Options Traders Remain Bullish and Control the Stock Market

Little has changed in the options market over the last few weeks, other than recent data that confirms what I’ve been saying here for some time. Which is that the options market is a greater influence on the stock market than the opposite.

And so, the action this week that saw a large amount of money go into Friday’s weekly SPY call options, and the usual reactions that this causes (dealers and algos having to hedge by selling calls and buying stocks), is essentially bullish for stocks, as long as it remains in place.

How does it work? Here are the simple steps again:

- Call buyers force market makers to sell calls.

- Market makers hedge their call sales by buying stocks and stock index futures.

- The cycle self-reinforces as long as call buyers persist, and the stock market moves higher.

So, until this pattern changes, the odds of higher stock prices remain better than even.

Market Breadth Remains Bullish

The New York Stock Exchange Advance Decline line (NYAD) delivered a convincing breakout last week and remains in a bullish configuration. Certainly, as I expected, it seems to have entered a short-term consolidation pattern. But at this point all signs remain positive.

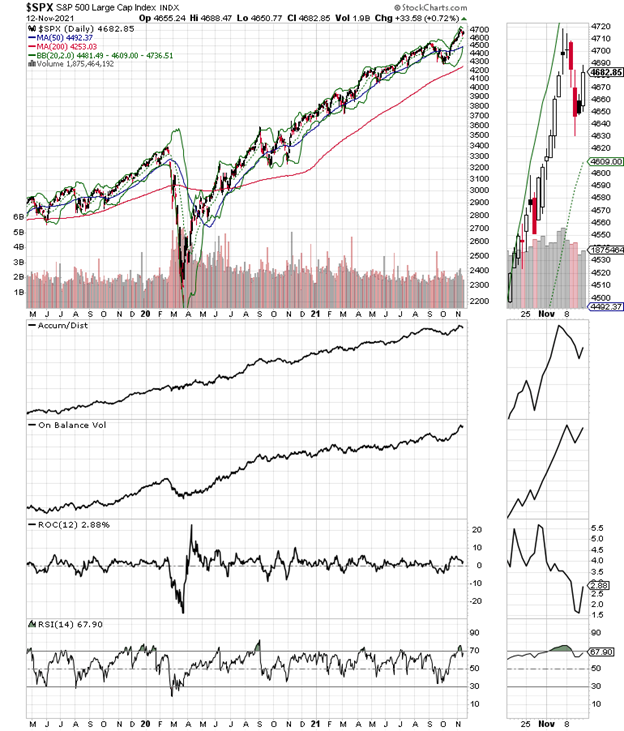

The S&P 500 (SPX) confirmed the new high on NYAD last week and remains well above its 20, 50, 100, and 200 day moving averages with good confirmation from accumulation distribution (ADI) and on balance volume (OBV). As with NYAD, we are seeing a short term pullback.

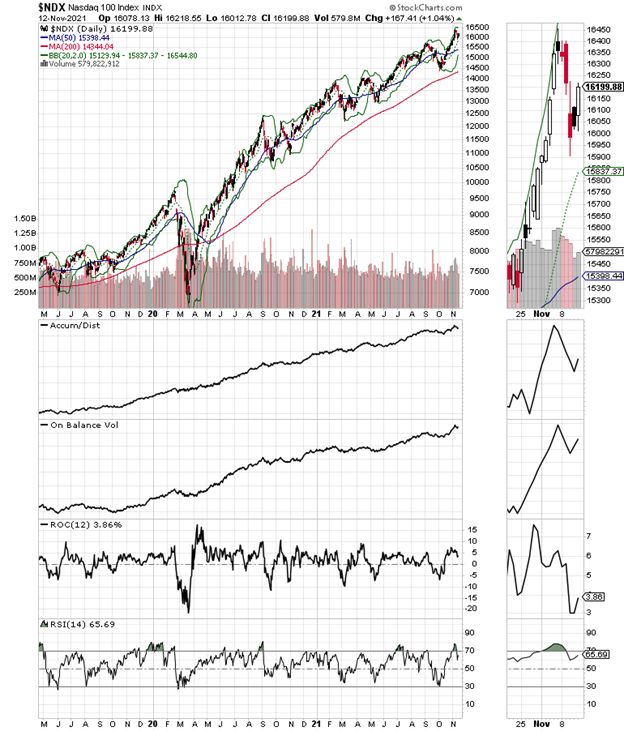

The Nasdaq 100 index (NDX) also confirmed the recent high on NYAD. Even better, the NDX breadth line made a new high, with accumulation distribution (ADI) and on Balance volume (OBV) confirming.

Small stocks have also joined the rally, which is a bullish development, although it may also be related to seasonal trading patterns.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.