Although large-cap value stocks (IVE) outperformed their growth counterparts (IVW) by 8% (18% vs 10%) from the beginning of the year through June 11, they have underperformed by 13% since (3% vs 16%), states Joon Choi of Signalalert Asset Management.

IVE’s recent relative weakness can be largely attributed to tamed inflation expectations. High inflation would force the Fed to raise short-term interest rates earlier/higher than expected. Stabilized inflation expectations resulted in almost no change in the 10-year Treasury yield since early June, after a spike during the preceding five months. As a result, investors resumed buying growth stocks, as they tend to outperform value stocks during a stable and falling interest rate environment. In this article, I will discuss why large-cap value stocks may have turned the corner vs. their growth counterparts.

Overview

Ever since their relative peak (2007) prior to the financial crisis, value stocks have been underperforming growth stocks, as interest rates entered a long-term downtrend. Investors preferred stocks’ growth potential over current earning power as IVW outperformed IVE by almost 6% a year; 12.7% vs. 6.8% respectively. As shown in Table 1, the top ten holdings for IVW make up 51%, with heavy emphasis in information technology and consumer discretionary sectors (42% & 16%). Whereas IVE’s top ten holdings make up 18% (Table 2), with top presence in the financials and healthcare sectors (21% & 15%).

The Study

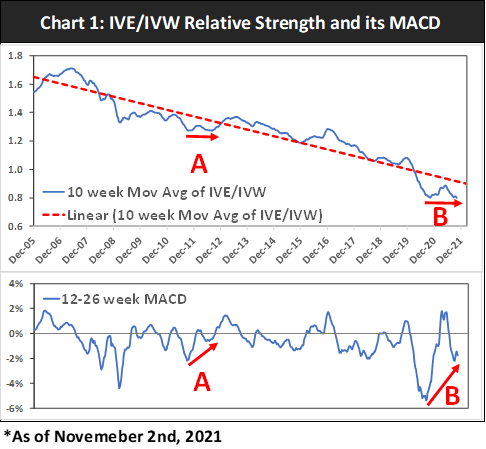

For data preparation, I divided IVE’s weekly prices by IVW’s (RS), and smoothed it by calculating the 10-week moving average (exponential). Then, I overlaid the best-fit line (or trendline) of the moving average (Chart 1). In addition, I charted the 12-26 week MACD of the relative strength ratio in the lower section. Notice that RS had a double bottom in 2012 (Point A) with the MACD putting in significantly higher lows. IVE outperformed IVW by 10% during the ensuing 12-month period, as RS peaked above the linear line.

In recent months, the relative strength ratio appears to be forming a double bottom (well below the best-fit line), while its MACD formed a very sharp rising bottom (Point B), more significant than Point A. This positive divergence may be a prelude to value stocks outperforming their growth counterparts for months or years to come.

Conclusion

Over the past 14+ years, value stocks have drifted down vs. growth stocks, as investors put more emphasis on earnings growth potential than current earnings. However, current inflationary pressure may last longer than anticipated, and may provide a relative advantage for value stocks. Moreover, FOMC president Jay Powell recently stated that higher prices will continue well into next year, deviating from his previous statements that inflationary pressure is transitory. I believe value stocks are finally ready to outperform their growth peers. Therefore, it may be a great time to jump on the value wagon and decrease growth exposure in favor of value. Another recommendation would be to buy IVE and sell short IVW to initiate a market-neutral strategy, with profit target of 15 - 20%.

To learn more about Joon Choi, please visit Signalert Asset Management.