Considering the season, I thought it would be useful to share how I recently managed a position around earnings, states Ian Murphy of MurphyTrading.com.

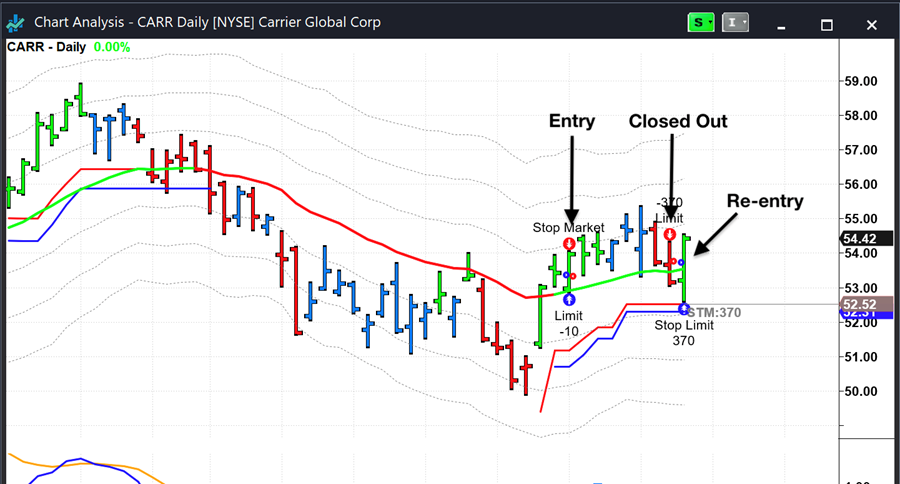

I bought 360 shares in Carrier Global (CARR) at $53.37 on October 18. Earnings were due before the market opened on October 28 and, as you know, when swing trading I don’t hold full positions through earnings. I didn’t scale out any shares, so I had to decide by the close on October 27 what to do. I closed the entire position for $53.78.

Earnings were duly announced on the morning of October 28, and after initially selling off and coming within 11c of the trailing stop, the price reversed and formed a one-bar washout. This was also a first higher low pattern on the -1ATR channel, so I re-entered the position. The stop was a little tighter this time round, so risk management rules allowed me to buy an extra 10 shares.

At the close on October 27, the trailing stop was just 1.2% below the price so a gap over the stop at the open was entirely likely if earnings had been negative. The exit and re-entry cost $5 each in fees, but a gap down would have cost significantly more.

Learn more about Ian Murphy at MurphyTrading.com.