Ethereum brought the use of smart contracts to scale. Smart contracts are essentially financial agreements between two or more parties, governed by code, says Ryan Wilday or ElliotWaveTrader.net.

Typically, they form both the agreement and the means to execute the actions specified in the agreement when terms are met.

A simple smart contract example would be a collateralized loan that does not involve the participation of a bank. Let’s say a borrower wants to borrow $10K collateralized by $20K in Ethereum. They lock the collateral in a smart contract with a lender and make payments to the lender through the contract. The lending party, which could be an individual investor, would receive the collateral in full after a set duration without a payment. But if the borrower makes all the payments on time the collateral is released back to them. Each of these actions are automated by the contract, with no human intervention.

Beyond lending, smart contracts have been used to form decentralized organizations, betting markets, and decentralized exchanges. They form the backbone of a revolutionary financial system that is growing up alongside the traditional one. This is called decentralized finance or DeFi for short.

Funds locked up in DeFi applications were recently measured at over $90B. This lockup is a vote of confidence in decentralized economies, but the volume of activity has clogged the Ethereum network.

Issues

When the use of decentralized finance began to grow, in 2020, Ethereum was able to conduct only 10 transactions per second ("TPS"). Increasing demand led transaction fees to skyrocket while the network bogged down. This past summer I made transactions on popular decentralized exchanges ("DEX") that cost me $60-$100.

Recent changes to the protocol have increased Ethereum’s capacity to 100,000 TPS. Shortly before writing this article, I loaded a transaction in Uniswap, a popular DEX. Had I confirmed the transaction, it would have cost me $22, regardless of size. That is better than $100, but I would have had to make a transaction equal to nearly $14,000 in order to equal the highest tier fee rate on Kraken.com, a centralized exchange I use often.

These problems have not stopped Ethereum from growing in use. Its first-mover advantage, and the fact that many users have become used to interacting with it, have built a moat around the cryptocurrency’s market cap. Ethereum has held the #2 market cap spot, just below Bitcoin, for many years.

However, this barrier to entry has not stopped numerous other teams, such as Binance Smart Chain, and Elrond, from developing competitive smart contract platforms, hoping to capitalize on Ethereum’s weaknesses. In 2018 I highlighted EOS, a cryptocurrency and smart contract platform that I had used for decentralized exchanges and gaming. I discussed how EOS may take market share from Ethereum and gave my perspective on price structure, using Elliott Wave analysis. Ultimately, Ethereum’s market share never gave up ground to EOS despite these advances.

Clearly, usability and transaction rates are not the only determinants of a smart contract platform’s longevity. New smart contracts have to gain a strong user base, as Ethereum has.

Enter Solana

In this article, I’m going to look at Solana, a newer competitor that launched in April 2020. I have used Solana extensively this year for DeFi transactions and have covered many of the tokens in our Cryptocurrency Trading service that run on the network. Much of my DeFi return in 2021 has come from liquidity pools on the Solana network.

Solana has been clocked at over 400,000 TPS, putting Ethereum to shame. But it did recently "overheat" and the entire network had to be rebooted. The development team has said the problem is now solved.

While writing this article, I loaded a transaction on the Solana network that cost 32 cents. As with Ethereum, the fee is the same regardless of transaction size. That is a dream, compared to Ethereum.

Funds locked up in Solana DeFi are growing fast. The reported lockup in Solana was $1.8B in August. NFT markets, all the rage to 2021, are popping up on Solana. Its speed and cost also make gaming more practical on Solana than on Ethereum. The lauded Star Atlas game recently launched on Solana; it allows players to make money while playing.

Despite all the advances in Solana’s technology, it has received much criticism. It is considered very centralized. Its development is controlled by one group: the Solana Foundation. Further, the cost of being a validator—those that approve transactions and create more blocks on the chain—is high, limiting participation in validation.

The risk of centralization is that transactions may not prove immutable, as they are with Bitcoin. If they choose those in control can roll back transactions. This same criticism has been leveled against Ethereum, and Ethereum did indeed roll back transactions during the Dao hack.

More to Go, with Caution

All of these benefits and concerns should be looked at carefully by anyone considering an investment in Solana. But my expertise is technical analysis, and particularly the Elliott Wave Theory. So, how does Solana look from this viewpoint? This has been an explosive year for Solana, but are these gains likely to continue?

In trading the Elliott Wave Theory, we look for waves one and two to project the remainder of the expected five-wave move. We are particularly interested in the third wave, which is most often the longest wave and technically the strongest. The third wave is where the "easy money" is made. The length of wave one and the depth of wave two give us the projections, which include supports we use for entries and stops, and targets where we take profit.

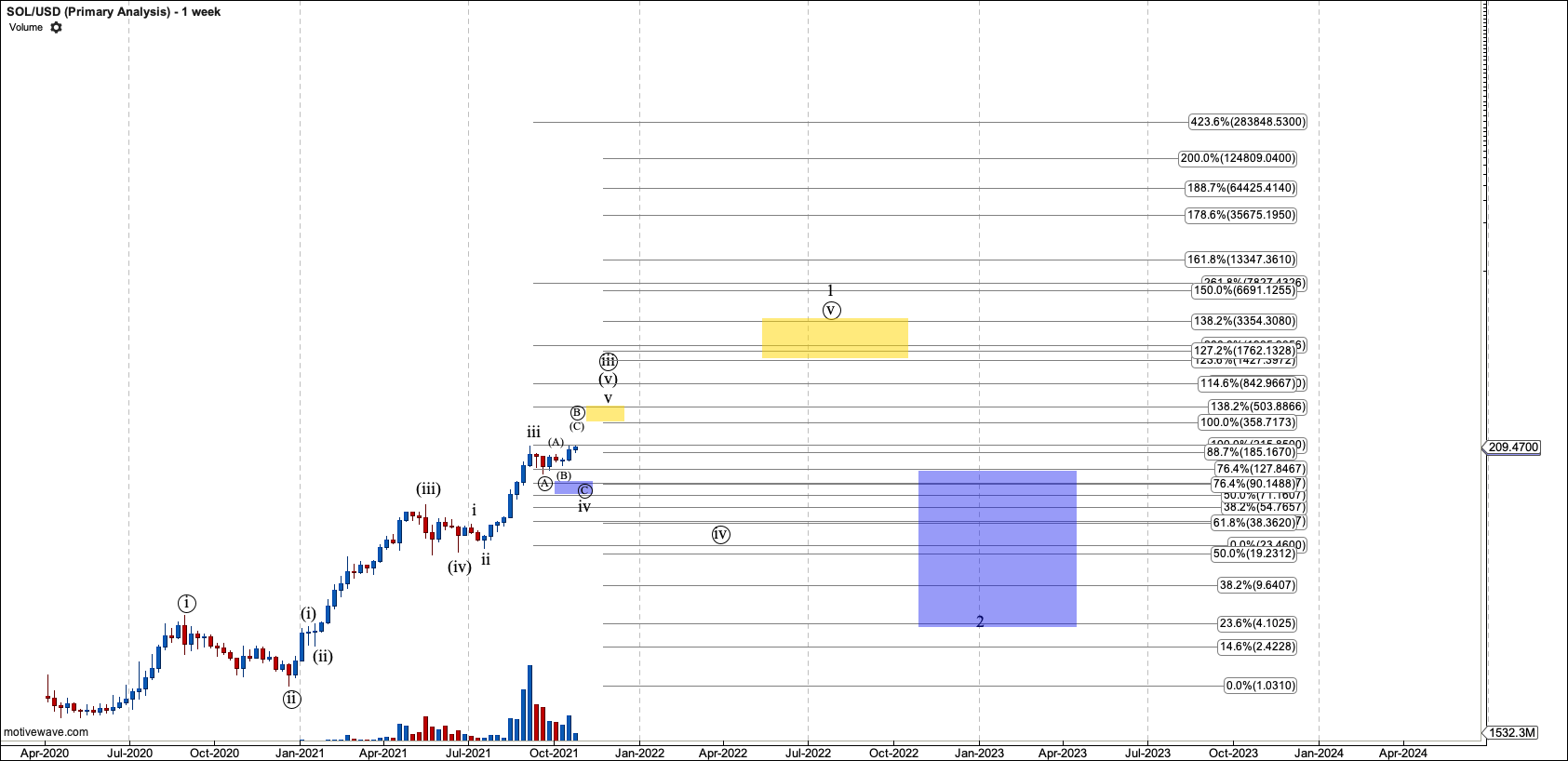

Solana bottomed in wave 2 in December 2020 at $1.03 and has been in the third wave ever since. We’ve been in the fifth wave of the third since June of this year. This means that most of the easy money has been made. However, the last wave of the third looks like it can extend to $364. On my weekly chart below, this is "V" of circle-v of 3.

Weekly view of Solana. This chart was produced with Motivewave

If trading aggressively, you may want to take some profit in that region because Solana will then be in wave four. If you follow our Bitcoin charts, this should correspond to wave four in Bitcoin, after Bitcoin reaches six figures. Wave four in Solana can easily drop down to between $19 and $38.

Despite this severe drop, wave four will be a great time to accumulate Solana. The grand finale, wave five, should send it to the $1400 region. This wave should correspond to Bitcoin’s wave five, which, when it tops, should usher in the next crypto bear market.

Solana investors will want to take substantial profit in wave five, because Solana’s next degree wave two should retrace to between .382 to .764 of its entire history. If we top in the $1400 region, it can retrace to between $119 and $4. However, should that retrace hold over Solana’s all-time lows, the next bull market in Solana should be spectacular.

However, please beware. In 2018’s bear market, 100% of altcoins broke their long-term counts. Holding altcoins through crypto bears is not advisable. Every altcoin is an experiment. With technology advancing fast, new projects will nip at the heels of today’s great altcoin. We’ll check in on Solana during the next great bear market to see if it has a chance at price leadership in the next bullish cycle.

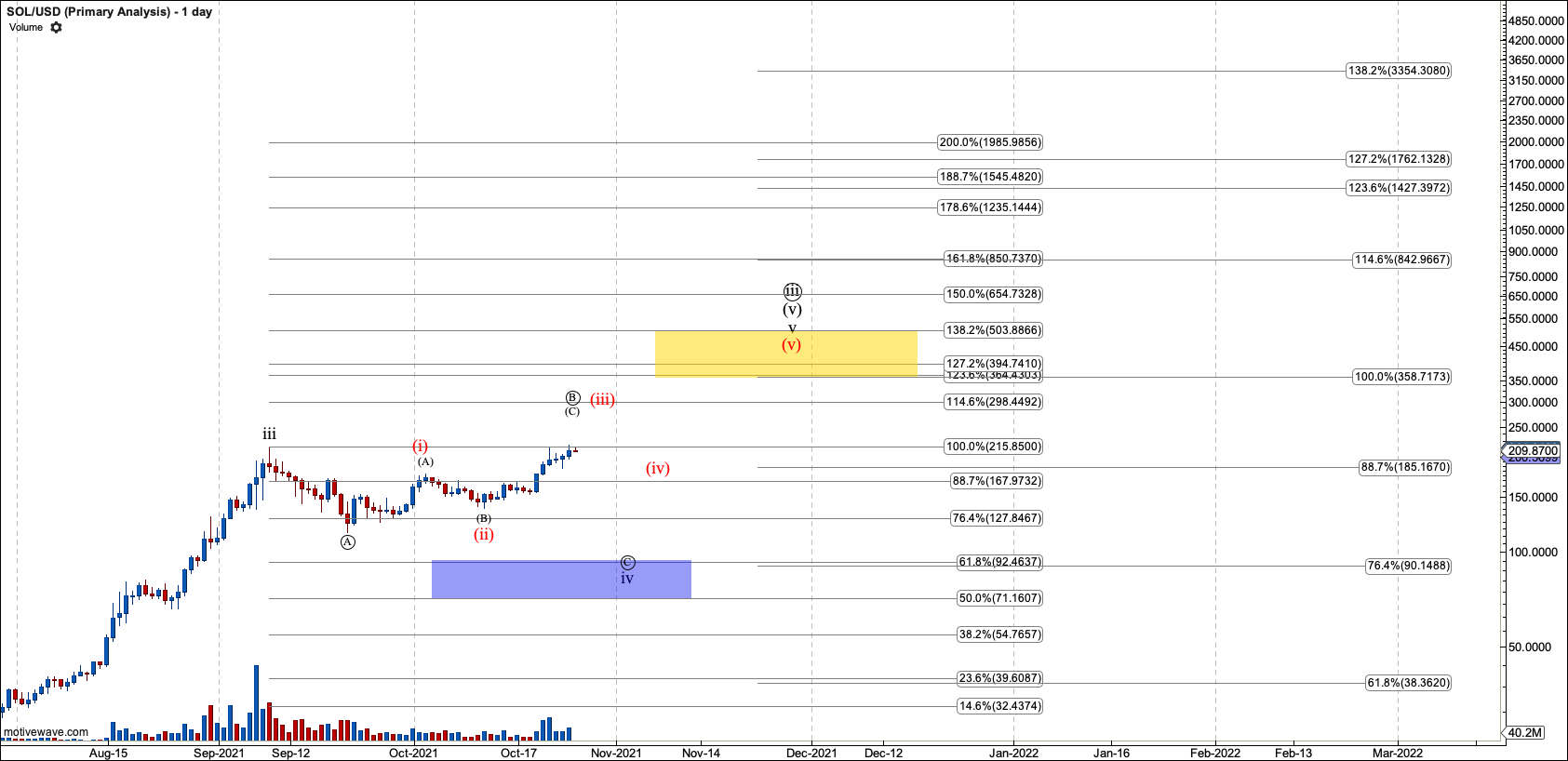

Zoomed in view of Solana. The chart was created with Motivewave.

Note that over $261 the red path directly to the target is more likely in play.

Conclusion

Solana is a great piece of technology that solidly challenges Ethereum’s dominance. While the easy money has been made in Solana, we expect more gains ahead.

But Solana traders should watch the targets we’ve given and take profit as they are reached. Crypto cycles are spectacular, but that upward movement doesn’t come for free, as crypto bear markets are brutal. Be sure to take profit before the next bear market takes hold.

Ryan Wilday is a senior analyst at ElliottWaveTrader.net where he co-hosts the Cryptocurrency Trading service.