Meme stocks, everybody is talking about them; but what exactly is a meme stock, asks Markus Heitkoetter of Rockwell Trading?

How do you find the next meme stock that is “going to the moon,” as they say? That’s exactly what we are going to talk about right now.

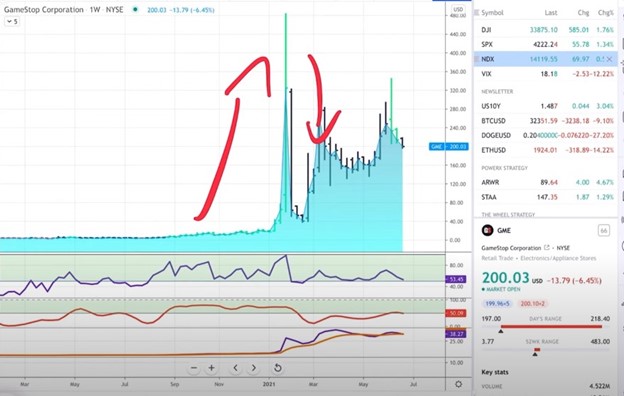

You see, it all started with GameStop (GME). Let me bring it up here because this is where looking at the weekly chart, earlier this year, it has gone crazy. What happened? You might have heard about the Reddit short squeeze of GameStop that happened earlier this year. You see, it all started with a couple of key figures.

Key Figures in the Short Squeeze of GameStop

First there’s Michael Burry, the well-known activist who was portrayed by Christian Bale in the movie The Big Short. Burry noted that GameStop was trading at a massive discount and revealed that his hedge fund, Sayan, held a position in the video game retailer. Now, this was back in 2019 before all of this craziness happened.

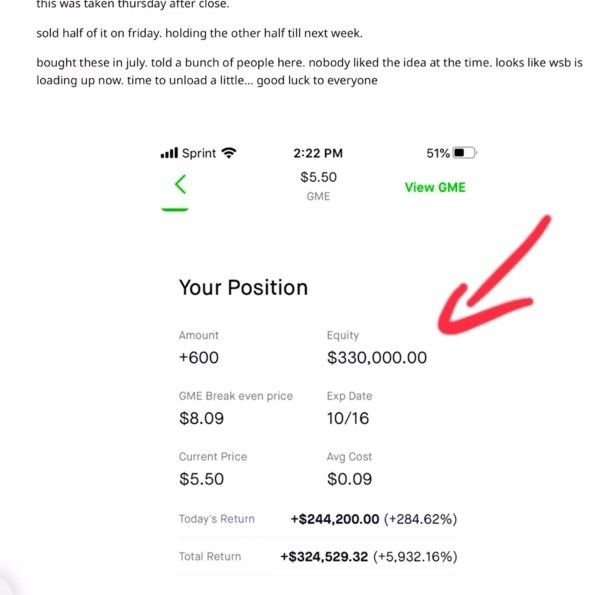

Then we also have Keith Gill, who is also known as “Roaring Kitty,” or DFV, which stands for “D Effing Value” in Reddit forums. Now, in July 2020, again well before all this craziness, Gill posted YouTube videos outlining why he liked the GME stock, and he showed screenshots of his portfolio. But here’s the kicker. Gill also famously held 500 call options for GameStop, which he actually exercised in April of 2021 with a strike price of $12 per share.

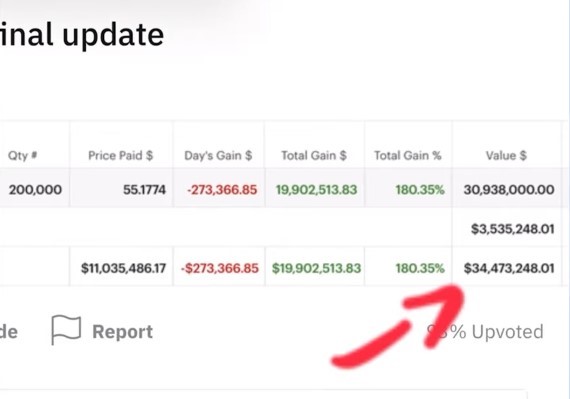

Now, this is where it gets super interesting. With the 50,000 new shares, this is where Gill now owns over 200,000 shares of GameStop. If you go back and take a look at the current prices, at the time of this writing, which was around $200, this position was worth nearly $44 million. I mean, this is just crazy. This is where you see the final update, this is actually an update of the account size of his account from April 21.

You’ll see that in April it was already up at $34 million, and now it is even more. You see, Gill posted his progress, and users of the forum WallStreetBets started buying shares of GameStop. This rapidly escalated into a massive short squeeze that led several hedge funds to lose hundreds of millions of dollars.

And it caused GameStop, looking back here at the stock, to explode from around $20 to a whopping $483 per share. I mean, this is just like, “Whoa!” This is where GameStop’s jump brings gains for that week to 400%. I mean, this is just amazing what happened there.

What Are These Stocks & Why Are They So Controversial?

We have been talking about GameStop right now, and why are they so controversial? Well, meme stocks received the nickname due to their popularity among retail investors who band together on social media platforms like Reddit and TikTok. I actually found a really cool video, and here’s a transcript from it so that you have an idea of what this is all about.

“Today, Reddit actually shut down the stock market. You will not believe what happened. So basically, all the old guys in suits thought GameStop stock was going to crash. So they all got together and bet against it. But then a band of Reddit users called WallStreetBets wanted to mess with them. Keep in mind these guys are famous.”

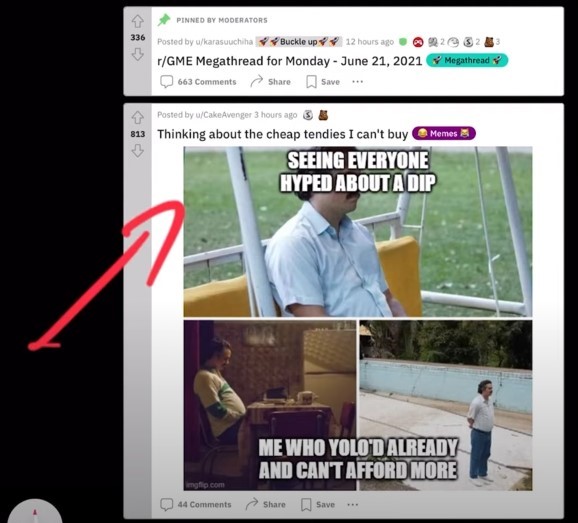

All right. You get the idea. So, in WallStreetBets, they call themselves Apes. These are young investors who use memes as a regular part of their communications about investing. Let’s just peek into one of these Reddit forums. Here is the GameStop forum.

As you can see, the reason why they are called meme stocks is that the community communicates through memes. Pretty much every post beside a few account screenshots is memes.

Now, let’s talk about what are all these different meme stocks. A lot of stocks have recently been lumped together into the “meme stock category” as short squeezes have become a popular way for younger investors to try and make some fast money.

The short-squeeze movement that happened in the WallStreetBets forum on Reddit. Not only is this where Keith Gill, “Roaring Kitty” or “DFV” posted his updates, but also the moderators of the SubReddit were some aggressive, high-risk investors who just said, “OK, let’s go all in.“

Above you can see, for example, one of these guys is in with $330,000, and this is the YOLO mentality, or “You Only Live Once.” of being all in here. You get the idea and now probably know why they are called meme stocks. Let’s move on and let’s talk about…

How Can You Find Another Meme Stock?

You see, most of these discussions that you have from WallStreetBets revolve around meme stocks. GameStop and AMC have been the more famous meme stocks, but several others have risen to fame and also experienced short squeezes on their own in recent months.

If you look at some of them, for example, Bed, Bath and Beyond together with AMC was one of the meme stocks. Then we also had good old BlackBerry, which is also has become part of the meme stocks family.

Why Do People Buy Meme Stocks?

Well, there’s a lot of reasons why retail investors buy meme stocks. Like with any investor, the idea of a short squeeze leading to big profits in a short period of time is tempting enough to take a chance. This is why many on Wall Street and the mainstream media, have compared meme-stock trading to gambling rather than investing.

If you look at Jim Cramer, I mean, Cramer is the guy who is basically portraying the boomers that Reddit stands against. This is where there’s this “stick it to the man and hurt short-sellers mentality.” There’s a lot of these meme investors who are looking to stand up to Wall Street institutions and actually stick it to the man.

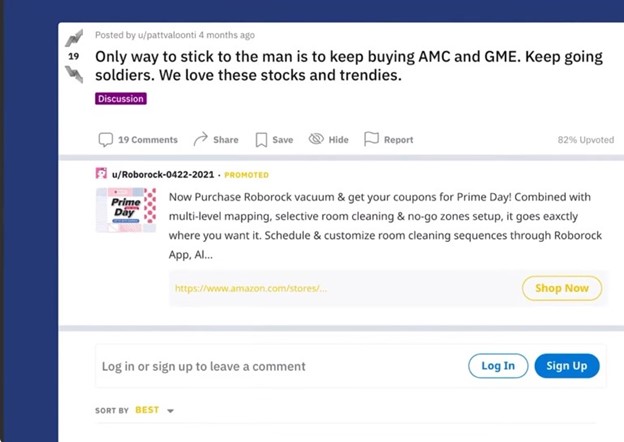

Here’s a screenshot. You see, “Only way to stick it to the men is to keep buying AMC and GME. Keep going soldiers. We love these stocks and tendies.” There’s a certain pleasure that these meme stock investors get when short-sellers, usually hedge funds, lose millions or even go bankrupt from their short positions.

If you’re reading through Reddit here, there’s certainly a David vs Goliath attitude that has developed with this Reddit forum, like WallStreetBets, now sitting at over 10 million users and more and more of these SubReddits popping up. There’s definitely a strong momentum behind the cause here.

What Is the Meme Stock Bubble?

A meme stock bubble is like in any other sector on Wall Street. As stock prices get overinflated due to the short squeeze, the general rules of physics apply. What goes up must come down. This is where we have seen stocks that have been hyped up recently to go down on WallStreetBets they talk about paper hands and diamond hands. But can you really blame an 18-year-old college kid or high school student, who just tripled his account in a matter of days for selling it, right? And that’s why many of the latest meme stocks have crashed back down over the last couple of weeks.

Let’s take a look at some of them here.

For example, Wendy's was one of them, going quickly up, but then also crashing down.

Clover Health was another one, quickly jumping up and then going down. There’s always a downside to it, as you can imagine. What goes up comes down and often is very, very fast.

This is something else that I wanted to mention. Some actually know how to take advantage of this, and this is where here in The New York Times, they talk about how the meme stock bubble bursts. This is what they found out. So, the key question is, where can I find the next meme stock? How can we participate in this craziness here?

Now, of course, everybody wants to find the next meme stock that doubles, triples, and quadruples in value in a matter of days, but it’s not easy to find the next meme stock, there are some guidelines and criteria for really good candidates.

Guidelines & Criteria for Really Good Candidates

Number one, the company must be known and likable and have an underdog story.

You might have noticed that a lot of these meme stocks are likable and nostalgic companies that many investors simply don’t want to see go bankrupt. Like BlackBerry (BB), GameStop, AMC, but the same applies also to Nokia, even Bed, Bath and Beyond that was in this meme stock craze here.

Is there any logic behind these choices? Not really. Although some will argue that GameStop and BlackBerry will still have a bright future, especially when Brian Cohen comes on. There might be a good chance for GameStop to turn it around. Generally speaking, Redditers love to choose underdog companies that are losing out on the modern world. So, you’ll never find an Apple, or Microsoft in this group. Companies that are on the brink of bankruptcy make perfect candidates for meme stocks.

Number two, they must have a high short interest.

As I said before, there’s more to investing in meme stocks than just getting rich quickly. Another motive is to hurt these short sellers. So, it’s very important that we find a stock with high short interest, otherwise, you’ll never get that squeeze that helps a price run-up so high, so fast. You can find short interest on most financial sites or stock screeners, that’s an easy way to pass through the thousands of different stocks super easy here.

Generally speaking, just a short interest of over 20% is considered high and can be a potential target for a short squeeze. Just for reference, at its peak, GameStop's short interest was a ridiculous 142%. So that’s just crazy. And this is where I found the article, GameStop on CNBC jumps another 90%, but short-sellers aren’t backing down. And this is what fuels it.

Number three, management must be pro retail traders.

The third criteria to find the next meme stock is the management, possibly the CEO must be pro retail traders. And this is where AMC Entertainment Holdings (AMC) actually did it perfectly.

You see, AMC recently said that they reward retail investors with free popcorn and exclusive screenings. The CEO, Adam Aaron, has praised retail investors on numerous occasions. This is why right now; AMC is still the poster child of these meme stocks.

Another example is GameStop’s new chairman of the board, Ryan Cohen, the former CEO of Chewy. He’s seen by many Redditors as the savior for GameStop, and he even often posts memes on his Twitter account. And again, he has big plans. I mean, he has plans to try to push GameStop to become the Amazon of the video-gaming industry.

Number four, it must be cheap.

The fourth criteria are that it must be cheap, preferably around $10 or $20. This way, a trader with a smaller account like $500 to $2,000 can buy them.

AMC, when all this craziness started, was trading at around $10. GME was trading at around $20. And if you look at companies like Clover, they were trading around $8-$10. Wendy’s a little bit higher, around $20. You get the idea.

Perhaps the most important part of the equation, the average Robinhood account, which is only around $5,000, has to be able to afford it. This way they can join in on the fun of the short squeeze. They buy a lot of shares. This is how you can find the next one. It’s not that difficult, but with so many stocks out there, how can you really find it?

We definitely won’t find stocks like Amazon, which is trading right now at $3,500. Or Google, which is trading at $2,500. At these prices, if you think about it, meme investors can only afford one share at a time. The key question is…

Which Stock Is Safer? Is It Safe to Invest in Meme Stocks?

If you’re asking about the safety in stocks, the answer is always going to be the non-meme stock. These meme stocks come with incredible volatility that is definitely beyond the risk tolerance of most investors, including myself.

Meme stocks have been known to drop down by 30% or more in a single trading session, and these swings can wipe out an entire account in a matter of days. Meme stocks are crazy, one day they’re loved by Redditors, and the next day they might focus on something else.

Recently I said, Clover, Wendy's, all of these on Tuesday Redditors liked it, on Wednesday they didn’t. These bubbles are fun to ride up, but what if you miss it on Tuesday and start buying on Wednesday?

Let’s take another look here at Clover. There’s definitely somebody who has bought it when it was going up at $28, and now they’re stuck with a big loss because, at the time of this writing, Clover is down to $11.20.

Would I Invest in A Meme Stock & What Do I Do?

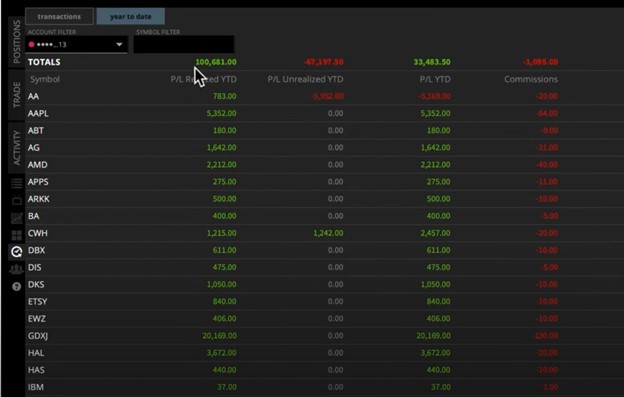

Well, at this point I’m much happier with my PowerX Strategy and my Wheel Strategy. Just to give you an idea, this is where we are doing really well.

This is The Wheel Strategy, and thus far, this year I have realized over $100,000 dollars in profits with The Wheel Strategy. So, this is why I stick with that, I love the SRC profit: strategic, repeatable, and consistent.

Learn more about Markus Heitkoetter at Rockwell Trading.