Previously, I wrote about how the market was getting hammered, and many names were very low, states TG Watkins of Simpler Trading.

I was posing the question of when will the markets bounce? Maybe the end of February since things had become so oversold. But I cautioned that we should not be in a hurry to jump in just because of this oversold condition. That would be what we refer to as catching a falling knife, and I tell people that in my eyes, trying to buy the dip just because price is very low, is no guarantee of being right.

I left off by saying that that is the luxury of being in cash because all your stops got hit, and the next thing you know this pullback turned into a much stronger move to the downside than expected. It’s a great place to be, nearly all in cash while the market descends further than many of us probably thought. This means that as we see the bottom really fall out, moves get even more extreme and because names are at support on time frames like the monthly/weekly, we can sit back and wait for the exact setup we know will eventually develop.

It seems to have taken till the second week of March for this to begin, and that’s fine. Like a good hunter waits for the prey to come within striking distance to make for a more assured attack, we have been waiting for the markets to stop their descent and then form the familiar patterns we know to enter long on.

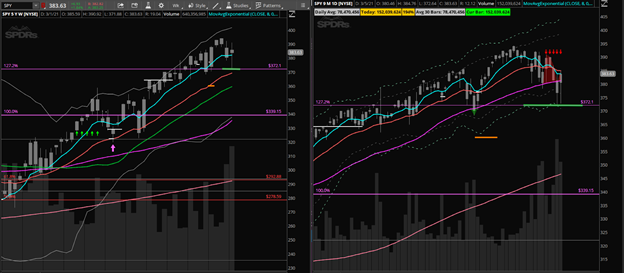

The S&P 500 ETF (SPY) actually went right to the proposed target I gave of $372 and there was a lot of energetic buying right at that level. This is merely the first move. Now we wait for the second move, which confirms support and gives us the green light to start putting money to work.

If price doesn't hold support and doesn’t confirm to the long side, then we will see that, too, and can continue to wait. But I have experienced this action before and I am relatively confident that we are in the process of bottoming and turning, which has me eagerly looking through my watchlists to find the names, which are ahead of the pack and ready to take off the moment the market confirms long.

It has been a real exercise in patience, but oh so worth it when you see the carnage out there. And now we have a full account of cash, ready to deploy, when or IF the markets are ready. Beware though, just because I see things warming up, doesn’t mean they ARE ready. And once again, just like a good hunter, we know when the shot is right and can wait till that exact moment to strike.

TG Watkins is the director of stocks at Simpler Trading.