Marvin Appel notes that spread between inflation protected and nominal Treasuries may signal stagflation.

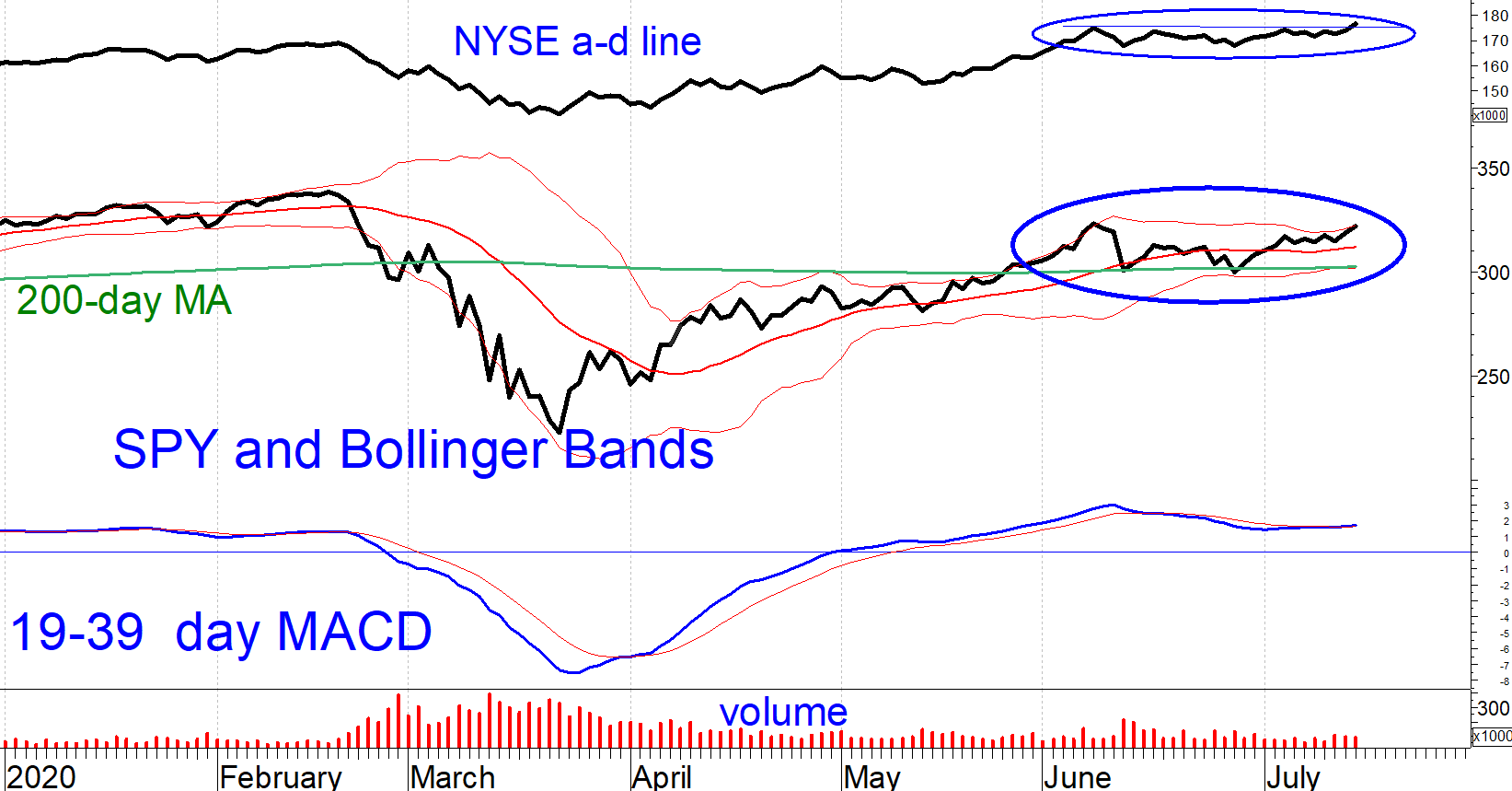

Despite the ongoing acceleration in U.S. coronavirus cases, the stock market remains resilient with the S&P 500 Index retesting its June 8 high on July 15 before retreating slightly. In recent days we have seen a shift in momentum from megacap tech stocks, which have hit new all-time highs, into lagging areas of the market such as small-caps and defensive sectors like the Consumer Staples Select Sector SPDR Fund (XLP). This is exemplified by noting that the NYSE advance-decline line eked a new high on July 15 while SPY has made what is so far just a double top. (See circled areas in the chart below.)

How will the stocks play out? With our U.S. equity model on a hold, downside risk should be well contained. The 200-day moving average in the SPDR S&P 500 ETF Trust (SPY), around 301, is a major support area. However, I don’t see any rational catalyst for significantly higher equity prices either. Look for an overall sideways stock market while our model remains on hold, and a possible market correction later in the summer when/if our model goes on a sell signal.

Based on this outlook and continuing high levels of option premium, covered call writing appears attractive.

Stagflation warning

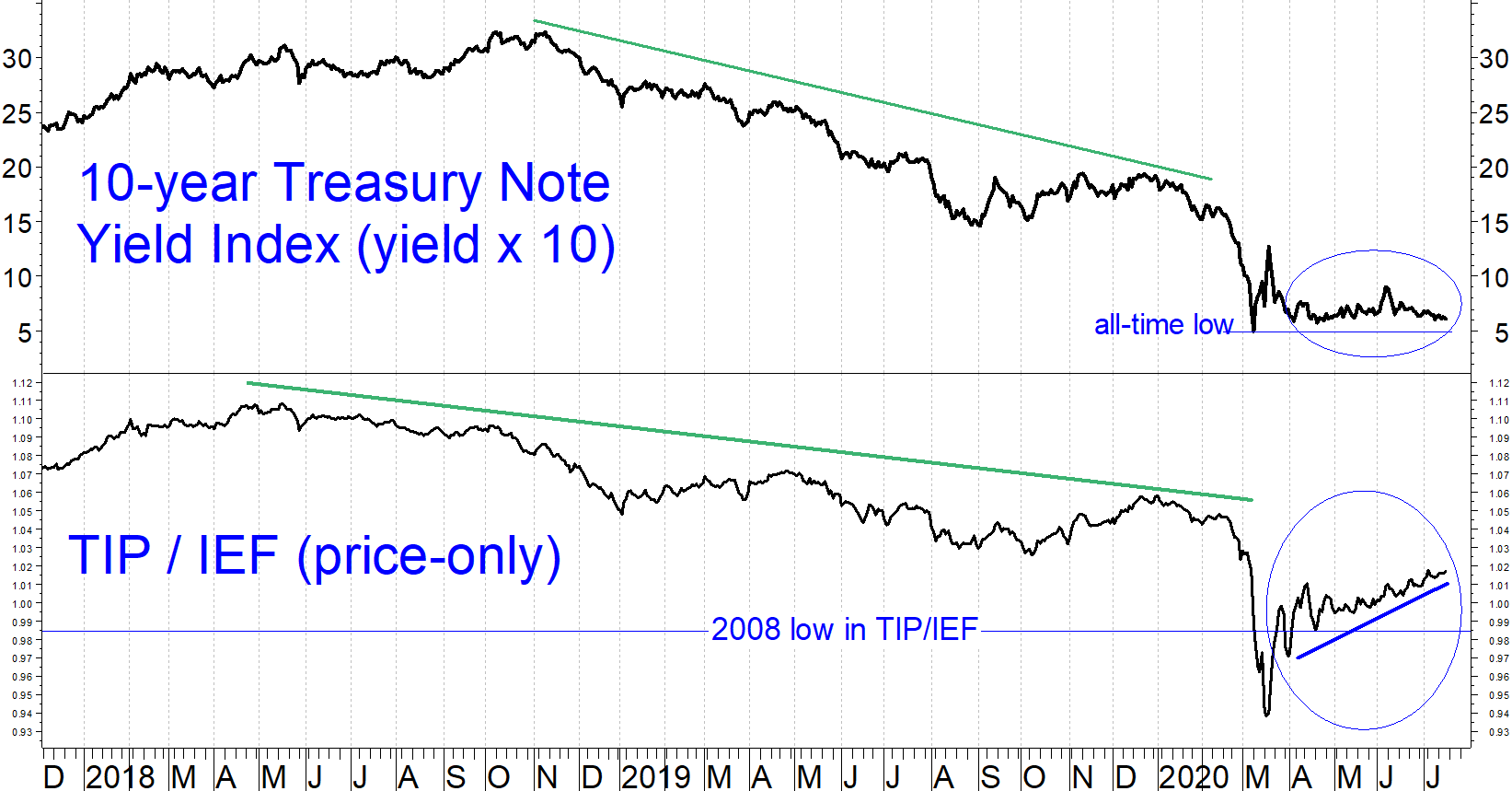

Even before Covid-19, the Treasury bond market was showing signs of economic risk. The 10-year Treasury note yields began falling in November 2018. In addition, the ratio of inflation-indexed to nominal Treasury note prices the iShares TIPS Bond ETF (TIP)/ iShares 7-10 Year Treasury Bond ETF (IEF) ratio started falling in May 2018. Both of these developments are consistent with bond market expectations of lower inflation, which in this time of sluggish productivity growth means slower economic growth (see chart below.)

Figure: Nominal Treasury yields (10-year Treasury note yield index, top) and TIP / IEF ratio (bottom). Note that since April 10-year Treasury note yields haven’t changed much (circled in the top part) while the level of inflation implied by the Treasury markets has been rising steadily (circled in the bottom part).

However, in the past three months we have seen a divergence between Treasury note yields and the relative performance of Treasury Inflation-Protected Securities (TIPS) vs fixed-coupon notes 10-year Treasury note yields remain near historical lows, now at just 0.61%. On the other hand, the level of future inflation expectations priced into TIPS has been steadily rising since March 19. On that date the Treasury market was priced to imply future inflation of just 0.5% for the next 10 years. Now bond prices imply 1.4% annual inflation.

Riskier areas of the bond markets such as corporate high yield and floating rate bond funds joined in the stock market rally until June 8. Since then they have been basically flat or have shown small losses. Both TIPS and nominal Treasury notes have enjoyed significant gains since June 8.

Unfortunately, these observations seem consistent with a return to stagflation: Rising prices not accompanied by growth in production. The U.S. suffered through this in the 1970s, a decade in which inflation averaged 7%. TIPS prices clearly project far lower inflation this time around.

Investment implications

higher inflation in the years to come. Some in the Fed have even proposed targeting an average inflation rate of 2%, so to the extent that inflation has averaged below that level in recent years the Fed could allow inflation to rise above 2% while still meeting its long term inflation target. In an environment where the Federal Reserve does not respond to rising inflation, stocks might benefit from higher prices if higher input costs, particularly labor, do not outstrip the prices of goods sold so that inflated prices boost the bottom line.

Corporate high yield bonds and floating rate bonds, both of which are below investment-grade, could benefit from inflation for the same reason: Higher prices potentially boost sales and profits, making existing debt easier to service.

The danger is the potential lack of economic growth that persistently low Treasury yields warn of. The only reason for Treasury yields to remain low while inflation expectations rise is a flight to safety due to the perceived danger in higher-yielding assets.

Right now, the markets are giving mixed signals: Treasuries are flashing a warning sign while stocks are exuberant. In fact, we may be starting a rotation into lagging areas of the market such as smaller company stocks that are riskier than the technology megacaps that have led the stock market higher in the past two and a half years. High yield bonds are in between, their sideways action over the past five weeks suggesting caution but not alarm.

In this environment, investors must not be complacent about risk. To the extent that you do invest in corporate high yield or floating rate bond funds you must have a risk management strategy such as our timing models, and you must be prepared to see some market corrections at the next threat of an economic downturn. Stocks will likewise continue to be more volatile than usual.

This time the stock market has so far apparently sidestepped the threat of inflation, perhaps because the Federal Reserve is clearly in dovish mode and is willing to tolerate -and-hold basis. Avoid the temptation to chase market rallies. High yield bond fund trading, SPY covered-call writing and balanced funds are the strategies that most appeal to me. And despite the zero yield, don’t be afraid to hold some cash.

Once the threat of the coronavirus is better understood, with the availability of a vaccine in the first half of 2021, then you can invest more normally. We, of course, will continue to use timing models to manage risk.